Divergence in monetary policy between Australia and Canada raises AUDCAD

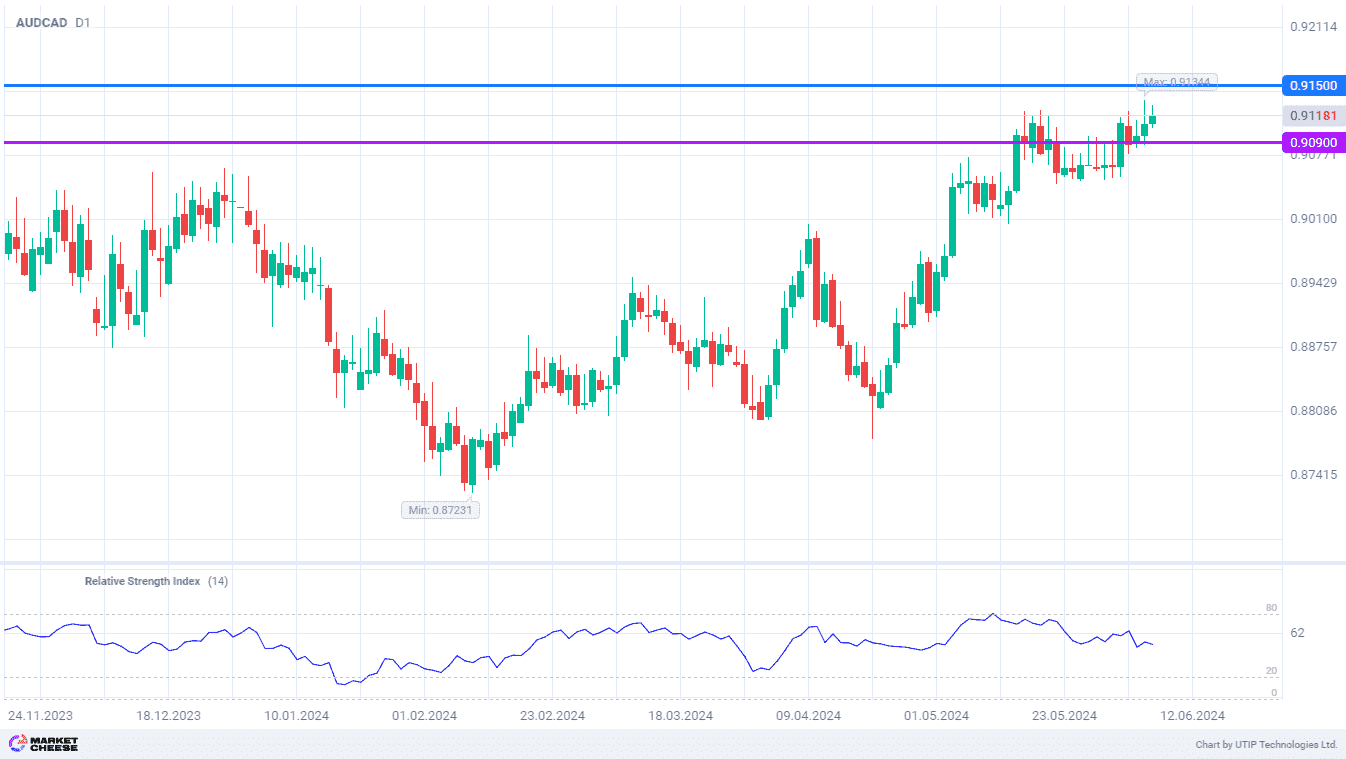

The AUDCAD currency pair, as expected, broke out of consolidation with the beginning of summer and started to update annual highs again. Last week's sideways movement gave currency market participants a chance to take a breather, and now they are actively buying the Australian dollar against its Canadian equivalent. Fundamentally, the rise in the quotes is quite reasonable, and the technical point of view also does not prevent the upward dynamics. The next target for the bulls is the level of 0.915.

The Bank of Canada was the second among developed country regulators to start the monetary policy easing cycle on Wednesday. The key rate was cut by 0.25% to 4.75%, in line with analysts' consensus forecast. BOC Governor Tiff Macklem did not confirm or deny the possibility of another rate cut in July, preferring to wait for new economic statistics. The Bloomberg survey among 6 largest banks in Canada showed expectations of at least 2 more steps to ease monetary policy until the end of 2024.

At the same time, ING experts see an opportunity for a more significant reduction in the borrowing costs in Canada, predicting the rate at 4% by the end of this year and at 3.5% by the mid-2025. In their opinion, the national regulator itself will determine the extent of monetary policy easing, without paying too much attention to the Fed and other central banks. Under these circumstances, the ING calls the Canadian dollar the least attractive option among all G10 currencies.

At the same time, ING analysts highlight the growth potential of the Australian dollar, considering it one of the best options for investment along with the currencies of Norway and New Zealand. This view was supported by today's speech of Deputy Governor of the Reserve Bank of Australia (RBA) Andrew Hauser. He pointed to the lower level of the key rate in the country compared to Canada, while the situation with inflation is exactly the opposite. This leaves no room for the RBA to ease policy in the near future.

The buyers of AUDCAD may reach 0.915 in the coming days. Given the highs of last year just below 0.955, the quotes still have an impressive upside potential.

Consider the following trading strategy:

Buy AUDCAD at the current price. Take profit – 0.915. Stop loss – 0.909.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account