Breaking through the 1.281 level will help GBPUSD to grow further

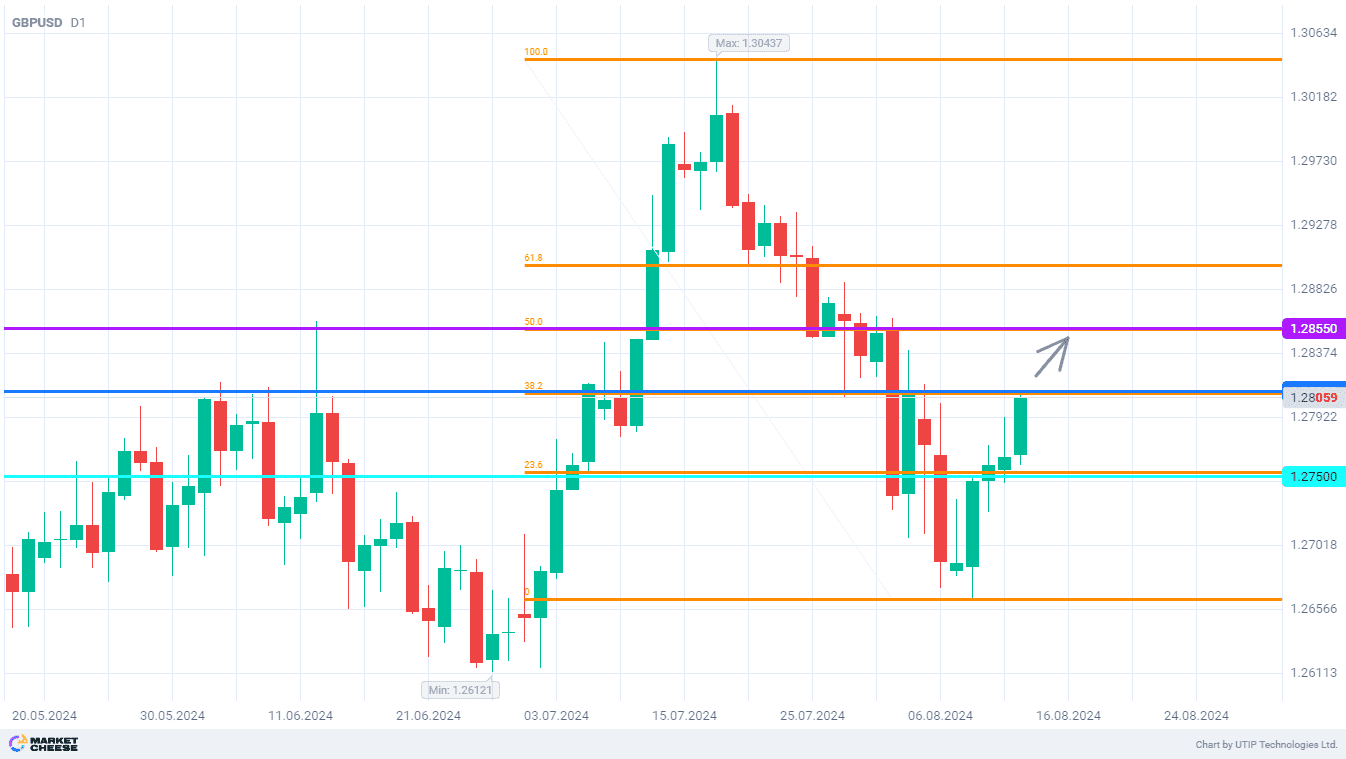

The GBPUSD currency pair updated a monthly low last week, after which it bounced sharply higher and began a gradual recovery. The bulls quickly regained control of the 23.6% Fibonacci level (mark 1.275), and today the 38.2% level (mark 1.281) is being actively tested. A consolidation above this level will confirm the buyers' resolve and open the way for GBPUSD to the next target of 1.2855.

The pound's strength against the dollar will be supported by today's UK employment report. The unemployment rate in the country fell to 4.2%, against expectations of an increase from 4.4% to 4.5%. The number of people employed in the British economy was also much better than expected, increasing by 97,000 people against a forecast of only 3,000. These data are in stark contrast to the U.S. labor market, where the decline in demand for labor is becoming more pronounced.

Catherine Mann, one of the Bank of England officials, pointed to the continued overheating in employment. According to her, normalizing the situation will take a long time, so the issue of easing monetary policy should be approached very cautiously. Mann was one of the four members of the regulator who voted against cutting the key rate at the August 1 meeting. Back then, the decision to lower interest rates was made by a narrow margin (5 against 4).

The number of opponents to the Bank of England's policy easing may increase when inflation data for July is released on Wednesday. Bloomberg analysts estimate that the country's price growth rate will accelerate for the first time this year, from 2% to 2.3%. Dan Hanson, an economist at Bloomberg, sees rising inflation as a clearly inappropriate backdrop for further interest rate cuts by the British regulator. In this context, the chances of an easing in September are very low, and such a move should not be expected before November. This circumstance supports further growth of GBPUSD.

Tomorrow's U.S. inflation report may also provide additional support to GBPUSD buyers. GBPUSD has a good chance of rising to the 1.2855 level.

Consider the following trading strategy:

Buying GBPUSD at the current price. Take profit — 1.2855. Stop loss — 1.275.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account