EURUSD buying to 1.0830

Yesterday U.S. Treasury Secretary Janet Yellen told the U.S. House of Representatives Financial Services Committee that inflationary factors including supply issues and labor market tightness have eased, which would help continue to drive down consumer price pressures.

"I believe that it (inflation) will continue to come down over time. Rents and housing costs continue to leave it higher than we would ideally like," Yellen told the U.S. House panel on financial services.

"Although the labor market was initially very tight, now we have a strong labor market, but one with fewer pressures that would create inflationary concern, so inflation is coming down," she said.

Rent and housing costs are keeping U.S. inflation higher than preferred but consumer price pressures will continue to come down over time, what the Treasury secretary called "tremendous progress" in bringing down inflation.

Lael Brainard, chair of the White House National Economic Council and a former vice chair of the Federal Reserve, said the Biden administration is encouraged by continued progress on lowering inflation.

Brainard said several months of data had confirmed that inflation was returning to the Fed's 2% target, noting that the most recent data showed an inflation level of 2.6%, which she said is a great achievement.

The inflation target is set in reference to the Personal Consumption Expenditures price index, which as of May was increasing at a 2.6% year-over-year rate.

Looking more closely at the underlying categories of inflation showed an actual reduction in food prices, and gasoline prices holding steady at around $3.50 a gallon over the July 4 "driving holiday," Brainard added.

All of the above-mentioned statements from high-ranking financial officials are in themselves factors that can move the prices of financial instruments. As for the currency market, these statements confirm the bearish sentiment towards the U.S. dollar, and accordingly - the hawkish sentiment towards the EURUSD pair.

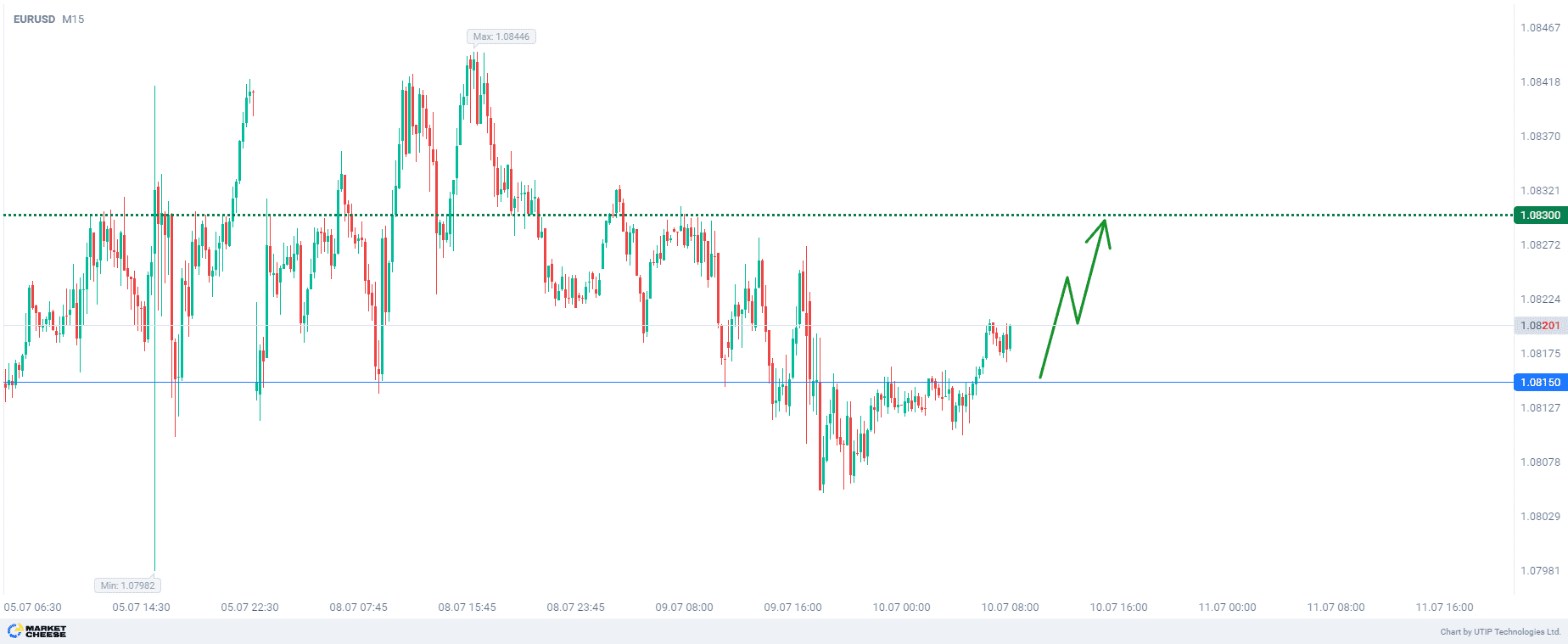

As a result, EURUSD is poised for further strengthening. From a technical point of view, the pair is in a tight range, and after a possible corrective move to the 1.0815 level, it is possible to consider buying again.

The final recommendation is to buy EURUSD after the correction starting from the level of 1.0815.

Profit could be fixed at the level of 1.0830. A stop loss could be set at 1.0800.

The value of possible loss should not exceed 2% of your deposit funds.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account