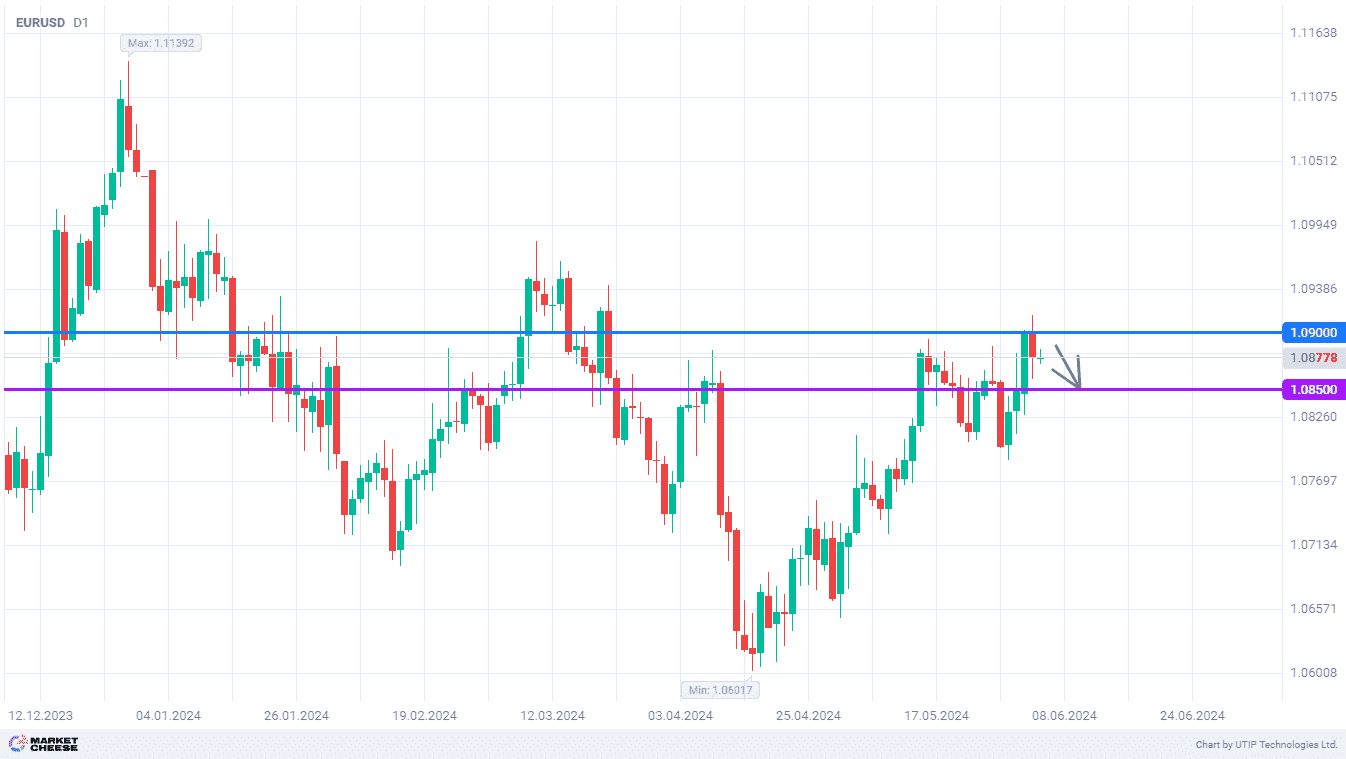

EURUSD correction to continue at least to 1.085

At the beginning of the current week, the EURUSD currency pair rose above the level of 1.09 for the first time since mid-March. However, an attempt to consolidate on the highs ended with the attack of the bears and further pullback in prices. Ahead of tomorrow's ECB meeting, with high chances of a rate cut, traders are unlikely to increase long positions in the euro. Therefore, the dollar may continue to strengthen, and EURUSD will drop even lower to the level of 1.085.

A new Reuters survey among currency market participants indicates expectations of a slight weakening of the dollar. However, such forecasts are common in 2024, while the US dollar index still suggests a gain of almost 3%. The main reason for these dynamics is persistent inflation in the States.

Analysts surveyed by Reuters predict the rate of price growth in the US to remain above the Fed's 2% target through the end of 2025. Jane Foley, Chief Currency Strategist at Rabobank, expects the Fed's monetary easing cycle to be very short regardless of a specific start date. In her opinion, demand for dollars may decline slightly, but EURUSD will not move out of the 1.08–1.1 range over the next 6-12 months.

Lawrence Summers, former US Treasury Secretary, has a similar viewpoint. Yesterday, he urged investors to get used to the current level of interest rates and not to expect significant cuts. According to Summers, the neutral level of the Fed's key rate under current economic conditions is 4.5%, which is well above the officials’ average estimate of 2.6%. Given this, the potential for monetary policy easing in the US does not exceed 1%, which will support sustained demand for dollar bonds.

If the ECB members are not too hawkish at the June 6 meeting, the EURUSD quotes will continue to correct. The level of 1.085 may become the next target for the sellers.

Consider the following trading strategy:

Sell EURUSD at the current price. Take profit – 1.085. Stop loss – 1.09.

Traders may also use a Trailing stop instead of a fixed Stop loss at their discretion

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account