Buying GBPUSD with target of 1.3000 amid monetary decisions

The GBPUSD currency pair is showing a slight recovery on Tuesday after comments from Federal Reserve (Fed) officials. These statements reinforced expectations of a significant interest rate cut in the US this year.

Data released on Monday indicated a rebound in the US services sector activity in July after a 4-year low, due to a rise in orders and employment.

According to Fed officials, weak employment data for July do not indicate a possible recession. At the same time, they believe that interest rate cuts may help reduce the risks of an economic downturn. San Francisco Fed President Mary Daly stated the regulator's willingness to support a reduction in borrowing costs if needed, stressing the importance of a proactive policy.

According to the CME FedWatch tool, the Fed may cut rates by 110 basis points this year. The probability of monetary policy easing by 50 basis points in September is estimated at more than 70%.

Meanwhile, major investors are increasingly interested in British assets. The positive sentiment was reinforced after the Bank of England cut interest rates from a 16-year high following the new government's convincing election victory. Last week, the British regulator reduced the rate by a quarter of a percentage point to 5.0%, causing a mixed reaction in the markets.

The monetary policy plans in the US and the UK are showing similar traits. However, traders' interest in the Fed data may soon exceed their focus on the Bank of England.

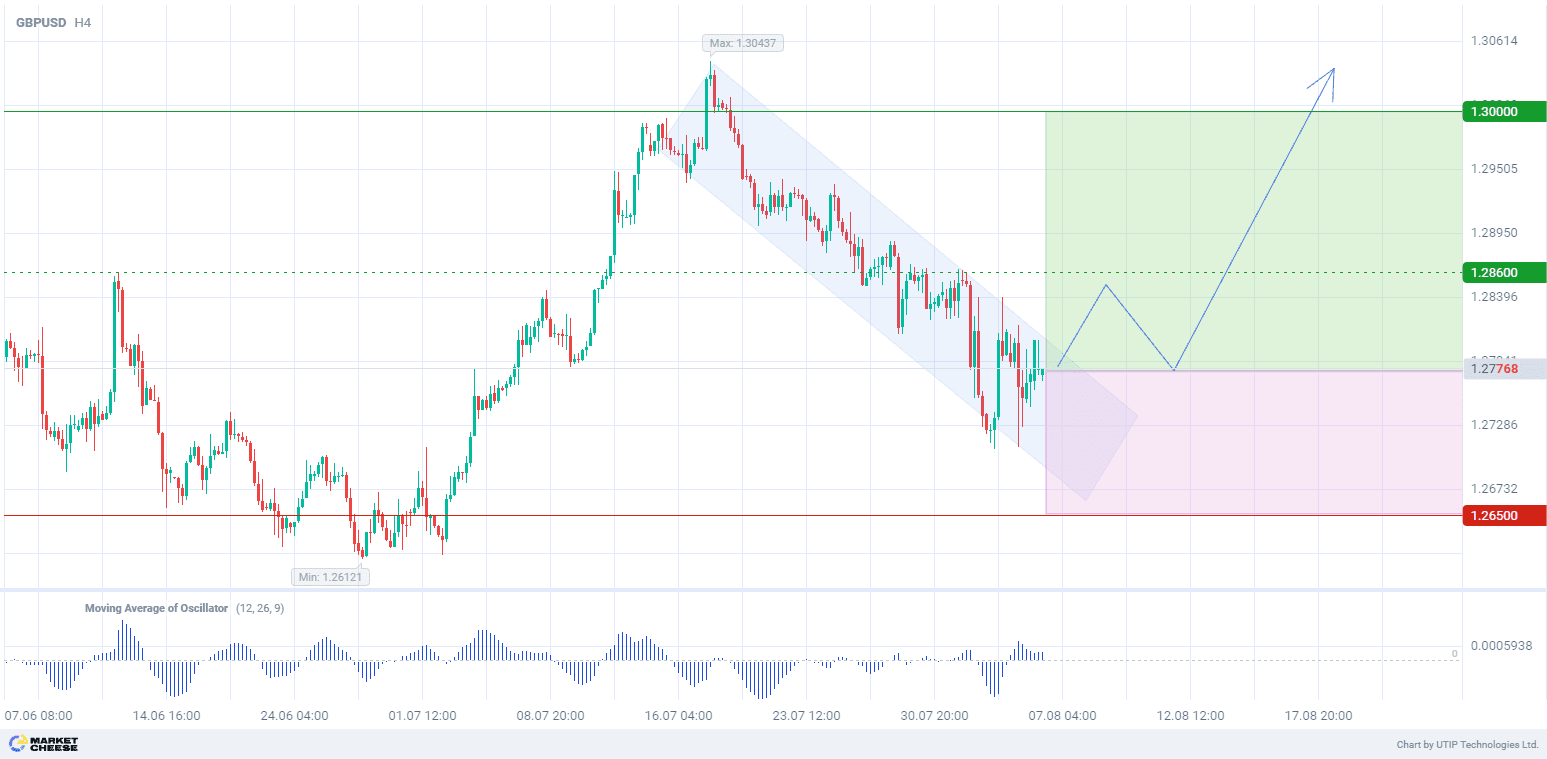

Technical data on GBPUSD shows that a downward correction channel is being formed on the H4 timeframe, while the last trend was upward. The price breakout from the correction channel may create conditions for a new bullish momentum. The volumes of Moving Average of Oscillator (with parameters 12, 26, 9) are above zero, which indicates potential price growth.

Short-term prospects for GBPUSD suggest buying, with the target at the level of 1.3000. Part of the profit should be taken near the level of 1.2860. A Stop loss could be set at 1.2650.

Since the bullish trend is short-term, the trading volume should not exceed 2% of your total balance to reduce risks.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account