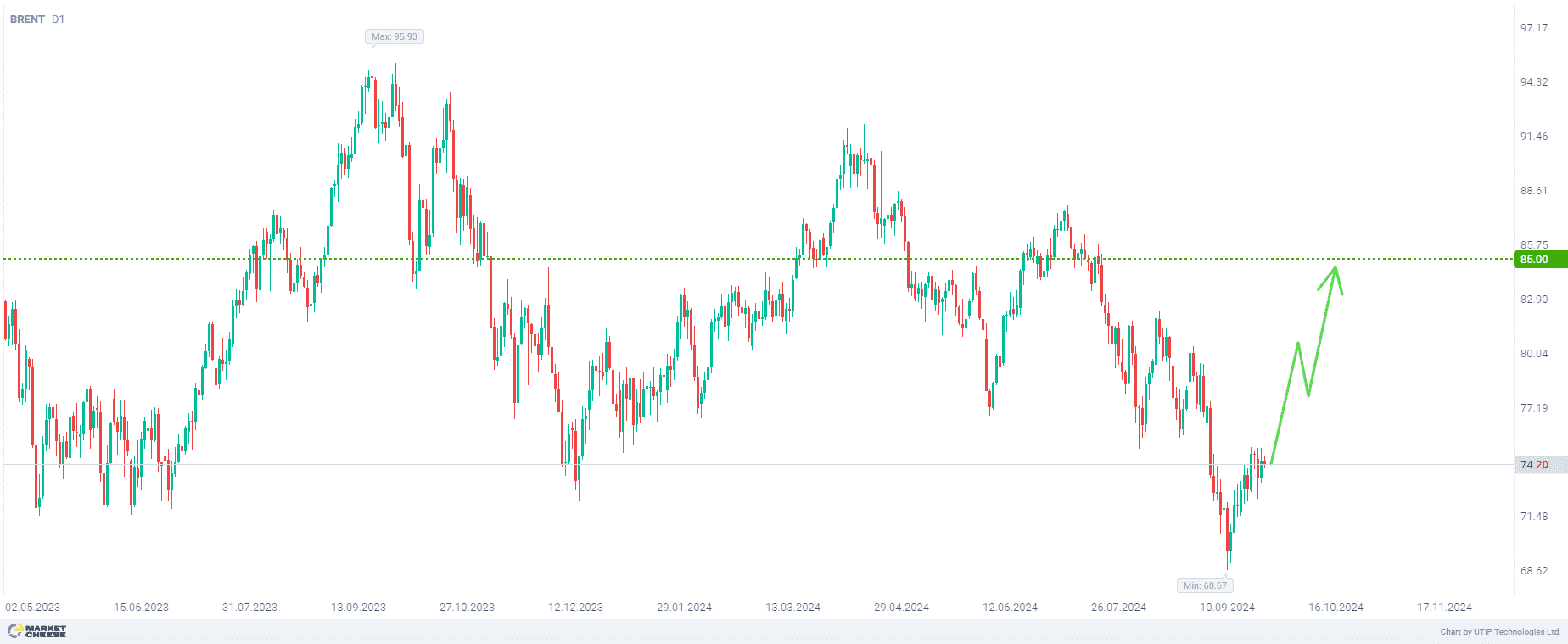

Buying Brent for long term to level of 85 dollars per barrel

In recent years, the demand for electricity in the developed economies of the world has begun to increase significantly due to the growing needs of the artificial intelligence industry.

According to a Goldman Sachs report published in May, data centers are expected to account for 8% of electricity generated in the U.S. by 2030, up from 3% in 2022. Goldman Sachs estimates that U.S. data center energy consumption is expected to nearly triple between 2023 and 2030, requiring about 47 gigawatts of new generating capacity.

For example, a number of U.S. energy companies are planning to open new facilities to power the AI data centers of tech giants such as Microsoft, Amazon, Google, and others. And some have already received orders to restart previously suspended units of nuclear power plants.

The growing expansion of data centers reflects the tech industry's hopes that nuclear power could be a quick answer to its massive electricity needs.

However, it may be difficult to meet the growing demand for electricity from AI-powered data centers with new or reactivated nuclear reactors quickly, as companies will face significant regulatory hurdles, potential fuel supply issues, and sometimes stiff local and environmental resistance.

So, the focus of power generation methods remains on conventional thermal power plants using hydrocarbon fuels as feedstock, which will certainly support Brent crude oil prices in the long term.

The final recommendation is to buy Brent oil on a long-term perspective.

Profit from buying Brent is to be taken at the level of 85.0. We fix the loss at the level of 65.0.

The volume of the opened position should be defined in such a way that the value of the possible loss, fixed with the help of a protective stop order, amounts to no more than 2% of the size of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account