Annual Fed symposium results indicate a strengthening of EURUSD

Federal Reserve Chair Jerome Powell on Friday endorsed an imminent start to interest rate cuts, saying further cooling in the job market would be unwelcome and expressing confidence that inflation is within reach of the U.S. central bank's 2% target.

"The time has come for policy to adjust," Powell said in a highly anticipated speech to the Kansas City Fed's annual economic conference. "The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

Powell said his "confidence has grown that inflation is on a sustainable path back to 2%," after rising to about 7% during the COVID-19 pandemic, and the upside risks have diminished.

Meanwhile, he said, a slowdown in the labor market is "unmistakable" and "the downside risks to employment have increased."

And while slower hiring has so far driven the rapid rise in the unemployment rate to 4.3%, Powell signaled the Fed would not countenance further erosion.

"We don’t seek or welcome further cooling of the labor market," he said. "We will do everything we can to support a strong labor market as we make further progress toward price stability."

Analysts and financial markets had already widely expected the Fed to deliver its first rate cut at its Sept. 17–18 policy meeting. That view was cemented after a readout of the central bank's July meeting said a "vast majority" of policymakers agreed the policy easing would likely begin next month.

Most analysts have forecast the Fed will begin its policy easing with a quarter-percentage-point rate cut, the central bank's usual increment.

Markets are betting the Fed's policy rate will be in the 3.00%--3.25% range by the end of 2025, more than 2 percentage points below where it is now, which would create bullish momentum for EURUSD.

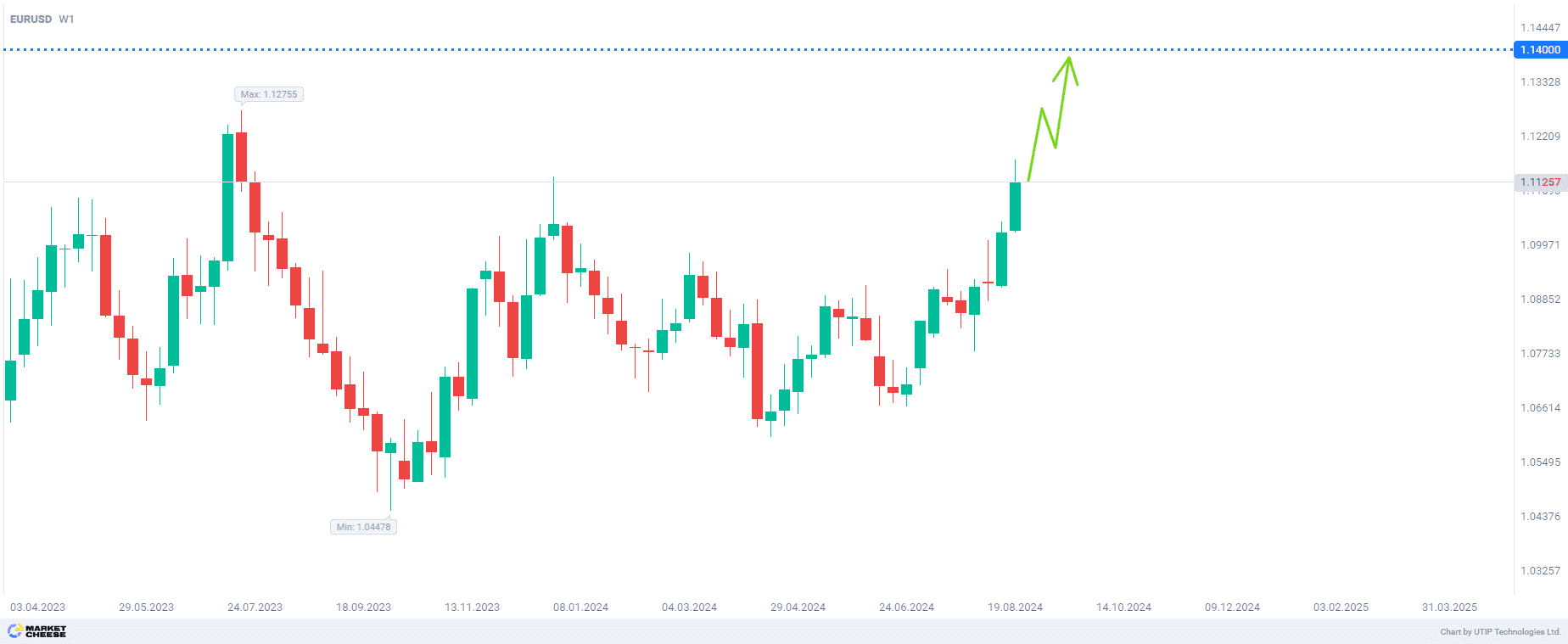

Thus, in the next 2–4 months a strengthening of EURUSD to the level of 1.1400 can be expected.

The final recommendation is to buy EURUSD in the long term.

The profit could be fixed at the level of 1.1400. The Stop loss can be placed at 1.0900.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, doesn’t exceed 2% of your deposit.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account