AUDCAD decline may intensify given monetary policy changes in Australia and Canada

The AUDCAD currency pair is moderately falling on Friday as the anticipated actions of the Bank of Canada support the national currency.

The Bank of Canada may end its pandemic-era stimulus program sooner than expected because of a lack of liquidity in the financial system. This became evident after the central bank for the first time in four years introduced REPO operations worth 5 billion Canadian dollars, Reuters reports.

The CORRA rate, which represents lending between banks, rose above the BOC's target of 5%. This indicates a reduction in liquidity due to the quantitative tightening (QT) program launched in April 2022. Reuters analysts suggest that the end of the QT program could lead to lower borrowing costs and reduced ability of the BOC to increase its balance sheet in the future.

Meanwhile, the Reserve Bank of Australia (RBA), according to economists surveyed by Bloomberg, will start to ease its monetary policy in the last quarter of the year due to persistent inflation that needs more time to return to the 2% target. The RBA is expected to cut rates twice from the current level of 4.35% to 3.85%.

According to the Bloomberg survey, overall inflation in Australia will reach the target level only in early 2025. The RBA's decision to cut rates will depend on the inflation data for the fourth quarter, which is expected next week.

Potential easing of the monetary policy by the RBA and the Canadian dollar strengthening caused by the possible ending of the stimulus program by the BOC could lead to a decline in AUDCAD.

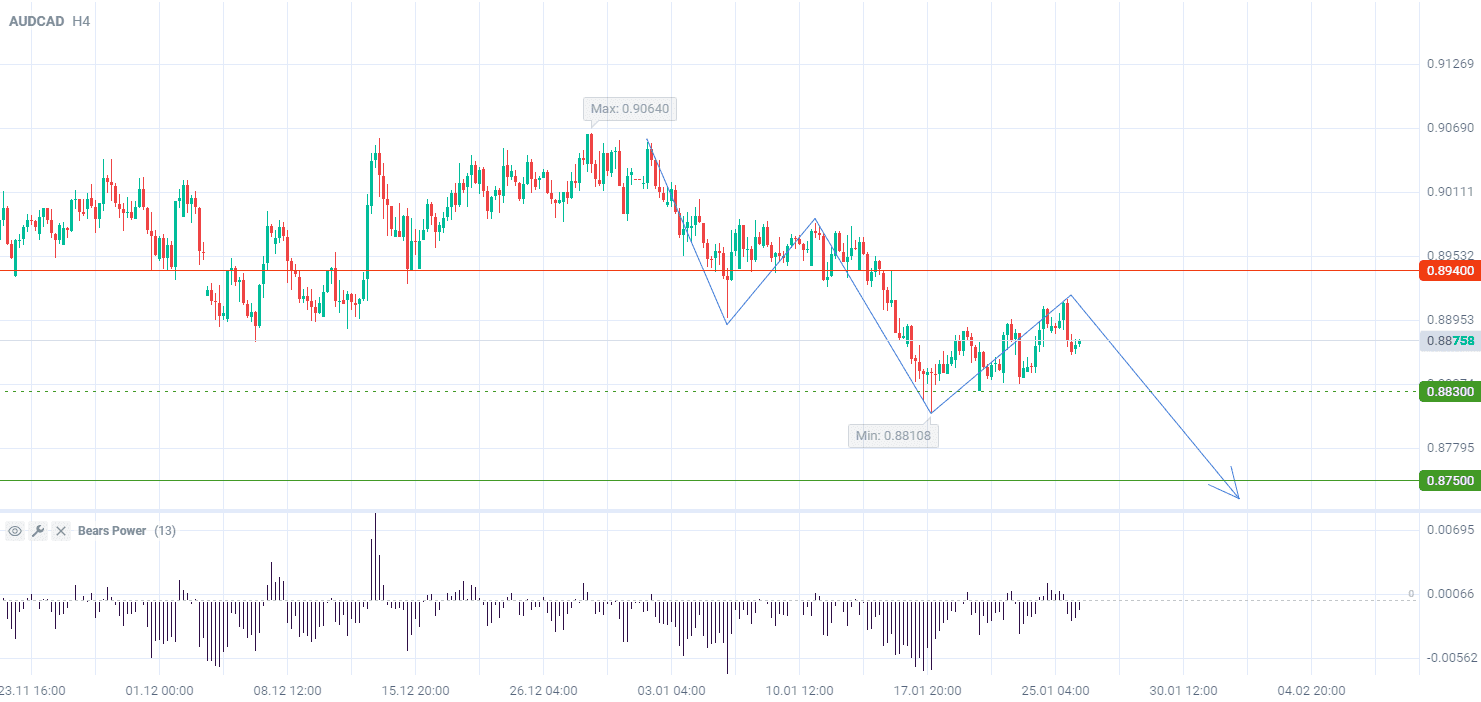

AUDCAD quotes are in a narrow correction on the H4 timeframe.

In terms of wave analysis, the price is forming the fourth ascending wave. Bears Power indicator (standard values) is in the negative zone. This suggests a move towards selling and the formation of a new downward wave.

Signal:

The short-term outlook for the AUDCAD pair suggests selling.

The target is at the level of 0.8750.

Part of the profit should be taken near the level of 0.8830.

A stop-loss could be set at the level of 0.8940.

The bearish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account