AUDCAD buyers are still trying to turn quotes back up

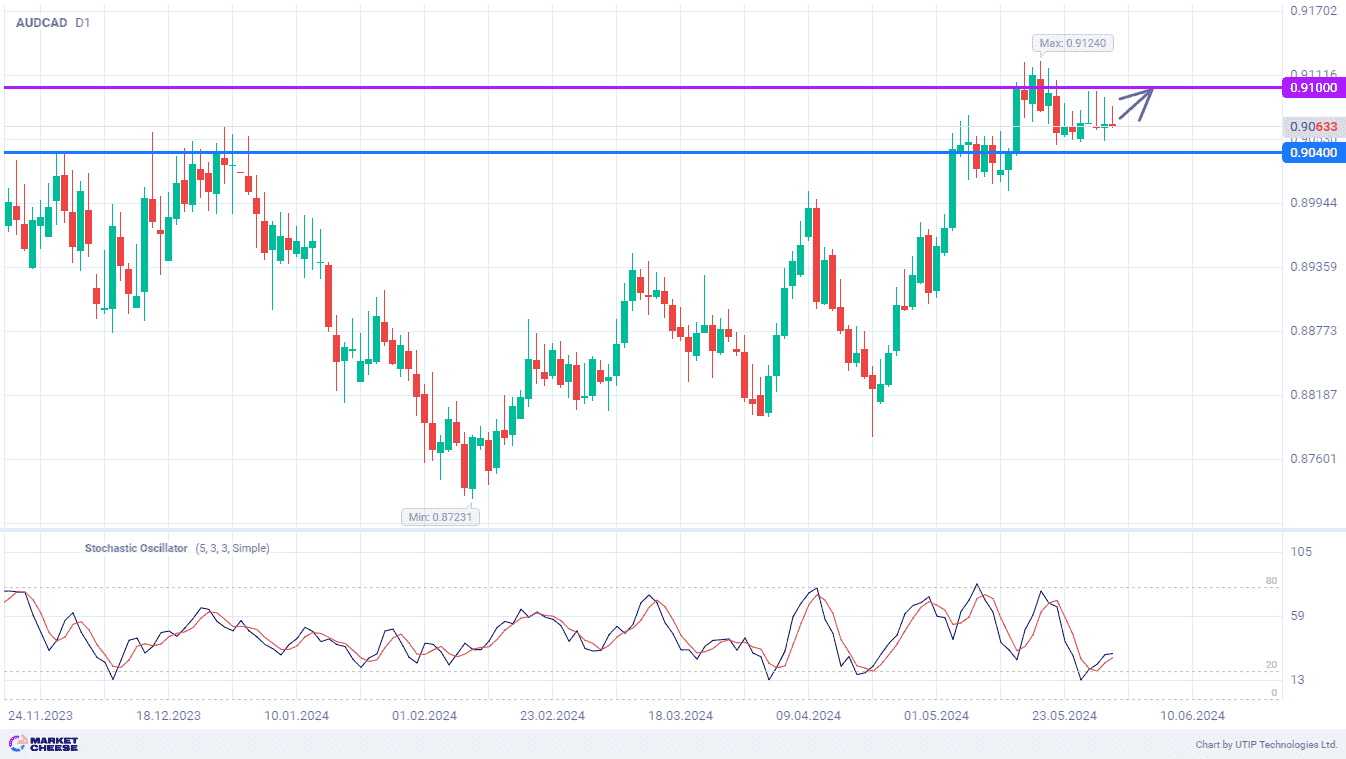

The AUDCAD currency pair, as expected, suspended the update of annual maximums and went into consolidation. However, the quotes are stabilizing without a significant correction, which indicates that traders are still highly interested in buying the Australian dollar against the Canadian currency. Attempts to turn the price back up were clearly visible in recent days, and soon the bears won’t bear the pressure. AUDCAD needs to consolidate above the level of 0.91 to continue its uptrend.

Inflation statistics for April, published on Wednesday, increased the attractiveness of the Australian dollar. Contrary to expectations of a slowdown in price growth from 3.5% to 3.4%, the actual figure accelerated to a 5-month high of 3.6%. Moreover, core inflation also rose from 4% to 4.1%, falling short of economists' forecasts. The figure increased for the 2nd month in a row, making it impossible to talk about a one-off surge in inflation in Australia.

According to the minutes of the RBA’s May meeting, officials resumed the discussion of an additional increase in the key rate. Participants of the currency market are pricing in about a 20% chance of such a step, but at the same time don’t expect any easing of monetary policy until mid-2025. Given the forecast of further acceleration of inflation to 3.8%, the outcome of the RBA meeting on June 18 may turn out to be even more hawkish.

Meanwhile, the Bank of Canada could start its interest rate cut cycle as early as next Wednesday. The price growth in the country has slowed for 4 straight months, opening the door for monetary policy easing. Phil Thomas of Scotiabank expressed hope for a reduction in borrowing costs in the coming months, otherwise the build-up of reserves for bad loans will take on alarming proportions. The figure doubled to 1 billion Canadian dollars in the last quarter, a similar situation was observed in other banks of the country.

The Stochastic indicator on the daily chart of AUDCAD has already formed a buy signal, increasing the chances of a new wave of growth. The nearest target of the bulls is 0.91.

The following trading strategy can be suggested:

Buy AUDCAD at the current price. Take profit — 0.91. Stop loss — 0.904.

Traders can also use a Trailing stop instead of a fixed Stop loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account