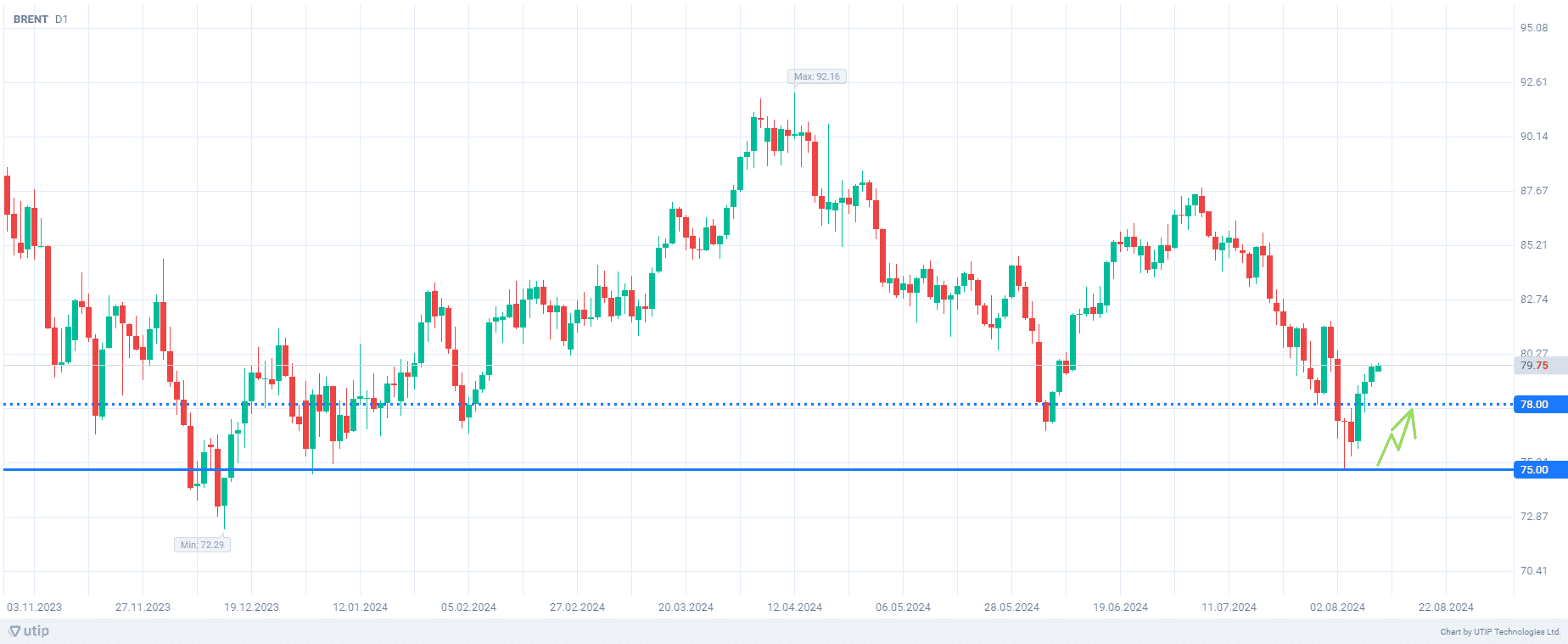

Buying Brent crude oil from the level of $75.0 with a target of $78.0 per barrel

There are many events expected this week that will clarify the future outlook for the global oil market. Traders need more clarity on the supply/demand balance in the energy market, as the gloomy outlook for China, the largest importer, is weighing on consumer sentiment.

Today will see the release of OPEC's monthly report. A similar report from the International Energy Agency is due tomorrow.

On Wednesday, U.S. inflation data for July will be released. This data is the last piece of information before the Fed's likely first interest rate cut. The easing of U.S. monetary policy will stimulate the global economy, provide additional impetus to its development and, accordingly, increase demand for energy resources and support global oil prices, including Brent. In addition, policy easing will weaken the U.S. dollar, which will automatically strengthen the cost of oil, which is priced in the American currency.

At the same time, fund managers have reduced their net long positions on the global benchmark Brent to the lowest level since 2011 and moved to a net short position on diesel. The physical market is also sending warning signals, as U.S. refineries are slowing down and profit margins are shrinking.

The risk of geopolitical tensions escalating in the Middle East remains, and any spiral of conflict could once again threaten the transport corridors that deliver oil to global consumers.

In terms of technical analysis, last week Brent oil showed a strong rebound from the level of $75 per barrel, which indicates the strength of this mark. If this level is touched again, it is likely that Brent will also correct upwards.

The overall recommendation is to buy Brent when the level of $75.0 per barrel is reached.

Profit could be taken at the level of 78.0. A stop loss could be set at 72.0.

The value of possible loss should not exceed 2% of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account