Buying gold as US labor market cools

US initial jobless claims increased last week while the number of people on the unemployment rolls hit a 2.5-year high by late June, indicating a gradual cooling in the labor market.

Layoffs remain low at the moment, so the rise in claims probably reflects an increase in the number of employees filing for benefits as they have found it harder to find work because of a slowdown in hiring.

The labor market is steadily cooling, as the government reported on Tuesday that for every unemployed person, there were 1.22 job openings in May. The vacancy-to-unemployment ratio is close to the average of 1.19.

The number of people receiving benefits after the first week, a proxy for hiring, rose by 26,000 to a seasonally adjusted 1.858 million during the week ended June 22, the highest level since late November 2021, the claims report showed.

The slowdown in the labor market was also highlighted in the Institute for Supply Management's survey, which revealed that employment in the services sector fell in June for the sixth time in seven months.

The government is expected to report today that Non-Farm Payrolls increased by 190,000 in June after rising by 272,000 in May. The unemployment rate is forecast to remain unchanged at 4.0%.

Along with lower inflation, this should allow the Federal Reserve (Fed) to start cutting interest rates this year, and financial markets are hopeful that the easing cycle could begin as early as September. The Fed's monetary policy easing will boost the gold price.

The ISM Services Purchasing Managers' Index fell to a four-year low in June, possibly indicating a loss of momentum in the economy at the end of the second quarter. The outlook for faster growth last quarter has been further weakened by the growing trade deficit.

All these factors are setting the stage for monetary policy easing later this year, with two rate cuts of 0.25% in September and December.

The overall recommendation is to buy gold if the change in US Non-Farm Payrolls is no more than 191,000 people, and the unemployment rate will not be higher than 4.0%.

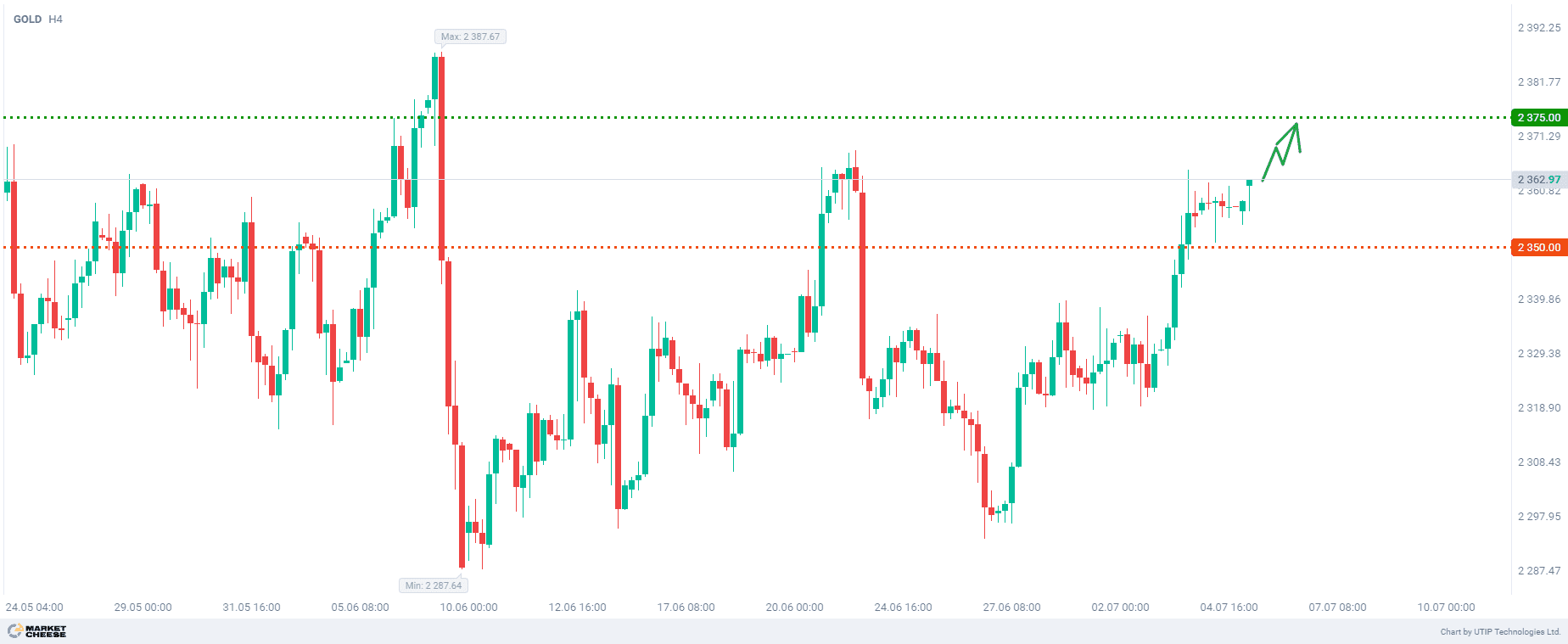

Profits should be taken at the level of 2,375.0. A Stop-Loss could be set at the level of 2,350.0.

The possible loss should not exceed 2% of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account