BTCUSD gets a buy signal with a target at 72,400 amid political uncertainty in the US

BTCUSD jumped more than 6% and hit a two-week high at $64,986. This is due to an incident involving US presidential candidate Donald Trump which happened at the weekend. This event increased his chances of winning the election and added to political uncertainty in the markets. Trump has positioned himself as a proponent of the use of cryptocurrencies.

The Republican, who is the main rival to incumbent President Joe Biden in November's US election, has criticized attempts by Democrats to regulate the crypto sector. During a campaign fundraiser in San Francisco in June, Trump described himself as a champion of cryptocurrency. However, he hasn’t revealed details about his policy regarding the decentralized market.

Last week, organizers of the Bitcoin 2024 conference in Nashville reported that Donald Trump is likely to be one of the speakers on July 27.

Bitcoin had a strong start to the year after the launch of exchange-traded funds in the US, propelling it to a record $73,776 in mid-March. Since then, however, the digital currency has struggled. It fell to an over four-month low in early July as traders fretted over the likely dumping of tokens from defunct Japanese exchange Mt. Gox.

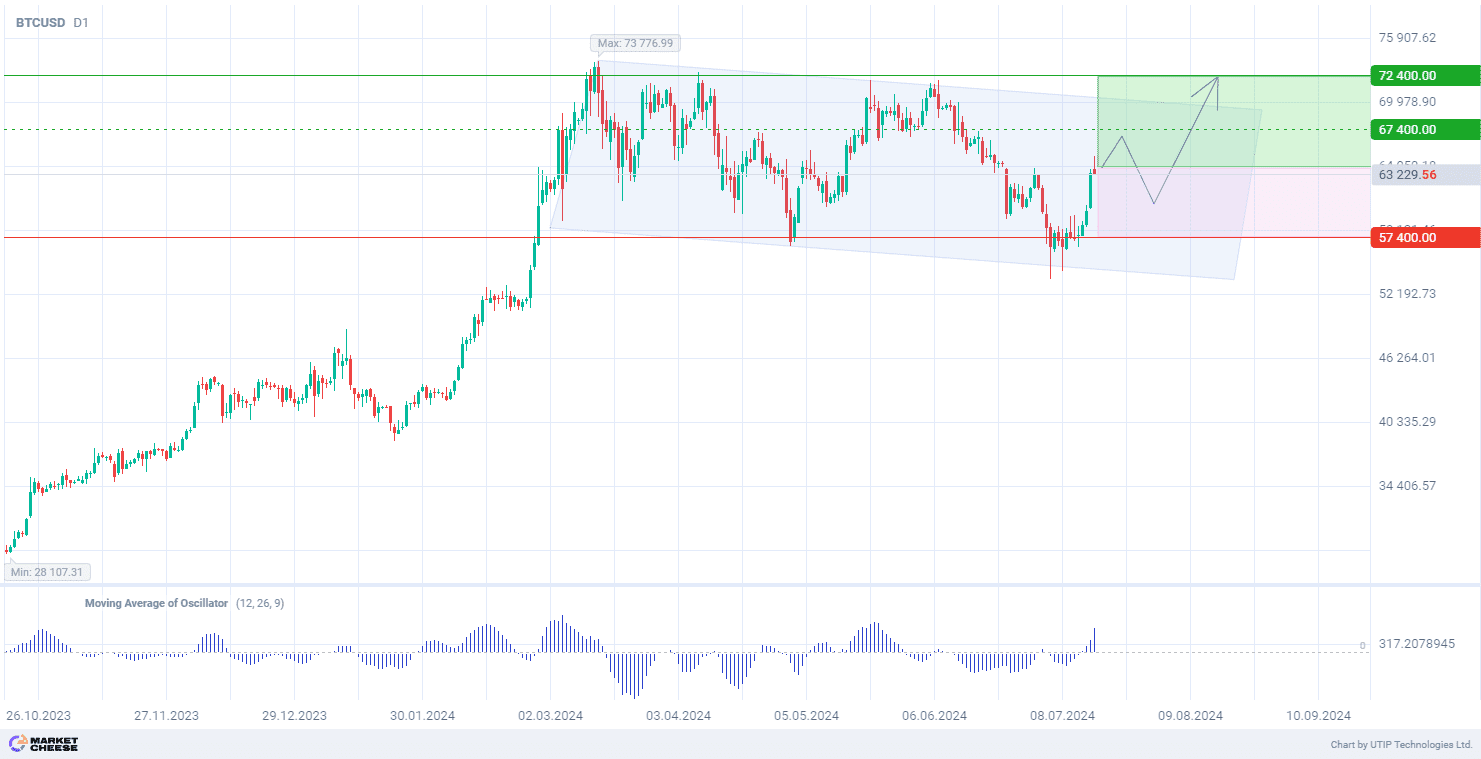

From the technical point of view, BTCUSD is forming a broad downward correction on the D1 timeframe. Moreover, the descending channel resembles a flag chart pattern. If the flag resistance is broken, the price volatility could increase. The volumes of the Moving Average of the Oscillator (with parameters 12, 26, 9) indicate a potential growth in the Bitcoin price.

The short-term outlook for BTCUSD is to buy with a target at 72,400.00. Part of the profit should be fixed near the level of 67,400.00. The Stop loss could be placed at 57,400.00.

The bullish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account