EURUSD could rise within the corrective channel in anticipation of strong data

The EURUSD currency pair is forming a broad correction as traders await comments from US Federal Reserve officials this week.

At the beginning of the trading session on Wednesday, the dollar exchange rate showed a decline from the almost 3-month high reached on Tuesday. The decline in yields in the US Treasury bonds puts pressure on the value of the dollar. There are a number of fundamental factors that contributed to the dollar's 1.4% rise against the euro over the past two days. The most important of them were strong employment data in the US and hawkish rhetoric of Fed Chairman Jerome Powell. It led to a significant reduction in market expectations regarding the regulator's imminent easing of monetary policy.

At least eight members of the Fed and two representatives of the European Central Bank (ECB) are scheduled to speak this week.

Meanwhile, ECB officials have noted mixed consumer sentiment on inflation. In December, inflation expectations of eurozone consumers showed mixed dynamics. This was reported by the European regulator in its extended survey.

According to the central bank, consumer prices in the region are likely to rise by 3.2% over the next 12 months. This figure is considered the lowest since February 2022. At the same time, they will grow by 2.5% over the next three years, compared to 2.4% estimated earlier. This can be seen as a short-term positive signal for the euro.

The absence of strong macroeconomic indicators this week helps to keep the EURUSD currency pair inside the rectangular range.

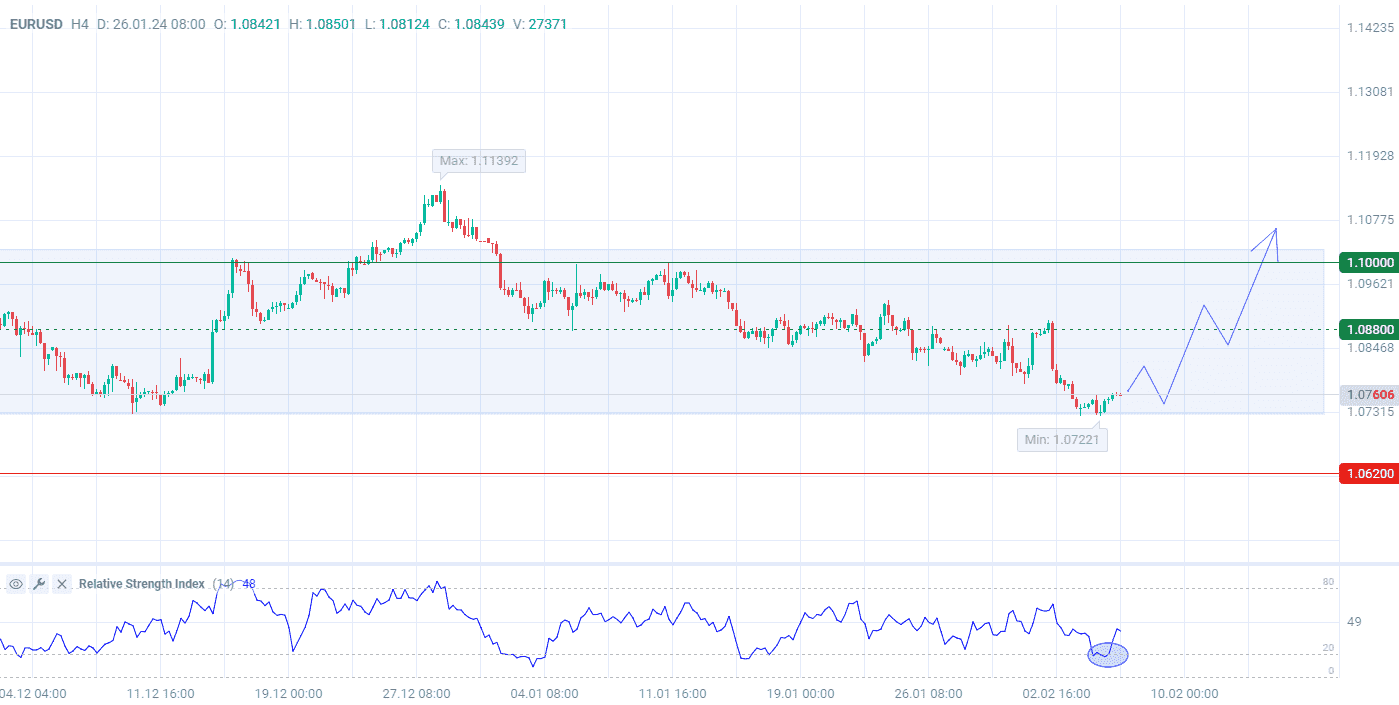

The EURUSD price is close to the support level of the corrective channel on the H4 timeframe. The curve of the RSI indicator (standard values) has left the oversold zone. The pair price pulled back from the support and could resume growth within the corrective channel.

Signal:

The short-term outlook for the EURUSD pair is to buy.

The target is at the level of 1.1000.

Part of the profit should be fixed near the level of 1.0880.

A Stop-loss could be placed near the level of 1.0620.

The bullish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account