Buying natural gas till 3.390 amid increasing market volatility

Natural gas prices stabilized near a four-month high on Thursday as traders assessed the outlook for the gas market in Europe.

European natural gas prices jumped after Germany’s Uniper SE was awarded more than 13 billion euro ($14 billion) in damages for unsupplied volumes from Gazprom PJSC, adding uncertainty over remaining fuel flows from Russia. While Uniper itself hasn’t received gas from Russia since 2022, other states in Europe continue to rely on deliveries from the country, with Austria’s OMV AG warning recently that court rulings risk disrupting supplies. Austria still imports about 80% of its gas from Gazprom.

Meanwhile, recent gas price volatility in Europe has been linked to various factors, including supply problems and unexpected maintenance of key infrastructure facilities. Abundant hydrocarbon reserves after a warm winter allowed European countries to limit imports. However, low levels of new gas purchases are diminishing the surplus and driving up prices. According to Gas Infrastructure Europe, since April of this year, EU natural gas stocks have increased by only 148 terawatt-hours, compared to an average of 206 terawatt-hours over the last ten years. As a result, the natural gas surplus has shrunk from 70% to 37% over the past 2 months.

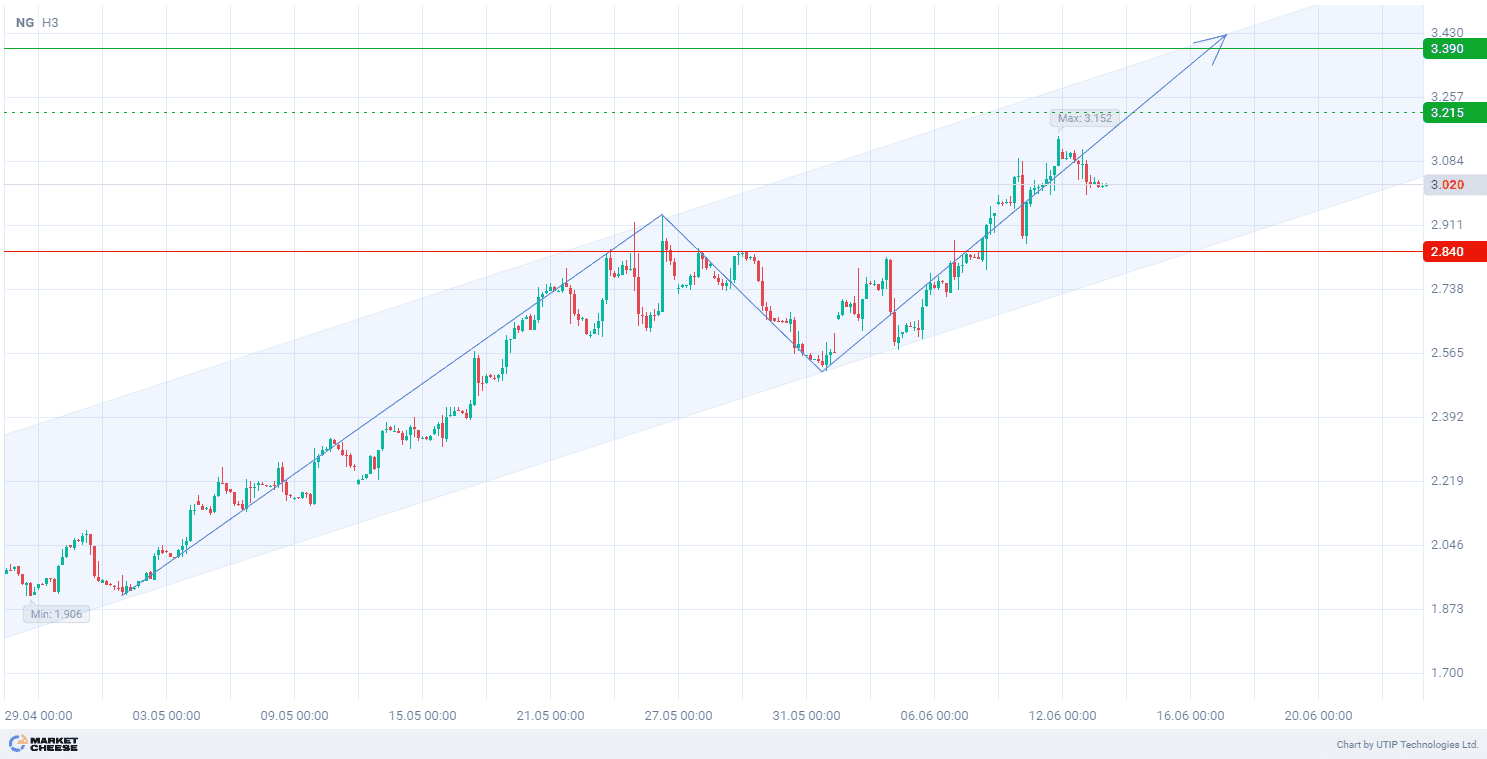

On a technical level, natural gas prices are currently within an emerging upward trend on the D1 timeframe.

In terms of wave analysis, the price is forming the third ascending wave on the H3 timeframe. The top of the first wave at 2,943 has already been broken. This indicates a potential strengthening of the upward momentum.

Signal:

Short-term prospects for natural gas suggest buying.

The target is at the level of 3.390.

Part of the profit should be taken near the level of 3.215.

A stop-loss could be placed at the level of 2.840.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account