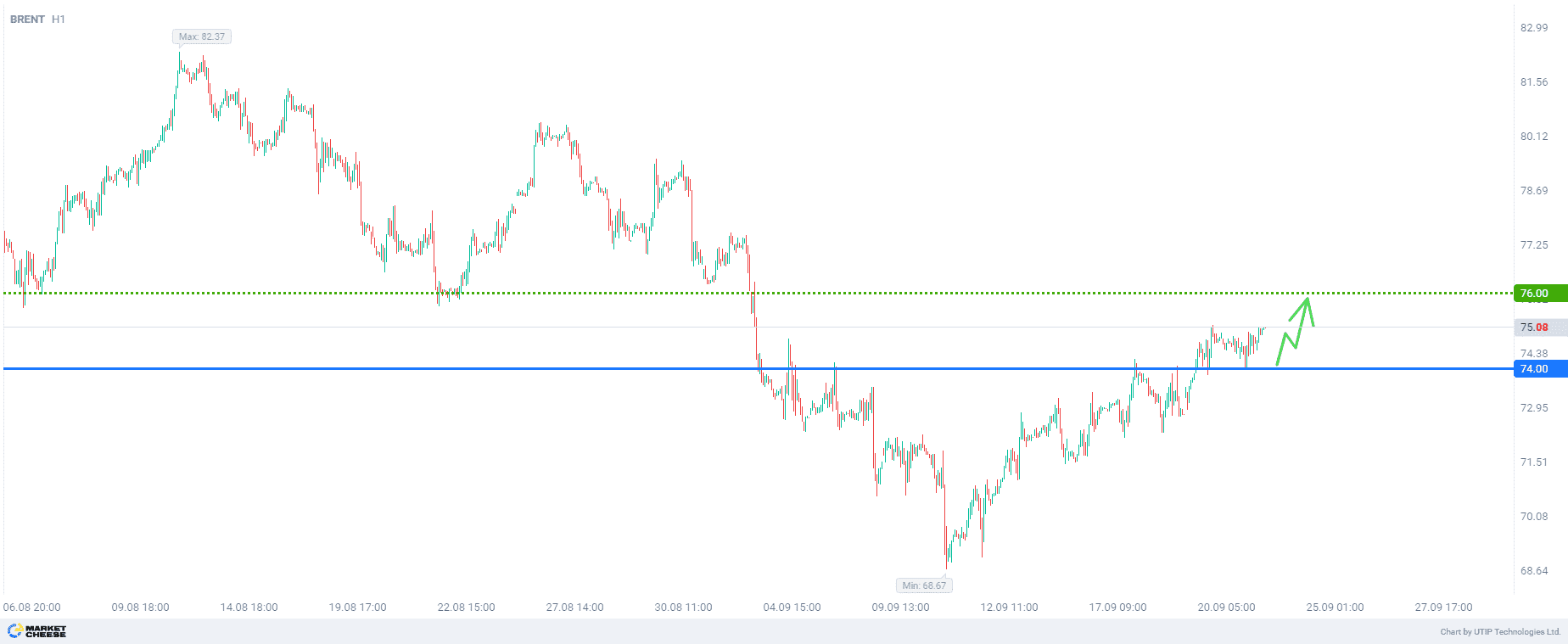

Buying Brent crude oil to the level of $76.0 per barrel

If the current situation with Brent oil prices is examined from a technical point of view, the quotes are trying to test the level formed at the previous local lows at $75 per barrel. In case the price breaks through this level, it is likely to continue moving even higher — up to the level of 76 dollars per barrel — due to the existing technical patterns.

From a fundamental point of view, this is facilitated by the tense geopolitical background in the Middle East. Escalation of tension may jeopardize oil transportation corridors, thus putting upward pressure on global oil prices.

Meanwhile, the release of the U.S. manufacturing activity index is scheduled for today. The indicator reflects the dynamics of economic growth and energy demand associated with it. The previous estimate of activity in the manufacturing sector amounted to 47.9, and it was the weakest figure for the current year (except for the January estimate, which was also 47.9).

According to the forecasts, the index is expected to rise by 0.7 to 48.6.

In relation to oil prices, the interest will be focused on the situation when the actual value of the manufacturing PMI will be above 49.0. This could push the Brent crude oil price to the level of $76.0 per barrel.

The final recommendation is to buy Brent oil, provided that the value of the purchasing manager's index in the U.S. manufacturing sector (PMI) will exceed the level of 49.0. It seems advisable to enter the purchase transaction with a pending order from the level of $74.0 per barrel, if the price falls to this level. Otherwise, it is better not to enter the transaction.

The profit is taken at the level of 76.0. The loss is fixed at the level of 72.0.

The volume of the opened position should be defined in such a way that the value of the possible loss, fixed with the help of a protective stop order, amounts to no more than 2% of the size of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account