BTCUSD strengthens signs of growth inside the price channel towards 69,400 level

BTCUSD fell 0.25% on Tuesday, remaining near the $60,000 level. Last week, the cryptocurrency market was characterized by high volatility and significant price swings caused by investors' concerns about changes in global monetary conditions. Most central banks are poised to ease monetary policy. This is creating a lot of uncertainty in the markets.

Against this backdrop, there was a significant outflow of funds from centralized cryptocurrency exchanges. Bitcoin ETFs lost $89 million and Ether ETFs lost $15.7 million.

The further movement of the main digital currency's exchange rate will depend to some extent on the U.S. macroeconomic statistics. On Tuesday, the Producer Price Index will be released, and on Wednesday the main U.S. inflation report will be published. These data are important for determining the further monetary policy of the Federal Reserve (Fed).

According to experts, both the core and headline producer price indices are expected to rise by 0.2%.

Investors are also awaiting the release of consumer prices and retail sales reports for July. These indicators will be crucial in determining how much the Fed will cut rates in September: by 25 or 50 basis points. Currently, most experts are leaning towards the second option.

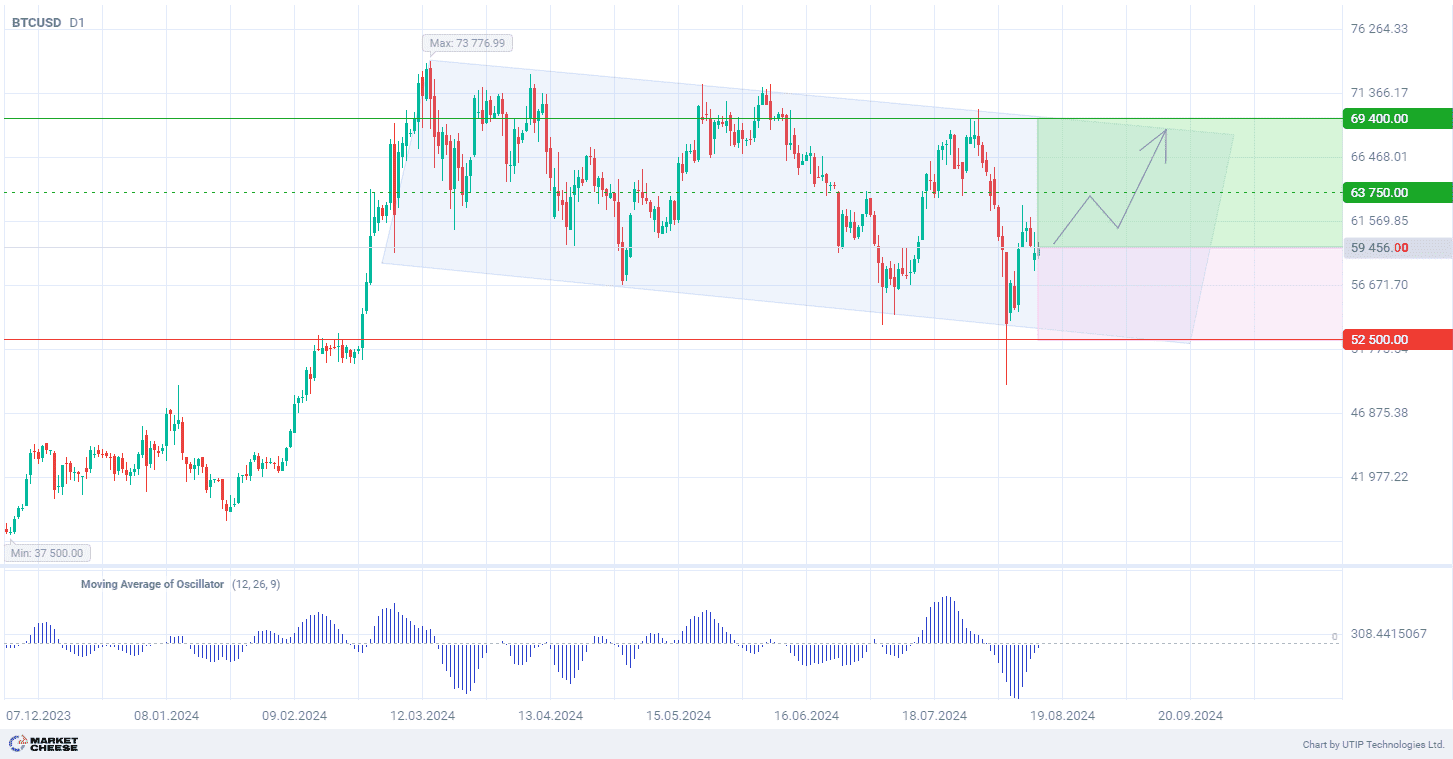

The technical analysis of BTCUSD quotes shows the formation of a broad bearish correction on the daily timeframe (D1). The price has retreated from the trend support, demonstrating the strength of the current range and direction towards the resistance level. The volume of the Moving Average Oscillator indicator (with parameters 12, 26, 9) is increasing and may enter the positive zone. This can strengthen the bullish sentiment.

The short-term outlook for BTCUSD suggests buying with a target at 69,400.00. Partial profit taking is recommended at 63,750.00. A stop loss could be set at 52,500.00.

Since the bullish trend is short-term, the trading volume should not exceed 2% of the total balance to reduce risks.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account