Bitcoin’s historic high update is a good time to take profits

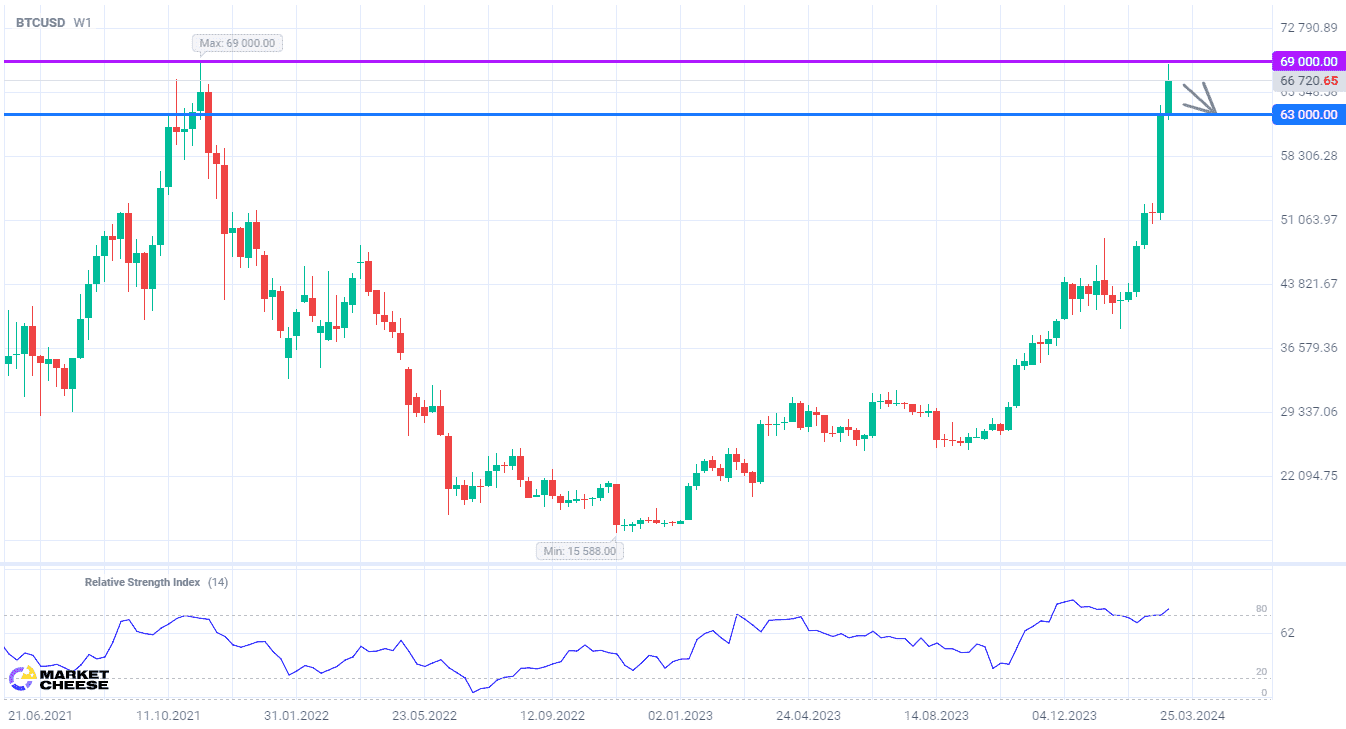

Bitcoin price after consolidation in the second half of February began a new wave of growth. Yesterday, the price of the main cryptocurrency jumped by more than 7%, and at the beginning of Tuesday's trading session, it didn’t reach the historic high of November 2021 at 69000. Due to the price approaching this mark there is volatility on the market. From a fundamental point of view, Bitcoin still has the potential for further growth, but technical factors clearly point to a correction.

Reuters analysts point to the strong demand from Asian buyers. Now traders from China, South Korea and neighboring countries account for almost 70% of Bitcoin trading volume in the world. The market participants from China are actively investing in cryptocurrencies, disappointed by the negative dynamics of the local stock market. Individuals and companies in South Korea have purchased almost as many Bitcoins in the first 2 months of 2024 as they did for all of last year.

Kyle Rodda, senior analyst at Capital.com, believes the current behavior of cryptocurrency market participants is irrational. Tony Sycamore, an analyst at IG, warns of the risks stemming from Bitcoin's high level of technical overboughtness. He is also concerned about the cryptocurrency's aggregate trading volume. While turnover has increased significantly in recent months, it’s still well below the 2021–2022 levels.

Bloomberg experts see a serious vulnerability of the cryptocurrency market to price declines. Many traders have accumulated long positions with the help of derivatives market instruments and active use of borrowed funds. If the inflow of liquidity in ETFs on Bitcoin slows down, and the euphoria of investors subsides, quotes could plummet. The mass closing of bullish positions can very quickly bring the cryptocurrency market to the levels of early March.

At the beginning of a serious correction in Bitcoin prices, the first targets for the sellers will be the marks around 62000–63000. Technical indicators on both daily and weekly charts signal a high probability of the beginning of the downward movement.

The following trading strategy can be suggested:

Sell BTCUSD in the range of 66000–67000. Take profit — 63000. Stop loss — 69000.

Traders can also use a Trailing stop instead of a fixed Stop loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account