Brent loses ground amid rising US fuel inventories and expectations that OPEC+ will roll over the cut into 2025

On Friday, Brent crude oil prices declined for the third day in a row due to hawkish comments from US officials and an unexpected rise in US gasoline inventories.

The Federal Reserve has no plans of easing monetary policy anytime soon, according to statements by officials. Dallas Federal Reserve President Lorie Logan said the officials are still worried about upside risks to inflation. Despite recent easing, in her opinion, it's too soon to really be thinking about rate cuts. The regulator will assess the upcoming data and determine how to respond.

Meanwhile, US crude oil inventories fell by 4.2 million barrels in the week ending on May 24, according to the Energy Information Administration (EIA). Traders' preliminary estimate was 1.9 million barrels.

Gasoline inventories, however, rose by 2 million barrels, compared with expectations for a 400,000-barrel draw, predicted by analysts.

Another important event for the oil market will be the OPEC+ meeting on June 2. During the event, the alliance intends to reach an agreement on the extension of oil production cuts into 2025. The organization is currently cutting output by 5.86 million barrels per day. This is equal to about 5.7% of global demand. The possible extension of the restrictive policy has already been taken into account by the market, so the oil price remains under pressure.

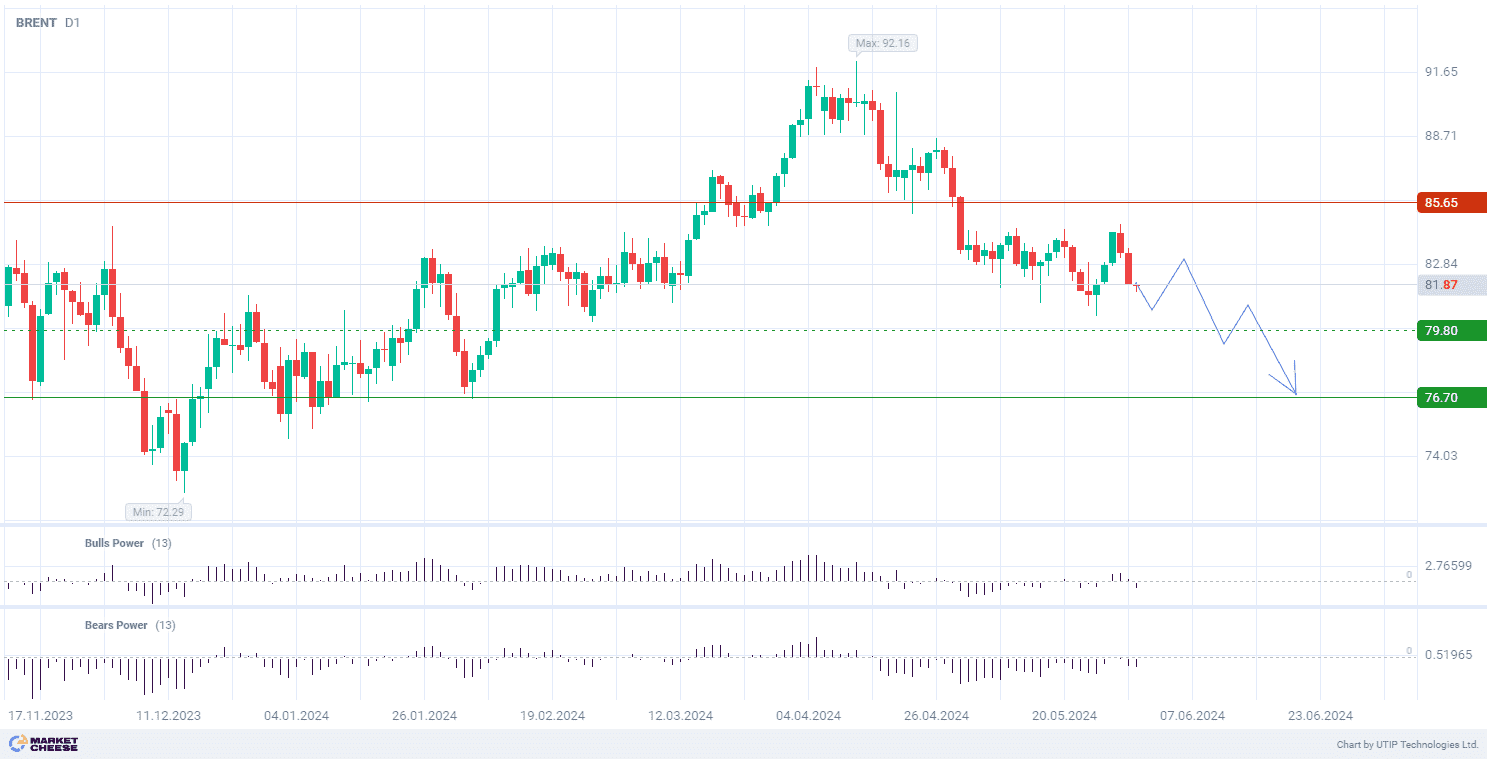

From the technical point of view, Brent is forming a downward trend on the D1 timeframe. Bulls Power and Bears Power (standard values) are in the negative zone, confirming the movement towards sales.

Signal:

The short-term outlook for Brent is to sell.

The target is near the level of 76.70.

Part of the profit should be fixed near the level of 79.80.

The Stop-loss could be placed near the level of 85.65.

The bearish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account