Divergence between Fed and ECB policy will weigh on EURUSD

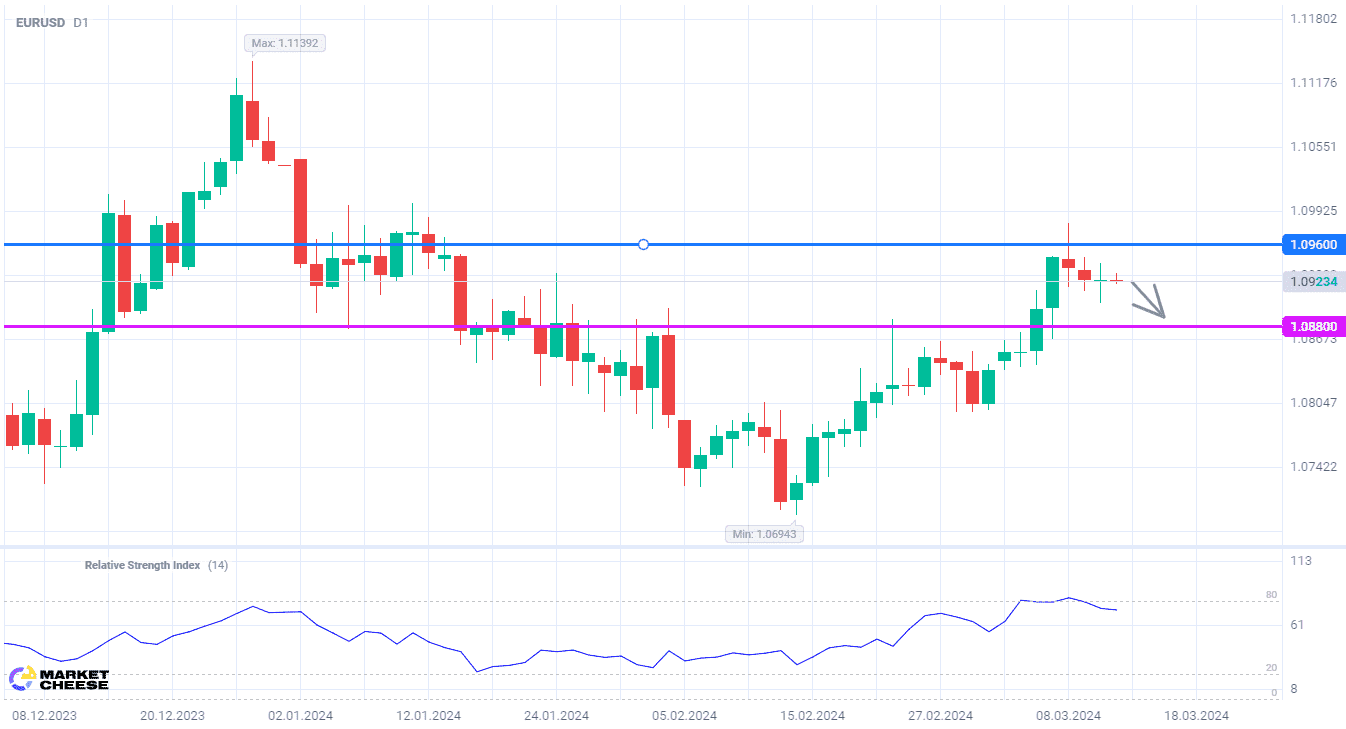

The EURUSD currency pair keeps pulling back from the 2-month high of 1.098 set on Friday. It seems that the bulls will have to wait for the next wave of the euro strengthening against the dollar to reach the critical level of 1.1. The EURUSD correction will not necessarily be large-scale, but the sellers can expect at least a movement towards 1.088. Both the fundamental background and the technical picture are in favor of this scenario.

Yesterday's US inflation data for February again indicated slow progress in stabilizing the price growth. The core index fell by only 0.1% to 3.8%, while headline inflation even accelerated from 3.1% to 3.2%. At the same time, the situation in Europe is improving much faster. Thus, German statistics showed a slowdown in inflation from 2.9% to 2.5%. This increases the likelihood of a divergence between the Fed and ECB policy.

According to Erik Nielsen, an economist at Unicredit, the European regulator should not be concerned about lowering interest rates, even if the US central bank will be hesitant to ease its monetary policy. Nielsen notes that the US labor market, with strong wage growth and plenty of fiscal support, requires interest rates to remain high. The EU, on the other hand, can conduct a more flexible policy. According to Nielsen's estimates, a potential drop in the euro-dollar exchange rate due to ECB rate cuts will not lead to a significant rise in inflation.

Pierre Wunsch, a member of the Governing Council of the European Central Bank, also supports this view. He encourages other ECB officials to ease monetary policy before inflation gets to the 2% target. According to Wunsch, the price growth rate will continue to slow and all the risks are under control.

The RSI, turning down from the overbought zone, confirms a signal to sell EURUSD. The nearest short-term target for the bears is the level of 1.088.

Consider the following trading strategy:

Sell EURUSD in the range of 1.091–1.093. Take profit – 1.088. Stop loss – 1.096.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account