AUDCAD will return to yearly highs after correction

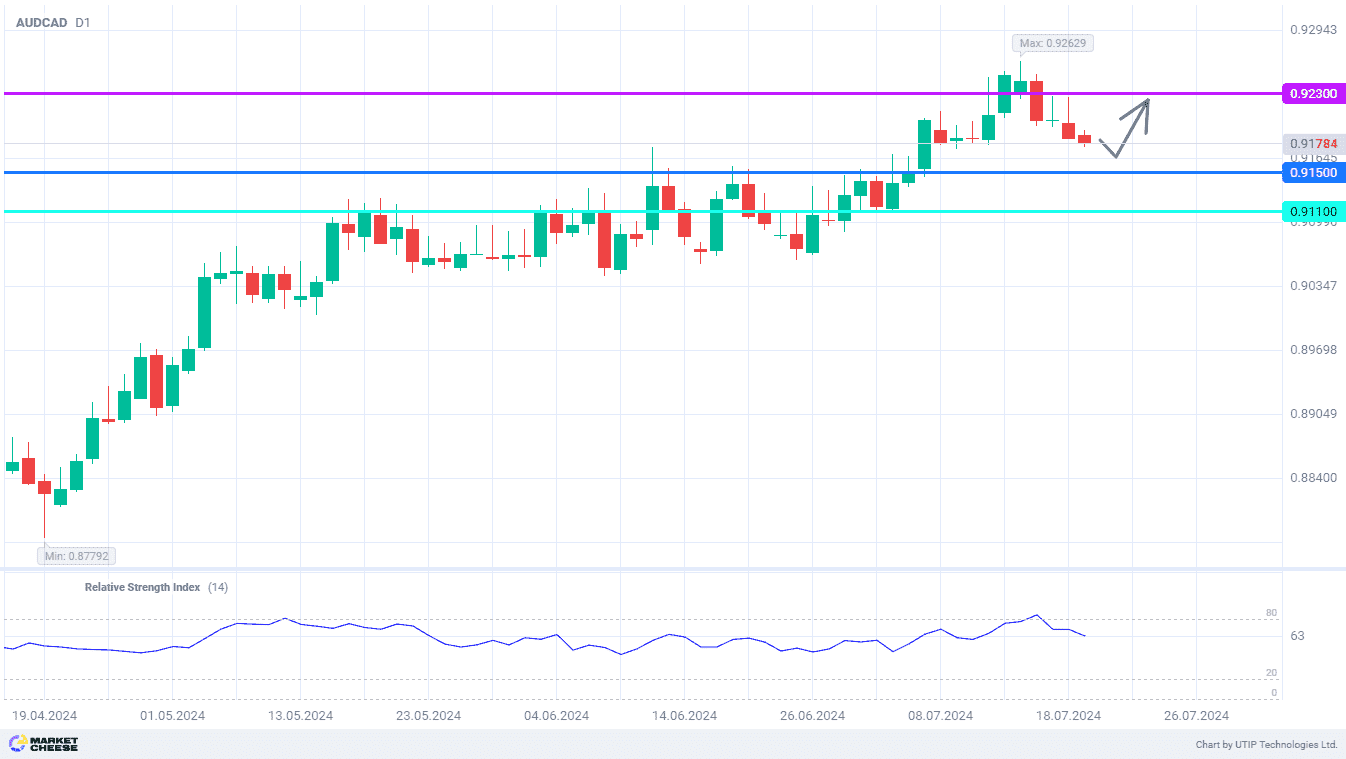

At the beginning of the current week the AUDCAD currency pair updated the annual maximum above the level of 0.926, after which it went into a corrective pullback. Technical factors spoke in favor of the quotes decline, but its scale was quite modest. The absence of mass AUDCAD sales indicates the initiative is still in the hands of the bulls and the possible rise in the currency pair in the nearest future. The first target of the new wave of growth could be 0.923.

Fundamental factors continue to indicate a stronger position of the Australian dollar in comparison with its Canadian counterpart. The economic statistics, released this week, again confirmed this state of affairs. Inflation in Canada slowed from 2.9% to 2.7% in June, as it was predicted by market participants. Retail sales data due today will probably show a significant decline of -0.6%.

According to Bloomberg estimates, the probability of another key rate cut by the Bank of Canada at the meeting on July 24 has almost reached 90%. Last month, the Canadian regulator became the first among the G7 countries to start the cycle of monetary policy easing, and now can be the first to make the 2nd step of reducing the cost of borrowing. Analysts at Bank of Montreal after the publication of the consumer price index immediately revised their forecast for the next easing of the Bank of Canada policy from September to July.

Meanwhile, the Reserve Bank of Australia (RBA) is still far from replicating the actions of its Canadian counterpart. Data on the labor market for June showed an increase in the number of new jobs by more than 50 thousand with much more moderate expectations of 20 thousand. According to traders, the chance of a rate hike at the RBA's Aug. 6 meeting has already exceeded 30%. Bloomberg analysts pay special attention to the report on inflation in Australia for Q2, due on July 31. If there is no slowdown in price growth, the RBA will have to further tighten monetary policy.

The current AUDCAD correction could end at 0.915. At this mark, opening long positions with a growth target at 0.923 could be a very interesting option.

The following trading strategy can be suggested:

Buy AUDCAD in the range of 0.915–0.918. Take profit — 0.923. Stop loss — 0.911.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account