Bitcoin growth to resume after overbought decline

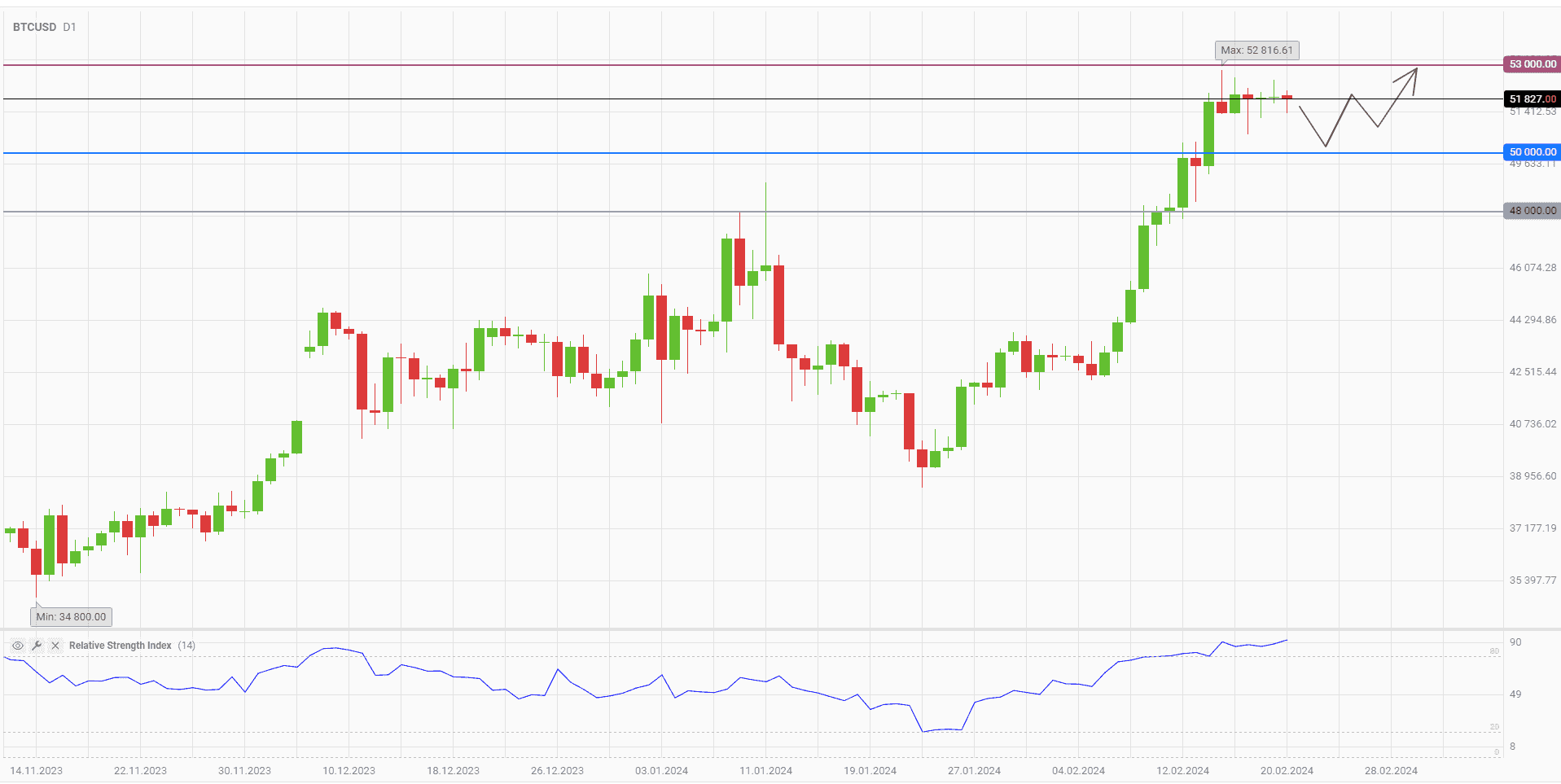

Bitcoin prices hit a new 2-year high slightly below the 53,000 level last week. Afterwards, the price of the main cryptocurrency is consolidating near these peaks, with no clear tendency to a new growth wave or to a correction. The fundamentals favor further increase in prices, but now this scenario is hindered by strong overbought on technical indicators. It is worth waiting for a price pullback closer to the 50,000 level to extend long positions.

February's wave of growth returned Bitcoin's capitalization to $1 trillion for the first time since the end of 2021. At the same time, the value of the entire cryptocurrency market exceeded $2 trillion. According to Bernstein estimates, exchange-traded funds increased their assets by 60,000 Bitcoins over the past month since the ETF was approved in the US. This is two times higher than the volume produced by the main cryptocurrency's miners during the same period of time.

Bernstein analyst Gautam Chugani expects 2024 to be a breakthrough year for cryptocurrencies. After the halving procedure in April, the Bitcoin price will update its historic high and will reach the $150,000 level by mid-2025. Higher trading liquidity will also contribute to the price growth. According to CCData, January's trading volume in the cryptocurrency market exceeded $1.4 trillion. This is the best result since June 2022.

Bitcoin's current rally has been continuing for almost a month now. According to statistics compiled by Bloomberg, after periods of 4 weeks of growth, the price of the main cryptocurrency on average increases by another 49% over the next 3 months. This gives a target at the 78,000 level by the end of spring. The use of Elliott Waves suggests a benchmark at 70,000.

Considering the highest overbought level since late October, it is better to buy Bitcoin after the start of the correction. From this perspective, the level of 50,000 looks interesting, and the growth target will be the local top update at 53,000.

Consider the following trading strategy:

Buy BTCUSD when the price declines to the 50,000 level. Take profit – 53,000. Stop loss – 48,000.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account