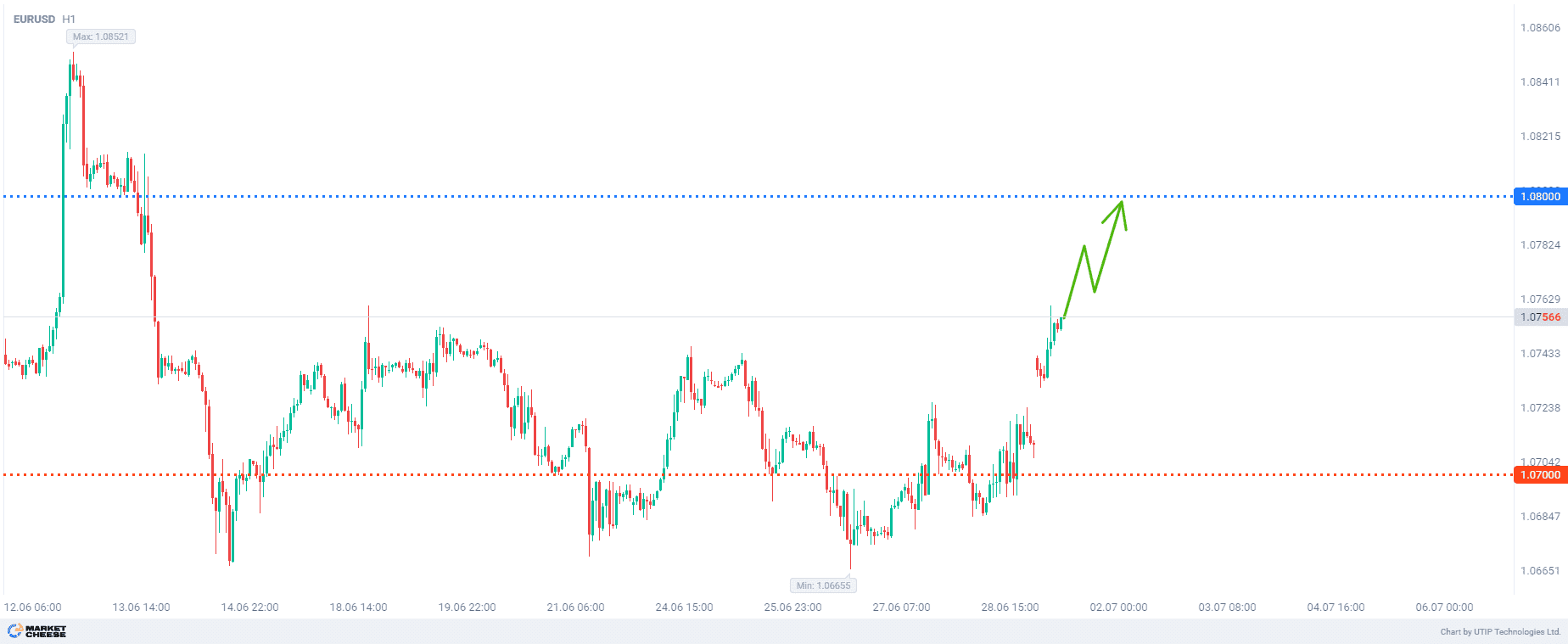

Buying EURUSD with target of 1.0800

The US Commerce Department's report showed on Friday that consumer spending increased modestly last month. Core prices rose at the slowest pace in six months, raising optimism that the US central bank could deliver a much-desired “soft landing” for the economy in which inflation cools without triggering a recession and a surge in unemployment.

Monthly inflation in the US remained unchanged in May as a modest rise in the cost of services was offset by the biggest drop in commodity prices over the past six months, pushing the Federal Reserve closer to initiating interest rate cuts later this year.

According to the Commerce Department's Bureau of Economic Analysis, the personal consumption expenditures (PCE) price index was at the same level last month after rising by 0.3% in April. The PCE inflation for the first time in six months remained unchanged. Goods prices fell by 0.4%, the biggest drop since November.

Prices of recreational goods and vehicles, as well as furnishings and durable household equipment, fell significantly.

Cost of gasoline and other energy goods declined by 3.4%, the biggest drop in six months. Clothing and footwear also became cheaper, while food prices increased insignificantly.

Services prices increased by 0.2% because of rising costs for housing, utilities and healthcare. Expenditure on financial services and insurance fell by 0.3% after growing for five consecutive months. These costs, along with housing, were among the main drivers of services inflation.

In 12 months through May the PCE price index increased by 2.6% after rising by 2.7% in April. Last month’s inflation was in line with economists’ expectations.

Inflation has been declining after a surge in the first quarter, as Fed’s rate hikes by 525 basis points since 2022 has cooled domestic demand. However, inflation continues to exceed the central bank's target of 2%.

Economists were divided on whether the Fed will still cut borrowing costs twice this year despite robust wage growth.

The US employment report for June due out on Friday may shed more light on the monetary policy outlook.

Financial markets are pricing in about a 68% chance that Fed policy easing will start in September, compared to about 64% before the data was released.

The overall recommendation is to buy ЕURUSD.

Profits should be taken at the level of 1.0800. A Stop-Loss could be set at the level of 1.0700.

The possible loss should not exceed 2% of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account