Bitcoin declines in anticipation of US inflation report and Fed meeting

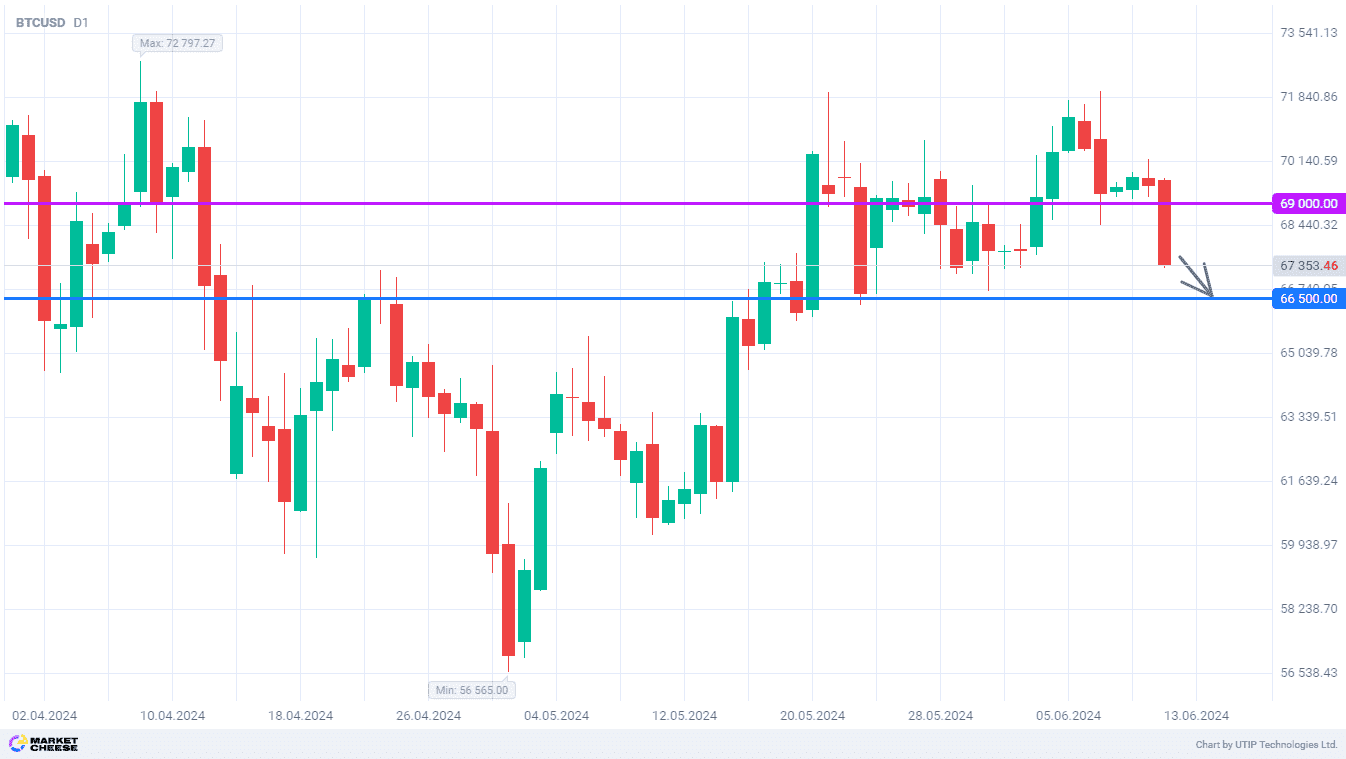

Last week, cryptocurrency market participants made another attempt to update the historical high in Bitcoin prices. However, the March high was once again beyond the reach of buyers, leading to a corrective pullback. Tuesday's trading session began with the downward movement intensifying, with the price targeting the late May lows near the 66500 level. With a number of important events expected tomorrow, the decline in Bitcoin prices may well continue.

According to Bloomberg, the correlation between Bitcoin and the 10-year US Treasury yield over the past month is -0.53, one of the lowest levels since 2010. With negative US inflation data and a hawkish report from the Federal Reserve meeting on Wednesday, bonds could fall significantly in value. This will cause bond yields to rise and Bitcoin as a non interest bearing asset will be on the outside looking in.

Tony Sycamore, market analyst at IG Australia Pty, notes that investors are risk averse ahead of tomorrow's events. On Monday, US ETFs on the major cryptocurrency saw $65 million in outflows. It was the first liquidity withdrawal by traders in the last 19 days. According to Sycamore, Bitcoin prices will be in a state of increased volatility for the next 36 hours.

Paradigm's Anand Gomez points to a significant disappointment among cryptocurrency market participants. Another attempt to set a new all-time high for Bitcoin has failed, and investors are already moving their capital into other assets. Gomez maintains a long-term positive view on the main cryptocurrency, but at the moment there are more conditions for the continuation of the correction than for a new wave of growth.

In today's trading Bitcoin rate broke through the level of 69000 without significant problems, which indicates the strength of the downward movement. The next target for the bears should be the 66500 level.

Consider the following trading strategy:

Sell BTCUSD in the range of 67500–68000. Take profit – 66500. Stop loss – 69000.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account