Australian economy resilience helps AUDCAD recover

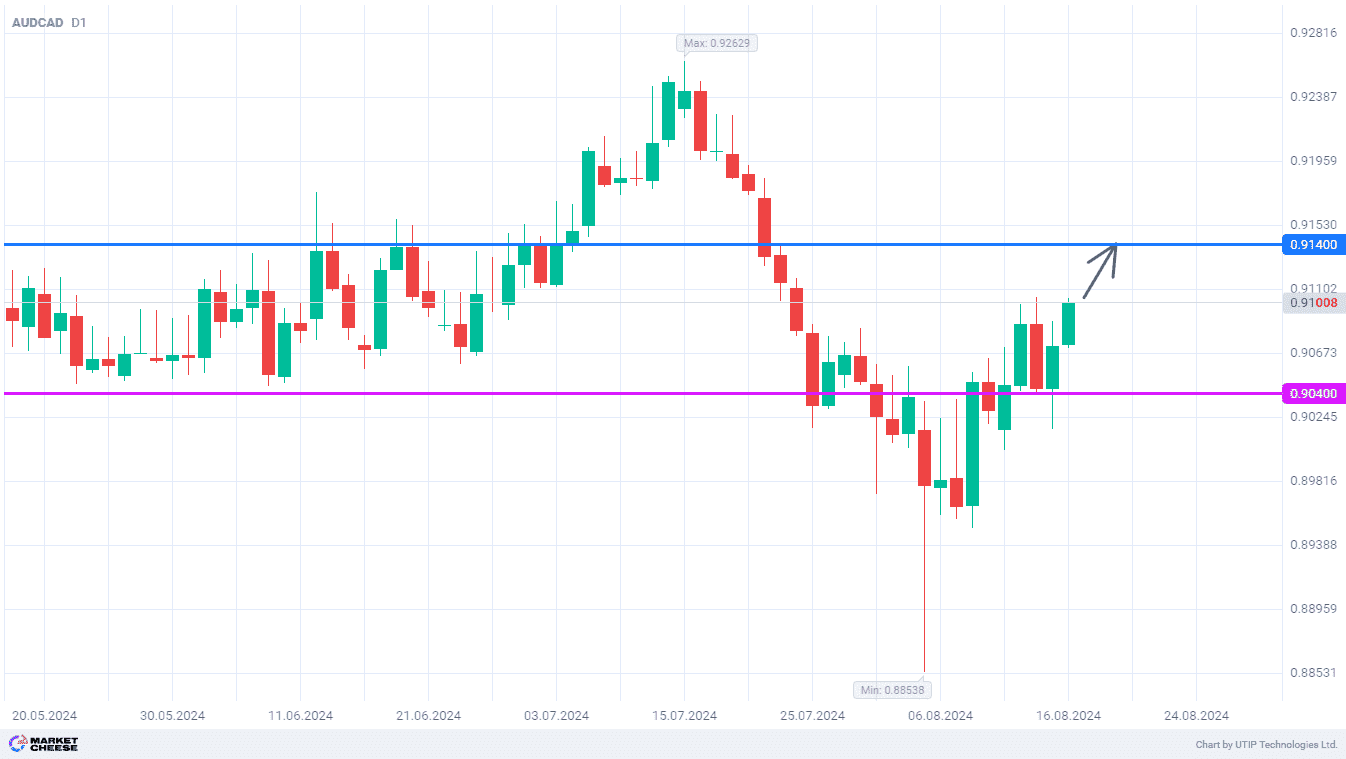

The AUDCAD currency pair continues to recover after breaking the short-term downtrend last week. Australian dollar buyers quickly regained control over the level of 0.904 and are now targeting the level of 0.914, which was a strong resistance in June and early July. Its breakthrough would open the way for a return to the yearly highs, and the news background supports this scenario.

Yesterday's July report on the Australian labor market confirmed that the national economy remains resilient. Almost 60 thousand new jobs were created last month, exceeding the forecast of 20 thousand. ABS's Kate Lamb noted the employment growth was higher than the population growth. This is a sure sign that the labor market is not cooling enough, and therefore the Reserve Bank of Australia (RBA) will keep interest rates high.

During today's speech, the RBA Governor Michelle Bullock confirmed the prematurity of any monetary policy easing discussions. According to her estimates, the stability of the labor market will be preventing inflation from falling down to the regulator's target level for over a year. Currency market participants are still hoping for the first RBA rate cut to be delivered in December, but UBS economists do not share this point of view. They expect the Australian regulator to start its policy easing cycle only in 2025.

Meanwhile, economic statistics in Canada proved to be much less optimistic. Volumes of wholesale trade in June decreased by 0.6% after a 1.2% decline in May, and July housing sales in the country fell by 0.7%. The Bank of Canada representatives reported about the risk of unnecessary inflation slowdown if the national economy continues to decline. In this regard, one should expect more steps aimed at reducing borrowing costs this fall, and interest rates in Canada may fall below the RBA's rate of 4.35%. This is the factor favoring further AUDCAD growth.

AUDCAD bulls will increase their advantage when taking control of 0.914. In case of success, it won't take them long to reach the July high.

The following trading strategy can be suggested:

Buy AUDCAD at the current price. Take profit - 0.914. Stop loss - 0.904.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account