Buying natural gas with target of 2.450 amid expectations of increased consumption

Gas prices fell for the third day in a row by about 2% because of an increase in production and a persistent surplus of gas in U.S. storage. There is still about 17% more gas in storage than usual for this time of year.

Hurricane Beryl, which hit the Gulf Coast in early July, caused disruptions in operations at LNG plants. As a result, U.S. supplies of gas abroad decreased, while the country's stockpiles increased. By July 12, inventories reached about 3.2 trillion cubic feet.

Nevertheless, July U.S. gas inventories were down from the record levels of March, when the difference with the five-year average reached 678 billion cubic feet. In addition, LNG exports from the country are gradually recovering amid normalization of operations.

Despite the negative dynamics of recent weeks, UBS experts did not cancel their forecast on the price increase of gas in 2025. According to their estimates, next year gas prices will rise on the back of increased export demand.

According to a report by China's National Energy Administration (NEA), the country's natural gas consumption will rise by 6.5-7.7% already this year. Total demand for gas in China will reach 425 billion cubic meters this year. During the same period, the country's gas production is estimated at 246 billion cubic meters, according to the report.

At the moment, China is trying to improve the system of production, supply, storage and marketing of gas.

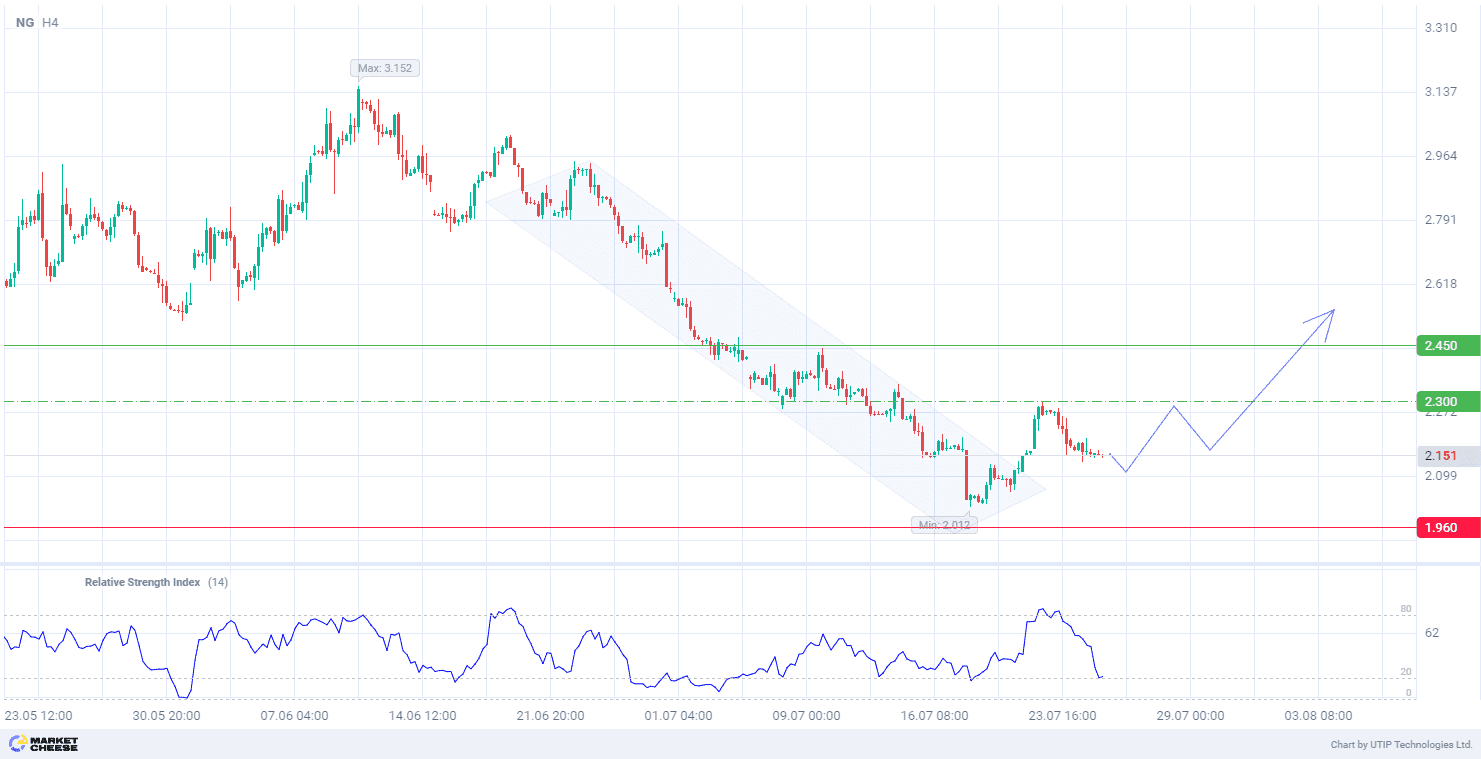

On the technical level, natural gas quotes have gone beyond the downtrend on the H4 timeframe. This signals a possible trend change. The RSI indicator curve (standard values) is approaching the oversold zone, which increases the chances of a bullish trend formation.

Signal:

The short-term outlook for Natural gas is to buy.

The target is at the level of 2.450.

Part of the profit should be fixed near the level of 2.300.

A stop-loss could be placed at the level of 1.960.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account