Decline in manufacturing activity puts pressure on Brent in medium term

Last week (including weekend) for the oil market were associated with the release of important data and events that clouded the prospects for stronger oil prices.

The downturn in China's economic activity, which has been present for half a year now, seems to be spreading to the US as well. The latest data on the US economy indicates the risk of a significant decline in production in the future, putting pressure on oil prices, including Brent.

The index of new manufacturing orders in the States fell to 44.6. This is the lowest level in a year and a half. Crude oil inventories in storage are at record low levels for the second month, which speaks of a rather weak oil demand by the American industry.

The Fed meeting on September 17–18, at which the policy easing cycle is expected to begin, will not lead to a quick market reversal towards growth; it will take months. Therefore, oil demand will also take a long time to recover. In addition, the risk of a recession is confirmed by the rise in unemployment to 4.3%.

The OPEC has already revised down its oil demand forecast for the 4th quarter of 2024 by 0.1% in its latest report.

The Organization of the Petroleum Exporting Countries and its allies, a group known as OPEC+, is expected to increase production in 2025 for the first time in several years. That said, the OPEC+ agreed last week to postpone planned oil output increases in October and November after crude prices hit their lowest level in nine months.

Short-term support for oil prices may be provided by a storm on the Gulf Coast, which is likely to last 3–5 days.

In mid-September, the International Energy Agency and the US Energy Information Administration are expected to publish new monthly reports on the state and prospects of global oil markets. New reports will give more specifics in understanding the further movement of the prices.

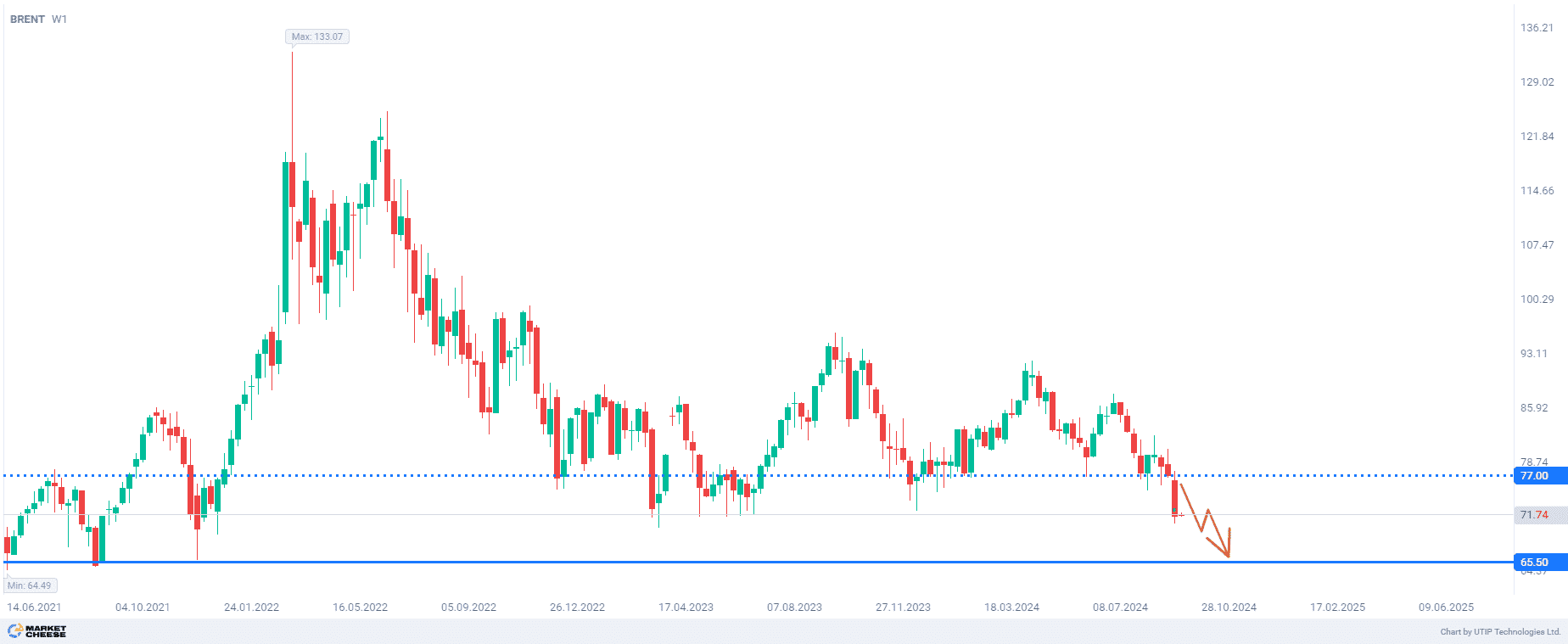

From a technical perspective, the price of Brent crude oil is trying to break through the multi-year support level at $70.0 per barrel.

The overall recommendation is to sell Brent in the medium term from the correction to the level of 77.0.

Profits from selling Brent should be taken at the level of 65.50. A Stop loss could be set at the level of 90.0.

The possible loss should not exceed 2% of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account