Divergence in monetary policy between Bank of Canada and RBA supports AUDCAD

The AUDCAD currency pair is moderately declining on Friday after reaching an annual high of 0.9124 at the beginning of the week. The growth of the currency pair is largely due to the fall in the Canadian currency index, which has fallen in price by 3.21% since the beginning of the year.

As Canadian data showed on Tuesday, the annual inflation rate fell to a three-year low of 2.7%. This led to increased expectations for the start of a cycle of interest rate cuts by the Bank of Canada as early as its next meeting on June 5. According to the average estimate of seven analysts who participated in a preliminary Reuters survey, the Canadian regulator may cut rates three times before the U.S. Federal Reserve's (Fed) first move before the currency's decline starts to cause inflationary pressures.

Meanwhile, the release of the minutes of the Reserve Bank of Australia's (RBA) May meeting indicated the possibility of an interest rate hike alongside the Fed. The RBA kept the interest rate at 4.35% this month, taking a neutral position and showing flexibility.

According to the central bank's economic forecasts, inflation will remain high until the second quarter of 2025 due to the consumer index on the services, and then return to the target range of 2%-3% by the end of 2025 and reach the average mark by 2026. The Melbourne Institute forecasts that the Australian regulator will leave the official interest rate unchanged at its June meeting and does not expect to cut rates this year.

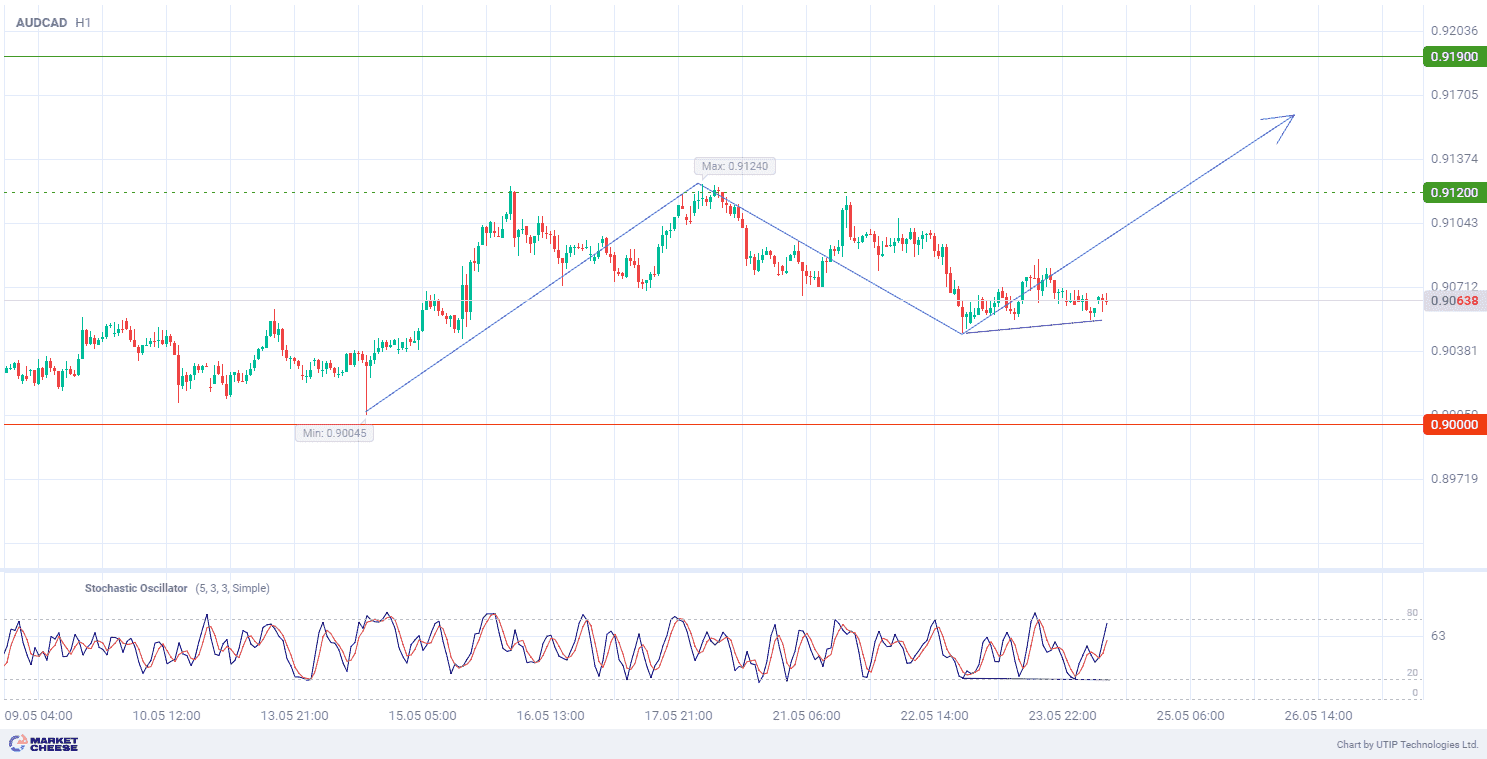

At the technical level, AUDCAD quotes are in the formation of an uptrend on the H4 timeframe. In terms of wave analysis, the price is in the process of forming the second downward wave on the H1 timeframe. However, the indicator Stochastic Oscillator (standard values) predicts a possible change of direction and the transition to the third upward wave, which is confirmed by the presence of divergence.

Signal:

The short-term outlook for AUDCAD is to buy.

The target is at the level of 0.9190.

Part of the profit should be taken near the level of 0.9120.

A stop-loss could be placed at the level of 0.9000.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account