Buying natural gas with target of 2,440 amid US production cuts and rising prices in Europe

Natural gas prices rose by 2.15% overnight due to potential production cuts in the US and a transit crisis in Eastern Europe.

The largest US natural gas producers plan to cut production in the second half of 2024 after a 40% drop in prices over the past two months. The decline is related to the supply-demand imbalance in the commodity market. This summer's mild weather has reduced demand, while the spring's surge in gas prices (+47%) has increased supply.

EQT is planning to strategically cut gas production this fall by 90 billion cubic feet. Another major US producer, Apache, is poised to reduce hydrocarbon recovery by 90 million cubic feet in the third quarter of the year.

Meanwhile, the Energy Information Administration (EIA) reports that natural gas production in the US this year will average 103.3 billion cubic feet per day. In July, the EIA experts predicted 103.5 billion cubic feet per day.

At the same time, gas prices in Europe reached the highest level this year due to an incident at a key energy transit point near the border with Russia and Ukraine. Fuel contracts jumped by 4.8% to 38.45 euros per megawatt-hour. Despite Europe's efforts to reduce its dependence on Russian gas, a potential supply cutoff would be a significant problem for consumers and the industry.

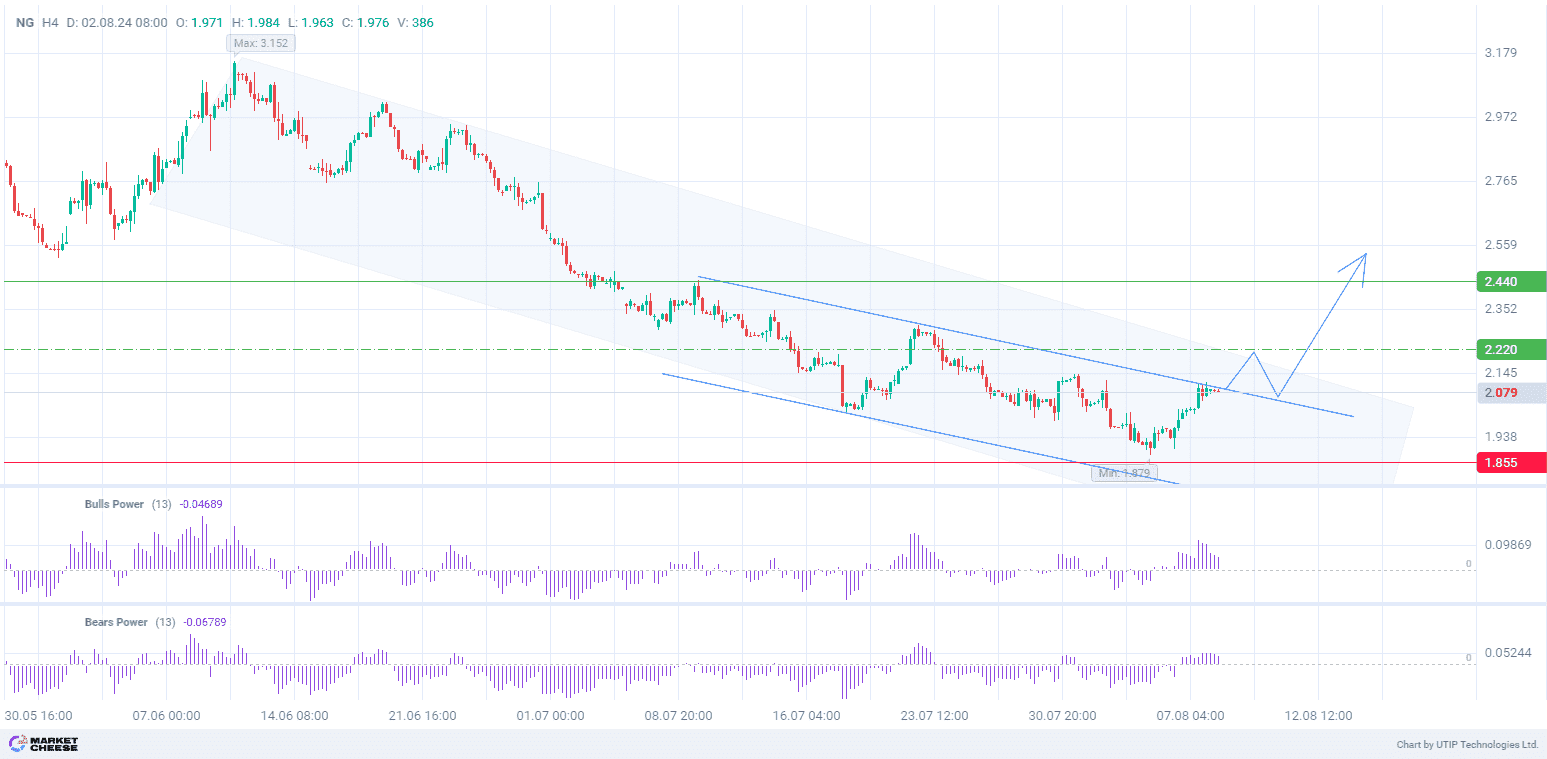

At the technical level, natural gas prices are testing the local downtrend resistance on the H4 timeframe. At the same time, the prices remain within the senior descending channel. However, fundamentals as well as the Bulls Power and Bears Power indicators (standard values), which are in the positive zone, confirm the strength of the bullish sentiment and the formation of a buy-side movement.

Signal:

The short-term outlook for natural gas suggests buying.

The target is at the level of 2.440.

Part of the profit should be taken near the level of 2.220.

A Stop loss could be set at the level of 1.855.

The bullish trend is short-term, so the trading volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account