Brent oil prices to hold above 80

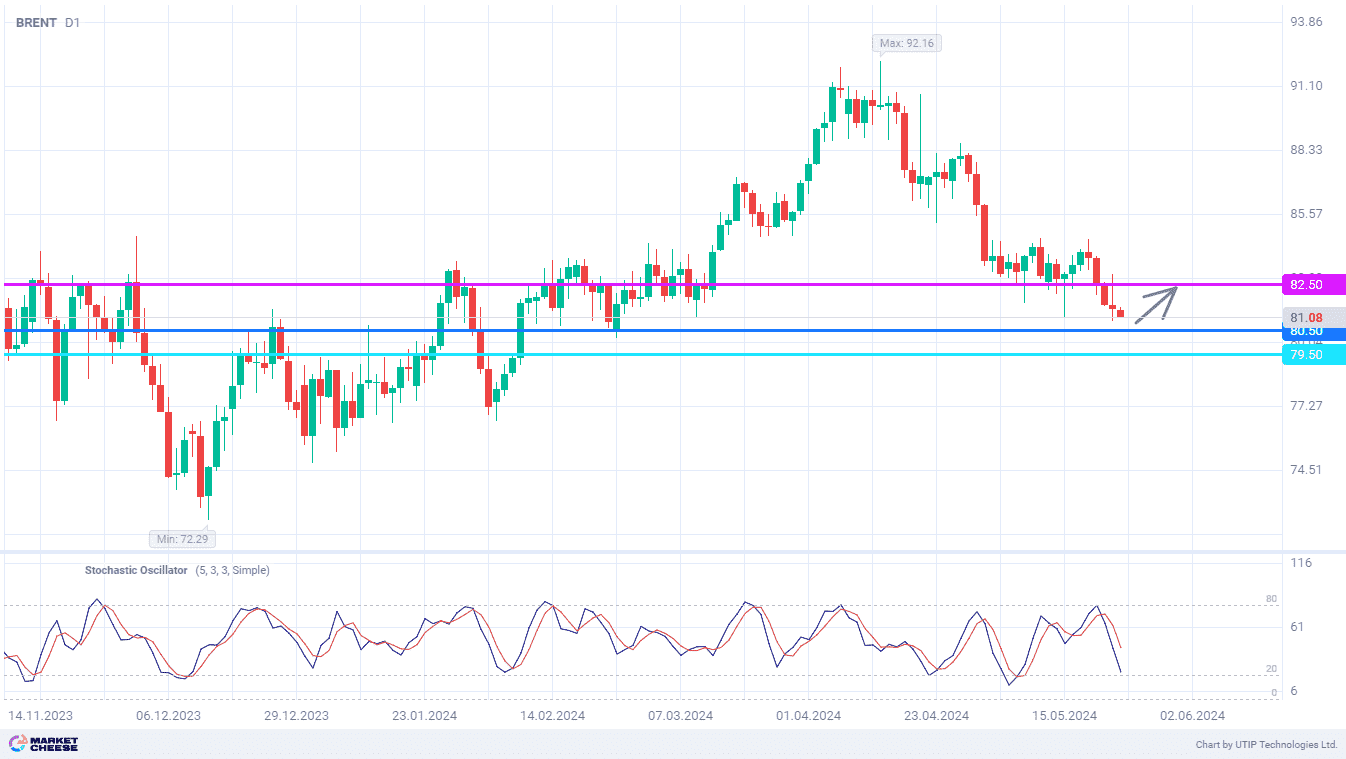

This week, Brent oil quotes broke consolidation and fell to the lows since the beginning of March. Oil is getting closer and closer to the level of $80 per barrel, below which the price has not been below for almost 4 months. Although the pullback in oil prices from the April highs is generally fair, its scale has already exceeded 12% and looks somewhat excessive. In the coming days, buyers will be looking to retake the initiative, and their short-term target could be the level of 82.5.

Goldman Sachs analysts note a sharp drop in the number of long positions in the oil market. Against the background of weakening tensions in the Middle East, traders started mass sales of oil contracts. As a result, their net long position was below the standard seasonal values, indicating excessive pessimism. Goldman Sachs maintains its forecast for the cost of Brent crude just below $90 for 2024.

Citi specialists pay attention to the approach of the next OPEC+ meeting, scheduled for June 2. In their opinion, the monthly downtrend in oil prices is unambiguously in favor of extending restrictions on the production of raw materials. In the baseline scenario, analysts expect the current level of OPEC+ production of oil to remain unchanged until the end of the first half of 2025.

Citi representatives consider the possibility of an additional reduction in oil production unlikely, although such a scenario cannot be completely ruled out either. It is very important for the members of Organization of the Petroleum Exporting Countries to show their determination to support commodity prices. We should expect at least verbal interventions, especially from Saudi Arabia, whose budget at current oil prices is at risk of being in deficit again.

The Stochastic indicator lines on the daily chart of Brent oil are approaching the oversold zone, and may soon form a reversal signal. The bulls may choose 82.5 as the nearest benchmark for the price rebound upwards.

The following trading strategy may be offered:

Buying Brent oil in the range of 80.5–81. Take profit – 82.5. Stop loss – 79.5.

Traders may also use a Trailing stop instead of a fixed Stop-loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account