Brent prices are recovering from last week’s losses

Brent oil prices after four consecutive sessions of growth have recovered almost all of last week's losses. Yesterday was a particularly successful day, which resulted in a price increase of more than 3%. On Friday, the activity of bulls may not be so high, but the potential for upward movement remains plausible. The highs of the end of January near the level of $83 per barrel are already within the reach of oil buyers.

A number of factors contributed to the recovery of oil prices after last week's correction. Another attempt to resolve the situation in the Middle East ended in failure, and supply disruptions will continue to affect the price of energy carriers. Market participants also paid attention to the reduction of oil reserves in the USA. Gasoline reserves decreased by 3.15 million barrels — much more than the forecast of 140 thousand. At the same time, U.S. crude oil exports continue to set records.

However, the upward trend in the supply of raw materials from the U.S. may soon come to naught. This opinion was expressed by experts polled by Reuters. Jesse Jones from Energy Aspects draws attention to the statistics of transactions between companies. In 2023, 39 private U.S. oil producing companies were absorbed by large corporations. Their investors prefer to recoup their investments through dividends and share buybacks rather than invest large sums in expanding oil production.

In the latest report from the Energy Information Administration (EIA) the estimate of the increase in oil production sharply worsened — from 290 to 170 thousand barrels per day this year. Alexandre Ramos-Peon of Rystad Energy attributes the slowdown in crude production growth to current prices. WTI oil has been trading in the range of $70–80 per barrel for the fourth month. This is enough for American oil producers, but doesn’t stimulate them to increase production.

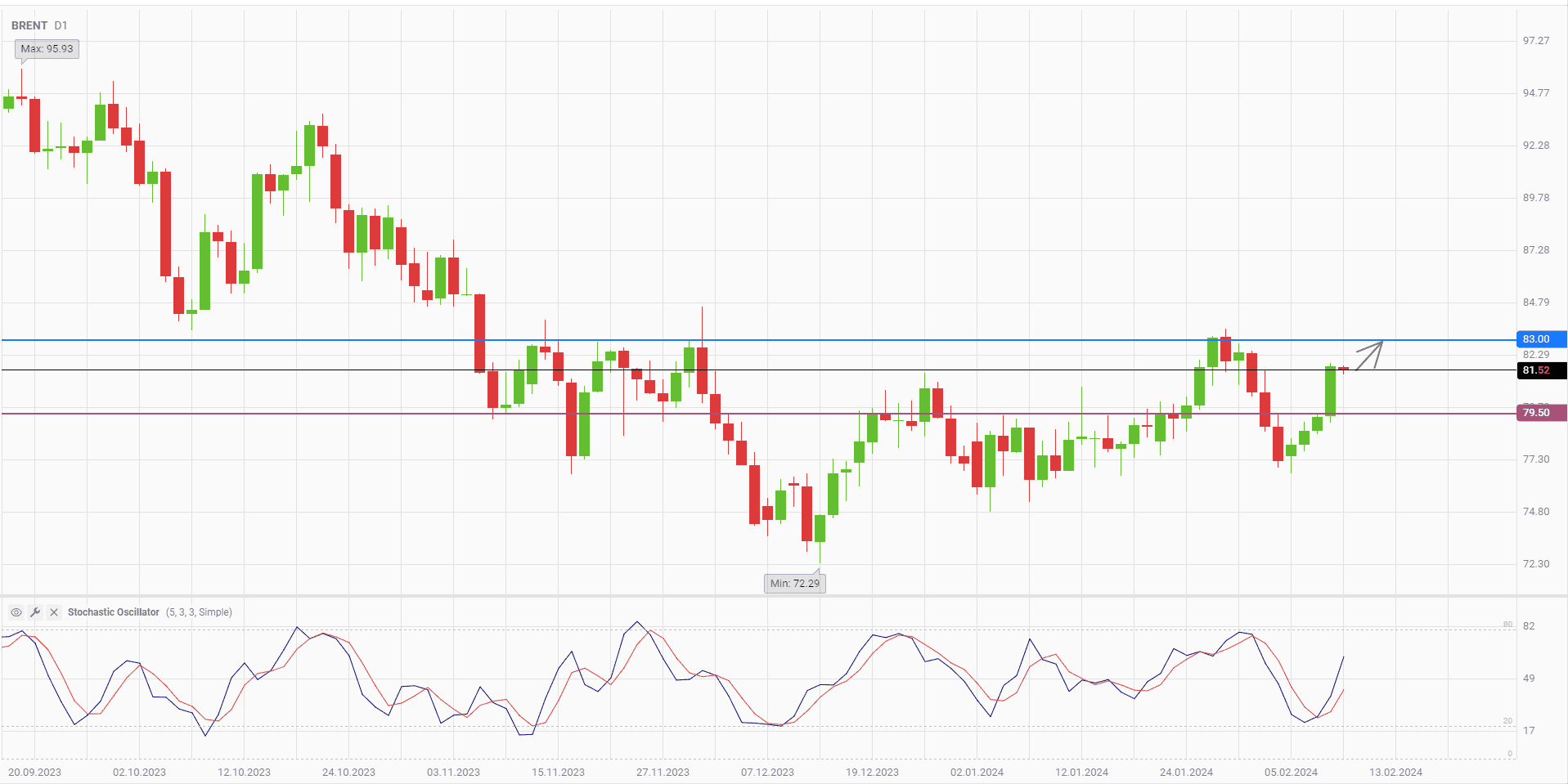

On the daily chart of Brent oil, the Stochastic indicator continues to rise after a reversal from the oversold zone. Excessive overheating hasn’t been recorded yet, and from the technical point of view there are no obstacles for the upward price movement. The target is the level of 83.

The following trading strategy can be suggested:

Buy Brent oil in the range of 81–81.5. Take profit — 83. Stop loss — 79.5.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account