Correction in gas prices will continue

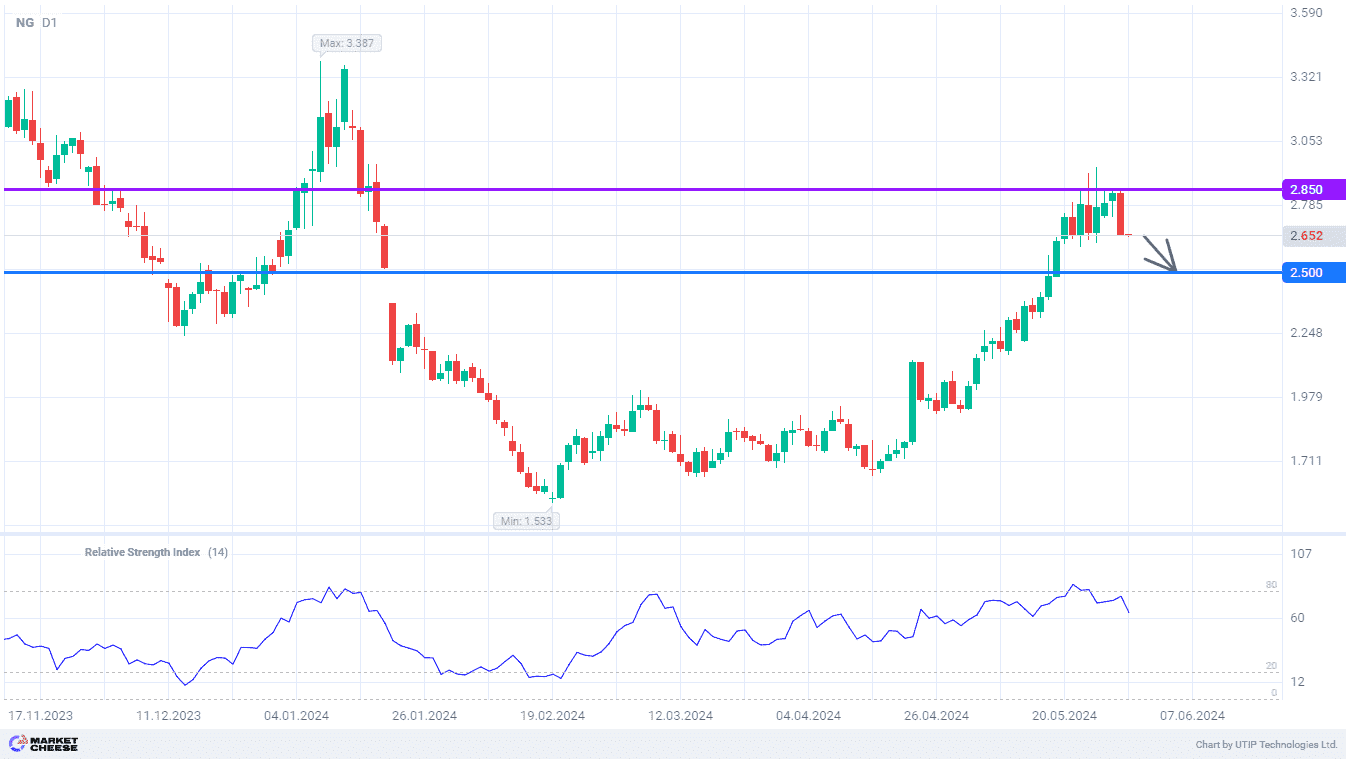

As expected, gas prices closed the January gap at 2.5, and then the upward momentum began to fade. Attempts to gain a foothold above 2.85 were met with active opposition from the bears, which resulted in yesterday's sharp drop of more than 6%. The gas market hasn’t seen a full-fledged correction for more than a month, and now we can observe its beginning. The next step of the sellers should be the testing of the previously broken level of 2.5.

The growth of gas prices to the highs since the beginning of 2024 hasn’t yet significantly affected the demand from Asian countries. However, Reuters analysts expect a decline in fuel consumption in the coming weeks. According to preliminary estimates, by the end of May the demand for gas in Asian countries will grow by only 1.6% compared to April. At the same time, all the increase in imports came from India and Pakistan, while the largest consumers of gas in the region are reducing purchases.

According to Kpler, China's LNG imports in May will fall 8% to 5.96 million tons. Japan's liquefied gas purchases by companies will drop 10% to 4.83 million tons. The same figure for South Korea will decrease by 13.5%, to 3.45 million tons. This trend could also soon affect South Asian countries.

Liquefied natural gas coming to buyers in May was contracted in a period between late February and early April. At that time, fuel prices had already rebounded from 3-year minimums, but still remained quite low. By now, the price of gas is already 50% higher than late winter figures, which will worsen its competitiveness against other fuels. This increases the chances of a large-scale price pullback.

The RSI indicator on the daily chart of natural gas turned downward and left the overbought zone, forming a sell signal. The nearest correction target is the level of 2.5.

The following trading strategy can be suggested:

Sell gas at the current price. Take profit — 2.5. Stop loss — 2.85.

Traders can also use a Trailing stop instead of a fixed Stop loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account