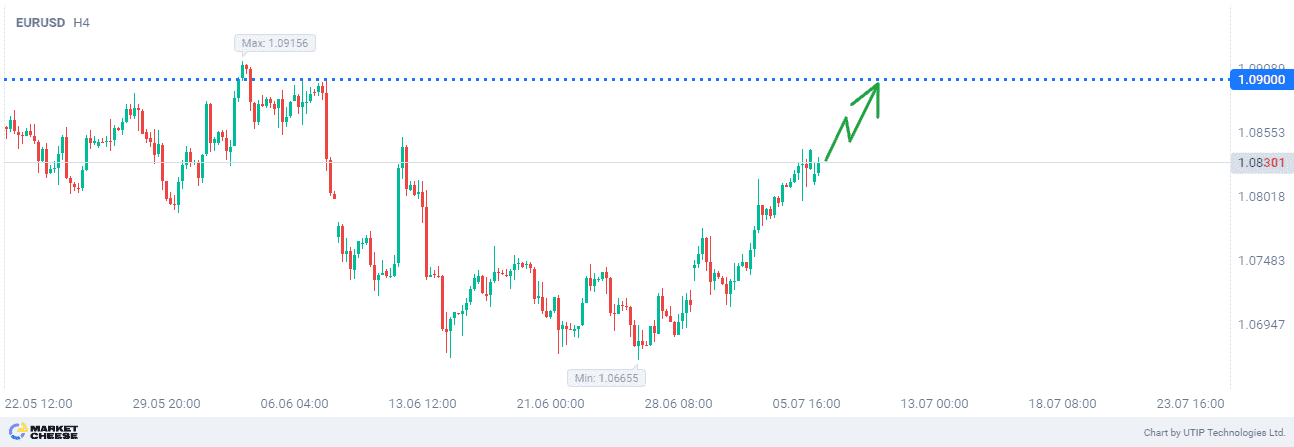

EURUSD buy to 1.0900

US job growth is slowing and the unemployment rate has risen steadily from 3.5% last July to 4.1% in June. Inflation remains around 2.6% according to the Fed's preferred measure of consumer expenditures, which policymakers still consider elevated, but it is approaching a point where things could change.

The labor market has returned to the “tight but not overheated” conditions seen before the COVID-19 pandemic threw the US economy into turmoil, the Federal Reserve said on Friday in a report to Congress that documented the steady emergence of more normal conditions in the aftermath of the health crisis.

The job market, meanwhile, “continued to rebalance over the first half of this year,” the report noted. “Labor demand has eased, as job openings have declined in many sectors of the economy, and labor supply has continued to increase, supported by a strong pace of immigration.”

“The balance between labor demand and supply appears similar to that in the period immediately before the pandemic, when the labor market was relatively tight but not overheated. Nominal wage growth continued to slow,” the report said.

The labor market report comes ahead of two days of testimony by Fed Chair Jerome Powell, set for Tuesday and Wednesday next week, that is likely to focus on the Fed’s plans for monetary policy heading into a sensitive election season.

New inflation data will be released on Thursday. If price pressures continue easing it may prompt Fed officials to open the door to interest-rate cuts as soon as September, which would provide a boost to EURUSD.

The final recommendation is to buy EURUSD if the US CPI figures do not exceed expectations.

Take profit at the level of 1.0900. Stop loss may be set at 1.0780.

The value of possible loss should not exceed 2% of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account