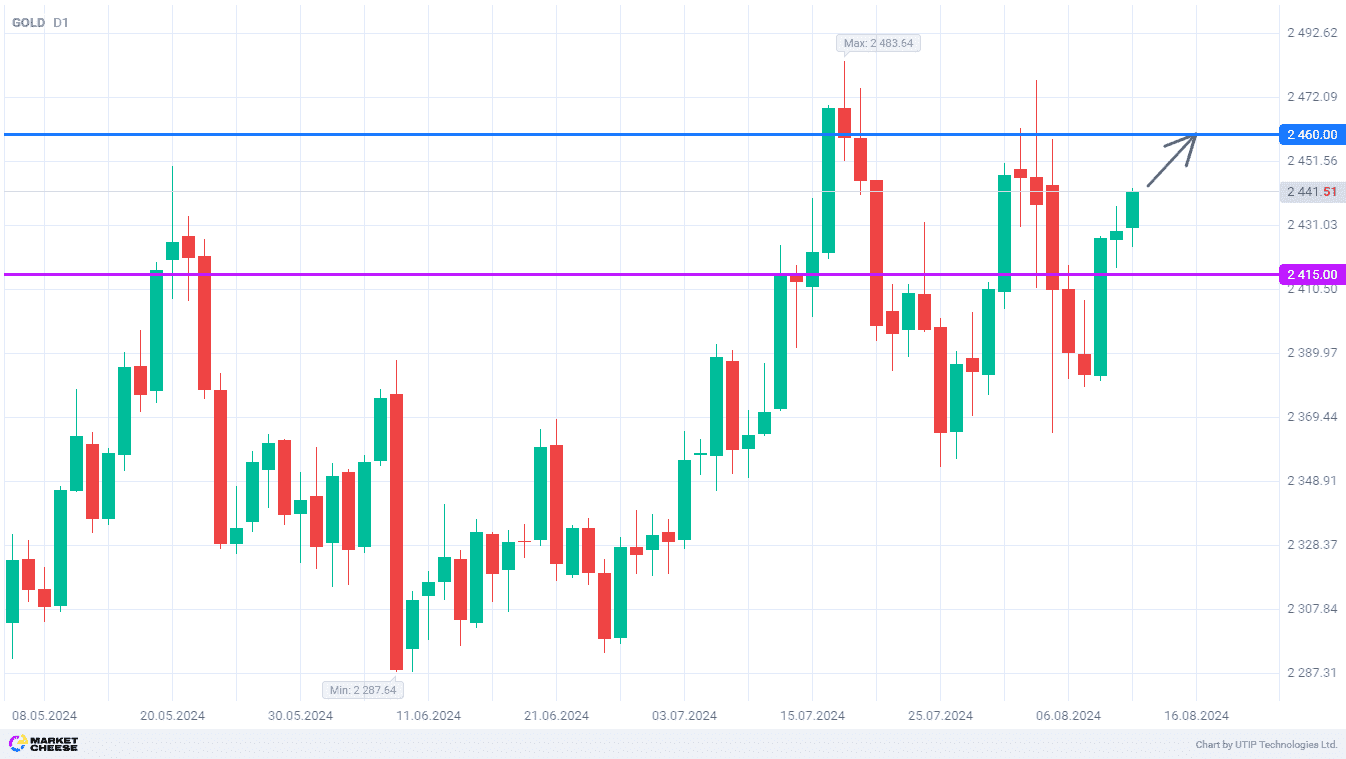

Buying back another drawdown takes gold prices to 2460 level

Gold prices came under heavy selling pressure in the first half of last week and once again fell below the $2400 an ounce mark. However, as was the case in late July, the bears were unable to hold these levels. On Thursday, the yellow metal began a confident recovery that has continued to this day. The full drawdown buyback and the moment for the bulls to take profits will come when the 2460 level is reached.

As had happened many times in recent months, consumers of the yellow metal actively used the local price dip to buy in bulk. In particular, the revival of demand was noted in Asian countries. Market participants from India noted an increase in the local premium for gold over world prices from $7 to $9 per ounce last week. Dealers are seeing a gradual return of buyers to the shops.

Gold dealers in China also increased the premium over local gold prices to as much as $18 an ounce. A week earlier, they had regularly had to offer discounts in order to close deals. According to Bernard Sin of MKS PAMP, demand for jewelry in China remains sluggish, but sales of coins and bars made of the yellow metal are growing. Even the People's Bank of China, which refused to buy gold in July for the third month in a row, is not preventing this.

Analysts at the World Gold Council (WGC) also note the growing interest in the yellow metal among Western investors. Last month they invested about $3.7 billion in gold ETFs, which was the maximum since April 2022. The dynamics of cash investments in ETFs since the beginning of the year remains negative, but the total outflow has already decreased to $3 billion. The activation of Western investors will support a new wave of growth in gold prices.

The yellow metal may continue a steady recovery to the level of 2460. In anticipation of the U.S. inflation report, further price growth is unlikely.

Consider the following trading strategy:

Buying gold at the current price. Take profit — 2460. Stop loss — 2415.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account