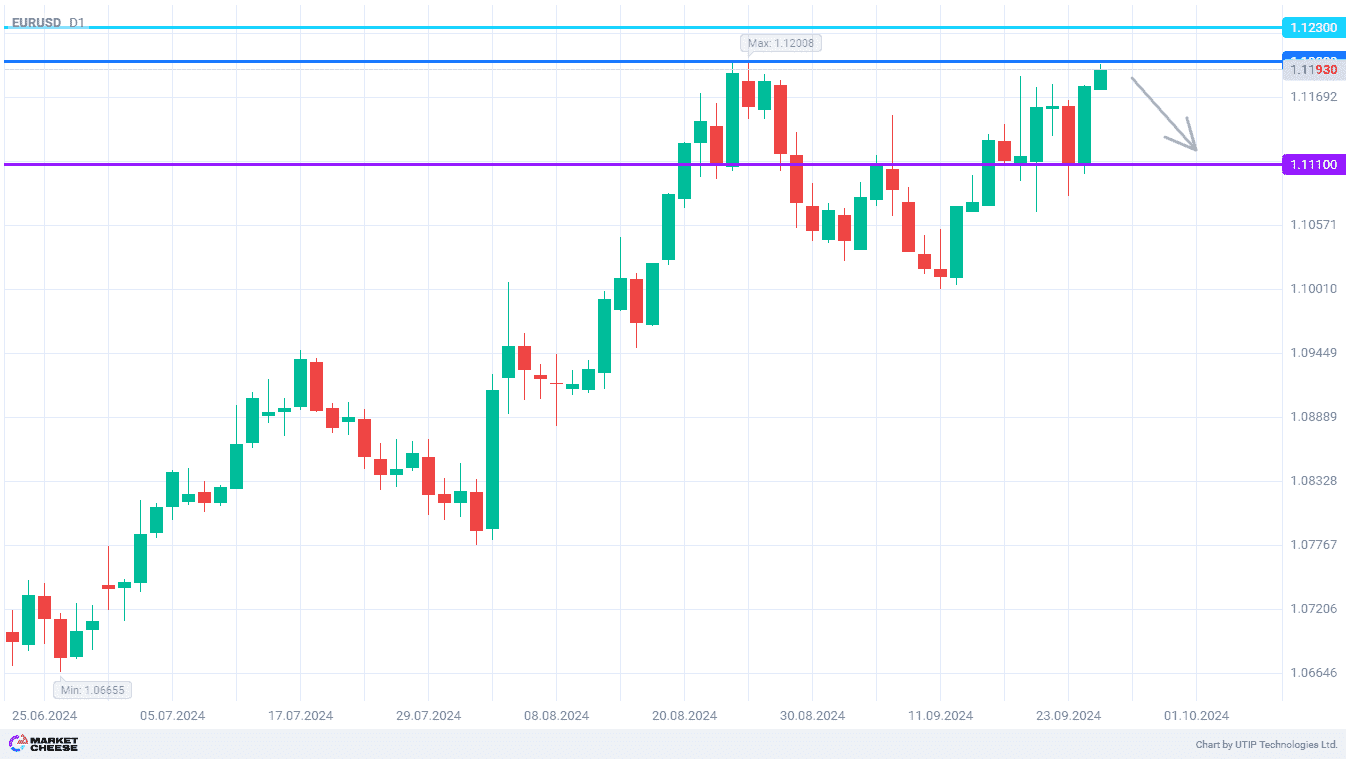

Another pullback to level 1.111 is expected for EURUSD

After a month, the EURUSD currency pair has once again approached the important resistance level of 1.12. At the end of August, this level was the starting point of a strong correction, which reached 1.1. This scenario may easily happen again, especially if traders reevaluate their strongly bearish attitude towards the dollar. The EURUSD pullback may be more moderate this time, but the level of 1.111 is an attractive target for opening short positions.

Citigroup analysts point out the data on The Purchasing Managers' Index in Europe. According to S&P Global, its preliminary estimate for September amounted to 48.9 points, which is significantly lower than the August figure of 51. The PMI value fell under the mark of 50 for the first time since February. While previously the main reason for the weak EU data was Germany, now the decline in business activity is observed in 20 countries of the continent, including France and Italy. All this increases the risks of a pan-European recession.

In such circumstances, Bloomberg expert Marcus Ashworth urges the ECB to follow the Fed's footsteps and start an aggressive easing of the monetary policy. In his opinion, the standard steps to reduce interest rates by 0.25% once a quarter will no longer help to prevent the decline of the EU economy. Ashworth expects the European regulator to reduce the rate at both remaining meetings until the end of 2024, but this may no longer be enough.

Despite the current strengthening of the euro against the dollar, Citigroup representatives recommend investors to act against the market trend. From their point of view, the economic situation in the EU is worse than in the U.S., and traders are overly pessimistic about the U.S. currency. Bank analysts hold a short position on EURUSD with the target level for profit taking at 1.1112. This tactic is relevant at least until the next report on the US labor market, which will be published on October 4.

If today there is no consolidation of EURUSD above the level of 1.12, the probability of a local correction will increase significantly. The quotes will have a good chance to move towards 1.111.

The following trading strategy can be suggested:

Sell EURUSD at the level not exceeding 1.12. Take profit — 1.111. Stop loss — 1.123.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account