ECB officials’ rhetoric is getting softer

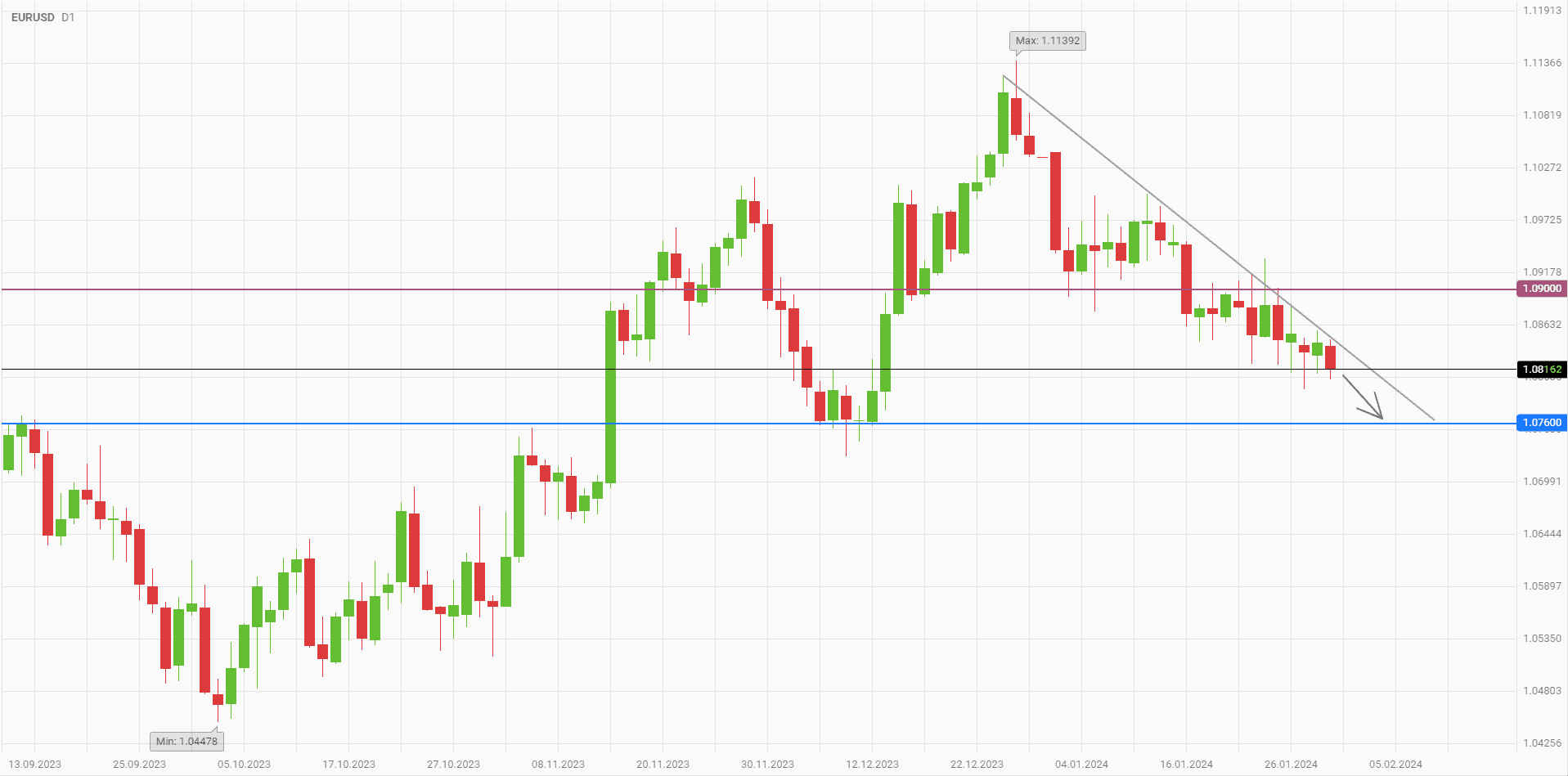

The EURUSD currency pair is approaching today's Fed meeting at its one and a half month lows. It is symbolic that the last wave of strengthening of the euro against the dollar began just after the previous meeting of the U.S. regulator's officials on December 13. By now, the entire growth has been lost, and the bears are already aiming at the last month's low near the level of 1.076. It may be reached in the coming days.

Before the Fed meeting additional factors appeared supporting the neutral rhetoric of Jerome Powell and his colleagues. The data on job openings in the U.S. labor market for December was much better than expected. The number of vacancies increased by more than 100 thousand and exceeded the 9 million mark for the first time since October. According to Ben Ayers from Nationwide, the continued demand for labor is a positive factor for the U.S. economy, but may hinder the Fed's efforts to reduce inflation.

At the same time, the rhetoric of European officials is becoming increasingly dovish. Bundesbank Governor Joachim Nagel, who spoke yesterday, departed from his usually cautious tone and declared that inflation in the European Union has been successfully curbed. According to him, the rate of price growth is already close to the ECB's 2% target and will reach it in the spring. Chances for April easing of monetary policy in the EU are getting higher.

On Tuesday, the statistics on GDP of European countries for the 4th quarter of 2023 was a little better than expected, but did not cause massive purchases of euros on the currency market. Italy and Spain showed good results, France recorded no change in its GDP, and Germany recognized a reduction in the size of the economy by 0.3%. Even if the situation improves this year, the EU will still lose to the USA in terms of GDP growth rates, and the pressure on the European currency will remain.

A downtrend has formed on the daily chart of EURUSD, stretching from the December high of 1.114. Within this trend, the probability of further decline in quotes is increasing. The nearest benchmark for the euro sellers is 1.076.

Consider the following trading strategy:

Selling EURUSD at the current price. Take profit - 1.076. Stop loss - 1.09.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account