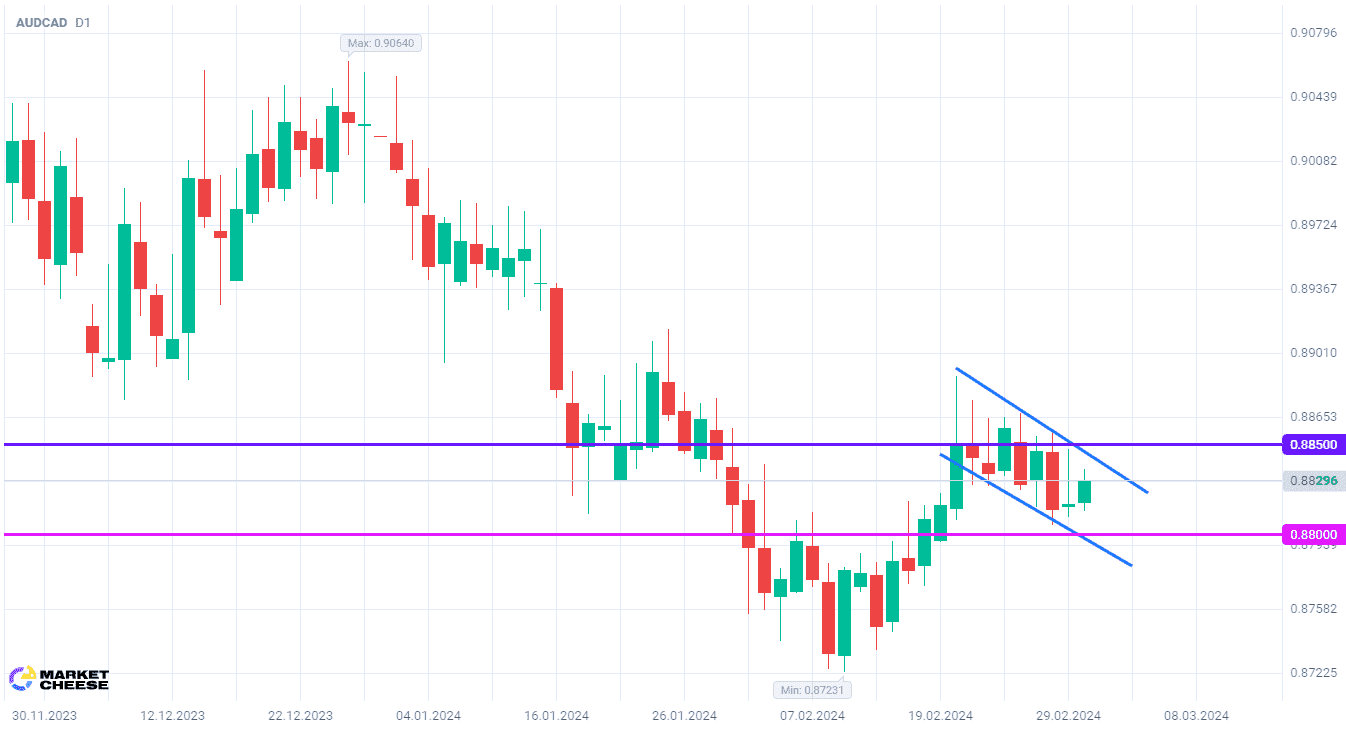

Downtrend channel suggests further decline in AUDCAD

The AUDCAD currency pair, having established a local high on February 20, proceeded to move further within the short-term descending channel. Its upper boundary limits the growth potential of the prices, which was particularly evident at yesterday's session. The bulls had reached the level of 0.885, but by the end of Thursday's trading almost all the gain was wasted. Now one can expect an impulse towards the lower boundary of the channel, to 0.88.

Yesterday's statistics on the Canadian economy put pressure on the AUDCAD price. GDP growth in Q4 2023 amounted to 1%, exceeding analysts' expectations of 0.8%. The stronger than expected data boosted investors' confidence in maintaining the current level of interest rates in the country. Expectations of the Bank of Canada's first monetary policy easing moved from April to June, keeping up with similar moves by the Fed and the ECB.

Douglas Porter, chief economist at BMO Capital Markets, noted the Canadian regulator's concern about the real estate market. Rising demand and increasing volume of transactions could accelerate inflation. The decline of the national currency is becoming yet another concern. Since the beginning of 2024, the Canadian dollar has weakened against its U.S. counterpart by more than 3%. This is fraught with the risk of higher prices for imported goods and increased inflationary pressure.

At the same time, the Australian economy may demonstrate a sharp slowdown. Minister of Finance Jim Chalmers in his speech did not rule out the possibility of stagnation or even recession. Official data for Q4 will be released on March 6, while the consensus forecast of market participants assumes a weak GDP growth of 0.2%. Chalmers believes such a situation is an inevitable consequence of high interest rates and cooling of the entire global economy. In his opinion, Australians should not expect a change for the better in the near future.

AUDCAD sellers' short-term target should be the level of 0.88. A more significant fall is possible, but it should be considered after the quotes leave the current channel.

Consider the following trading strategy:

Selling AUDCAD at the current price. Take profit - 0.88. Stop loss - 0.885.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account