BTCUSD recovers in anticipation of Fed rate decision

Bitcoin surpassed the $43,000 threshold again at the beginning of the week, for the first time in two weeks. This was partly due to a slowdown in investment outflows from Grayscale Bitcoin Trust. A study by Coinglass showed that more than $60 million worth of short positions were liquidated on Tuesday.

The leading cryptocurrency by market capitalization rose more than 2% over the past day, reaching $43,787.

The rise in BTCUSD on January 29 was driven by market expectations that the Federal Reserve (Fed) will leave interest rates unchanged at its upcoming meeting. According to the CME FedWatch tool, there is a 97.9% probability of the Fed keeping the current rate range at 5.25-5.50%. The unchanged monetary policy implies that the regulator is moving away from the soft stance adopted by Jerome Powell and his team in December in favor of a more neutral stance. This could have a positive impact on the price of bitcoin.

Analysts at Ryze Labs also noted that institutional interest in the digital currency will continue to grow and investment inflows into spot bitcoin ETFs are expected to increase as the market becomes familiar with the new product.

For example, Hong Kong's Securities and Futures Commission (SFC) recently received the first application to launch a spot bitcoin exchange-traded fund.

BTCUSD prices are forming a new price channel on the D1 timeframe. Last week, the price tested the major support at 40,400, but returned to the two-month correction range.

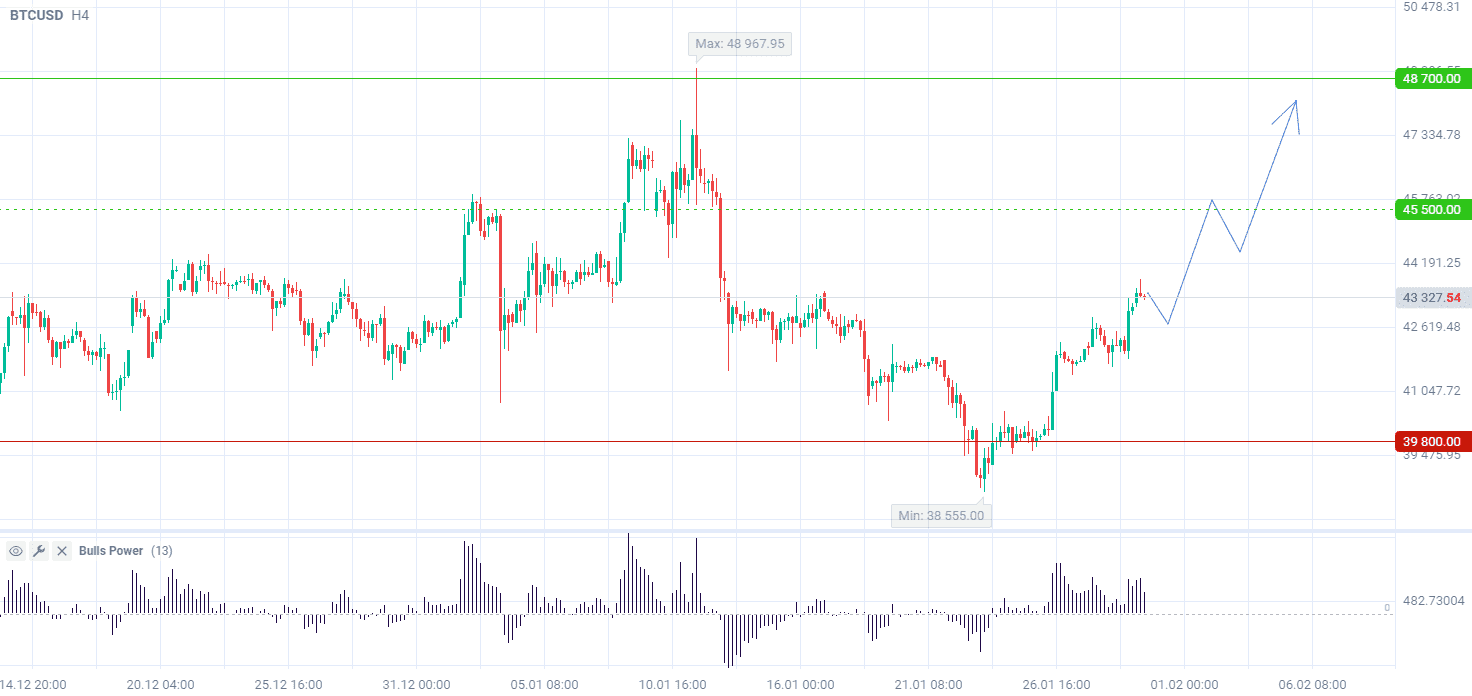

The Bulls Power indicator volumes (standard values) on the H4 timeframe are remaining in the positive zone, indicating an upward movement.

Signal:

Short-term prospects for BTCUSD suggest buying.

The target is at the level of 48 700.

Part of the profit should be taken near the level of 45 500.

A stop-loss could be placed at the level of 39 800.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account