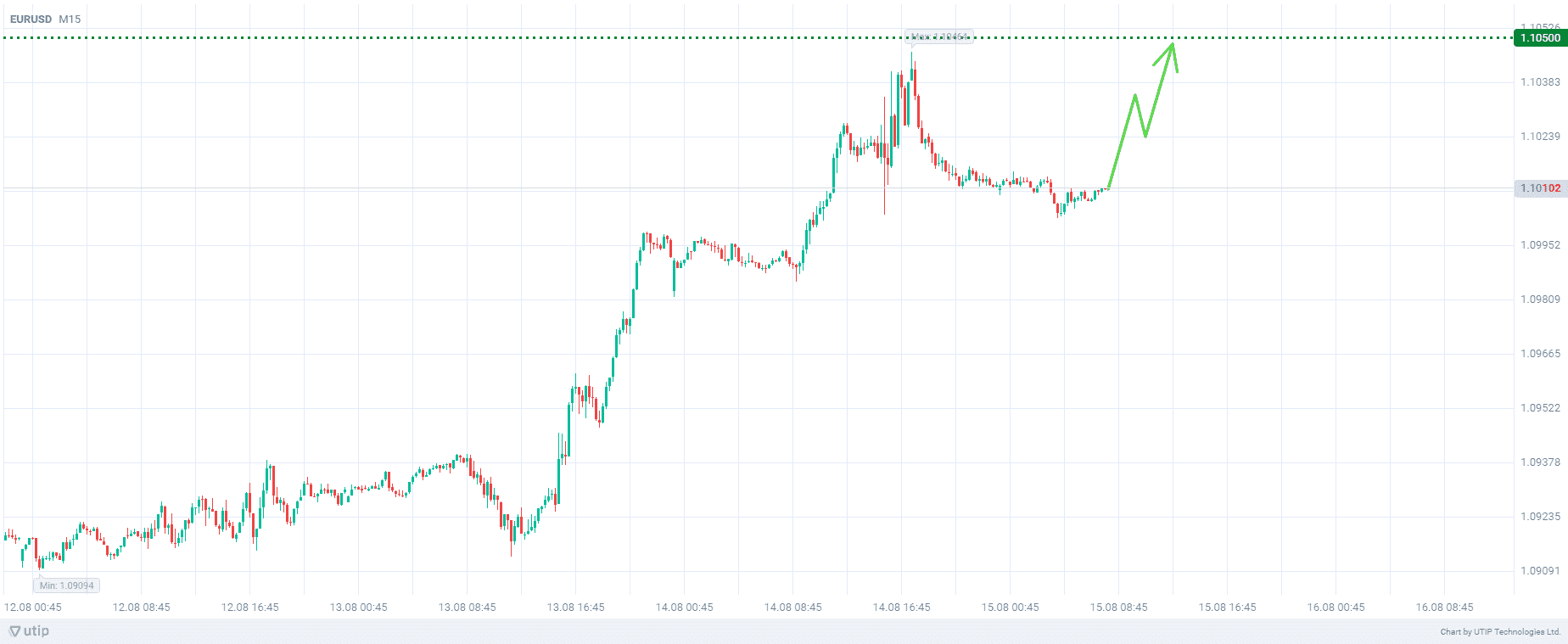

Buying EURUSD up to 1.0500 on release of reports indicating slowdown in US economy

This week, a number of reports on the US economy were published, making traders and investors more certain that the Fed's first rate-cut will be delivered in September. It’s worth mentioning that on Tuesday, producer price indices were released, which showed a significant slowdown. Yesterday, a series of US consumer price indices for July were published. The crucial CPI index demonstrated a year-on-year decline from the level of 3.0% to 2.9%.

Today, another number of reports are to be published, which will serve as guidelines for the Fed's further actions and will determine, in particular, the EURUSD currency pair's prospects.

In the first place, it is necessary to pay attention to the number of initial jobless claims. The figure is expected to slightly increase from 233,000 to 236,000. If the actual value is higher than the forecast, it will indicate a cooling labor market and provide more confidence for monetary policy easing.

Another important release is the Philadelphia Fed Manufacturing Index. It is expected to decrease from the previous estimate of 1.9 to 5.4. If the actual value does not exceed the forecast, it will confirm the cooling of the economy.

One should also take into consideration July retail sales (month to month). It is expected to rise from the previous level of 0.0% to 0.4%. If the actual sales volume increase is lower than the forecast, it will indicate a decline in consumer demand and, consequently, a slowdown in inflation.

If at least two of the three indicators mentioned point to a slowdown in economic growth, it will be a bullish signal for EURUSD.

The overall recommendation is to buy EURUSD if today's data points to the cooling of the US economy.

Profit could be taken at 1.0500. A Stop loss could be set at 1.0980.

The volume of the opened position should be set so that the value of a possible loss, defined with a protective stop order, does not exceed 2% of your deposit.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account