Brent oil maintains its uptrend after OPEC+ and Fed decisions

Brent oil prices strengthened early Friday in response to the OPEC+ decision to maintain the current quotas on oil production. However, the ongoing trend is far from reducing price losses created on Thursday.

In March, the group will decide whether to extend the 2.2 million bpd cap imposed in the first quarter. This cut was announced in November.

As noted by ANZ Research analysts, the reduction in production volumes should help to maintain supply at a sufficient level in the first quarter. At the same time, production growth in non-OPEC countries should normalize, and slow down to 300 thousand barrels per day in the United States.

Oil prices were also supported by the decision made at the last meeting of the U.S. Federal Reserve (Fed). The rates were kept in the range of 5.25-5.50%, and, according to central bank chairman Jerome Powell, they will decline in the coming months.

Monetary policy easing will reduce the cost of consumer borrowing. This, in turn, will contribute to economic growth and support oil demand.

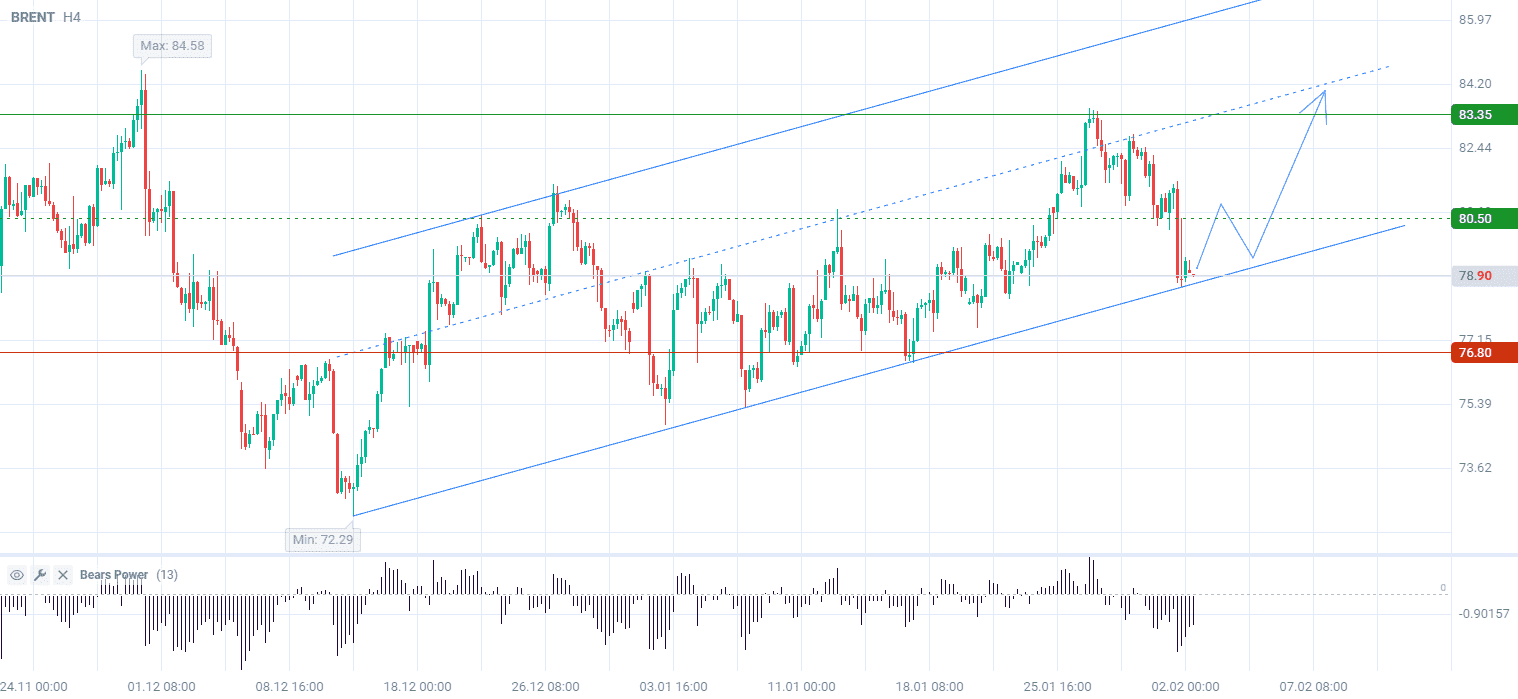

Brent crude oil prices have been correcting for a month and a half. At the same time, the price has formed an uptrend on the H4 time frame, approaching the level of the trend support. The volumes of the Bears Power indicator (standard values) are decreasing within the negative zone, indicating a possible change in the traders' sentiment towards growth. Impulsive upward movement may occur after the price bounces off the trend line.

Signal:

Short-term prospects for Brent oil suggest buying.

The target is at the level of 83.35.

Part of the profit should be taken near the level of 80.50.

A stop-loss could be placed at the level of 76.80.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account