AUDCAD currency pair is moving in downtrend

AUDCAD currency pair is correcting on Friday as traders are waiting for the Canadian employment data. These figures could give indications on the future course of the Bank of Canada's monetary policy.

The minutes of the Bank of Canada's January 24 policy meeting, released on Wednesday, revealed the central bank's concerns about the possible increase in inflationary pressures due to wage growth amid the lack of productivity growth.

Statistics Canada will release data on the country's labor sector today. The agency forecasts that the economy will create 16 thousand jobs in January. At the same time, the unemployment rate is forecast to rise to 5.9%, which is a negative factor.

Meanwhile, the head of the Reserve Bank of Australia (RBA) Michelle Bullock expressed concern about inflation, emphasizing that it’s still far from reaching the target range of 2–3%. Despite some slowdown in inflation, Bullock did not rule out the possibility of further rate hikes. This statement prompted analysts from UBS and Capital Economics to revise their forecasts regarding the time of the first rate cut. Against this background, the Australian currency began to decline.

Earlier this week, the Reserve Bank decided to leave interest rates unchanged during the monetary policy meeting.

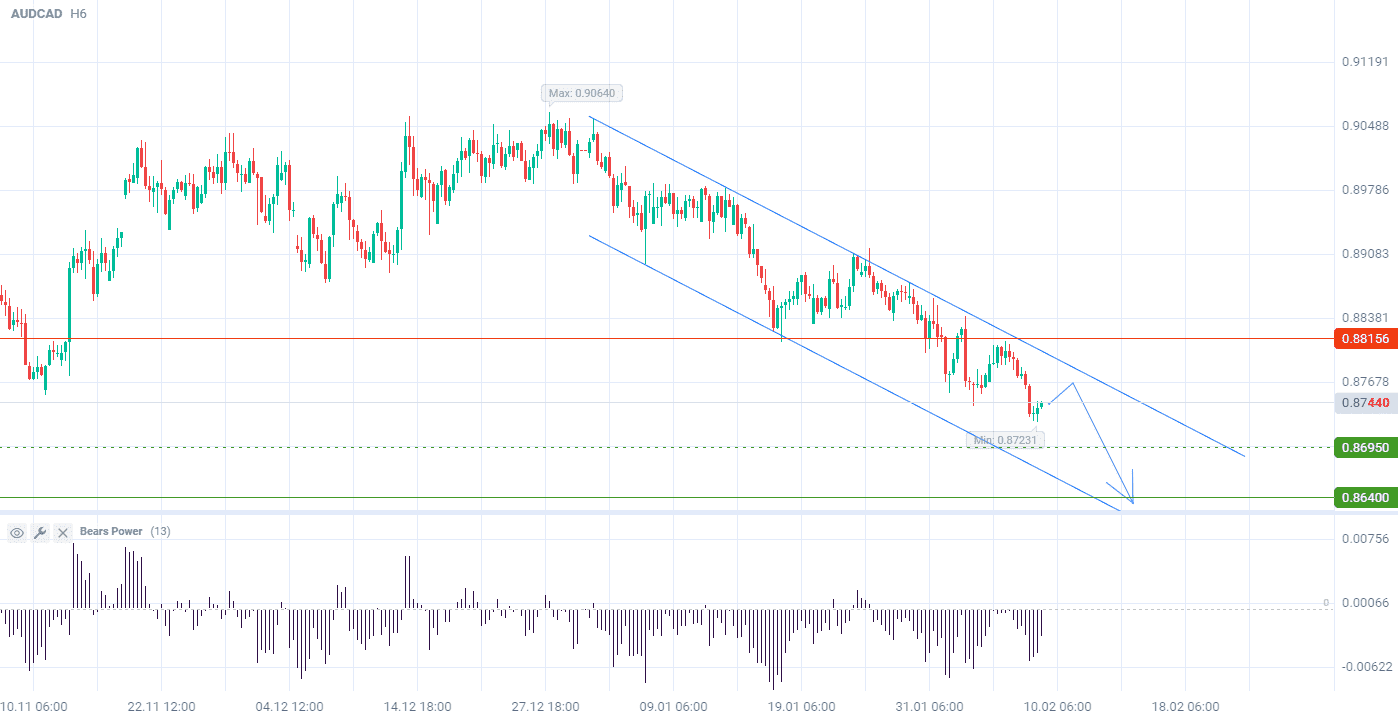

The AUDCAD pair price is forming a downtrend on the H6 timeframe. No change in the trend is expected. Today's news could cause a correction in the prices of the currency pair within the existing downward channel.

Bears Power (standard values) is in the negative zone. This indicates a sell-side movement.

Signal:

The short-term outlook for the AUDCAD pair is to sell.

The target is at the level of 0.8640.

Part of the profit should be fixed near the level of 0.8695.

A Stop-loss could be placed at 0.8815.

The bearish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account