Ethereum rally has positive effect on Bitcoin

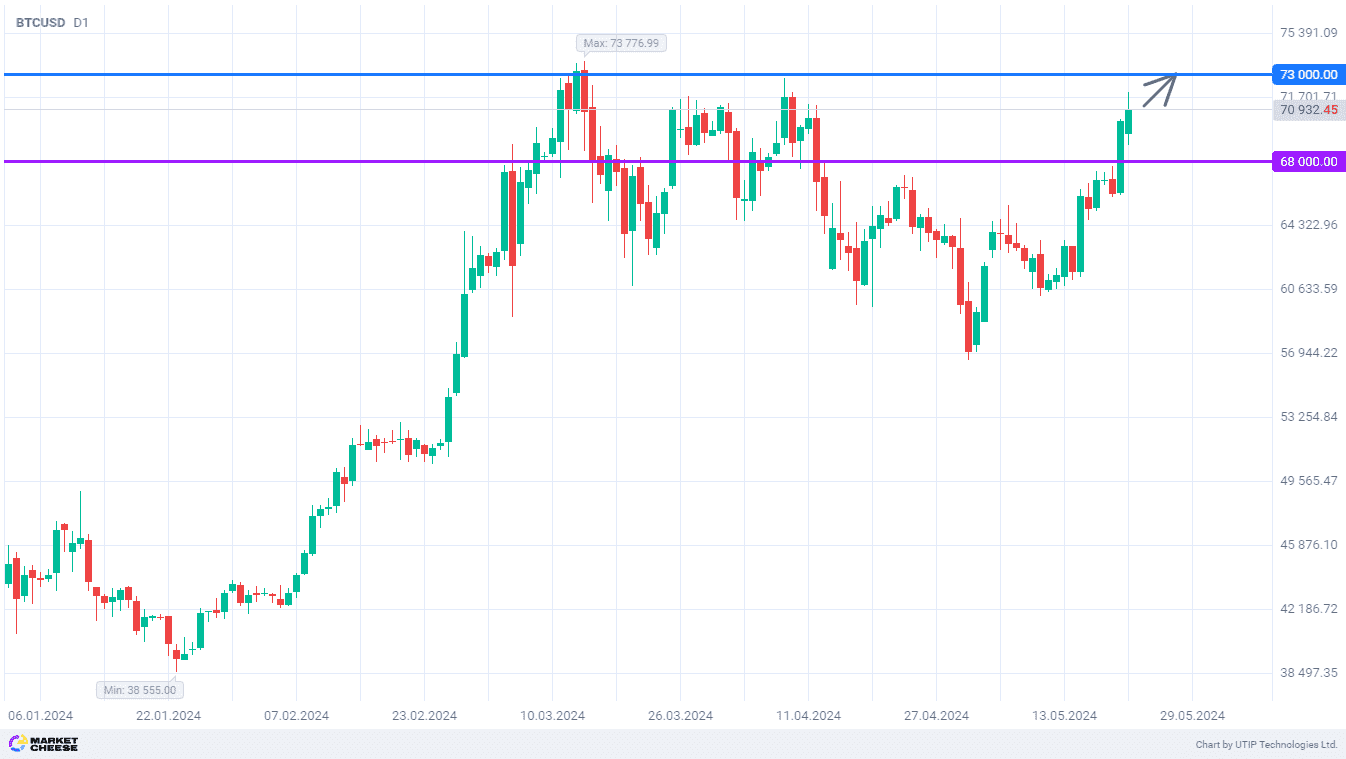

On Monday, Bitcoin quotes jumped by 6.4%, hitting their highest levels since mid-April. At Tuesday's trading session, growth continues, with the price of the main cryptocurrency getting closer and closer to the level of 73 000. In the very near future, Bitcoin buyers may test the March highs. The current rally in the cryptocurrency market is mainly centered on Ethereum, but Bitcoin is also recording a significant increase in demand from traders.

The long-awaited halving of Bitcoin never became a trigger for a sharp increase in its price. However, the bulls found another reason for optimism, related to the second most popular asset in the cryptocurrency market. By May 23, the U.S. Securities and Exchange Commission (SEC) should make a decision on applications for the listing of the first ETFs for Ethereum. A similar move to approve exchange-traded funds on Bitcoin, after some pause, resulted in a two-month uptrend. Investors are probably now counting on a repeat of this scenario.

Bloomberg Intelligence analysts Eric Balchunas and James Seyffart overestimated the probability that the SEC will approve at least one Ethereum ETF from 25% to 75%. According to their information, representatives of the U.S. agency have contacted exchanges and one of the ETF issuing companies to provide additional documents. According to Bloomberg representatives, this move shows an active dialog between the parties, which increases the chances of approval of applications.

IG analyst Tony Sycamore also connects the active growth of cryptocurrency quotes with positive data on inflation in the United States. April statistics interrupted a three-month trend of accelerating price growth, strengthening the appetite for risk on the part of financial market participants. Sycamore sees macroeconomic statistics as the main driver of Bitcoin's price in the coming weeks. In case of a further decline in inflation, the cryptocurrency rally has all the chances to continue.

The next target of the bulls should be the level of 73 000. Before the correction begins, Bitcoin may well update the historical maximum, now located just below the level of 73 800.

The following trading strategy may be offered:

Buying BTCUSD at the current price. Take profit – 73000. Stop loss – 68000.

Traders may also use a Trailing stop instead of a fixed Stop-loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account