EURUSD downtrend confirms its sustainability

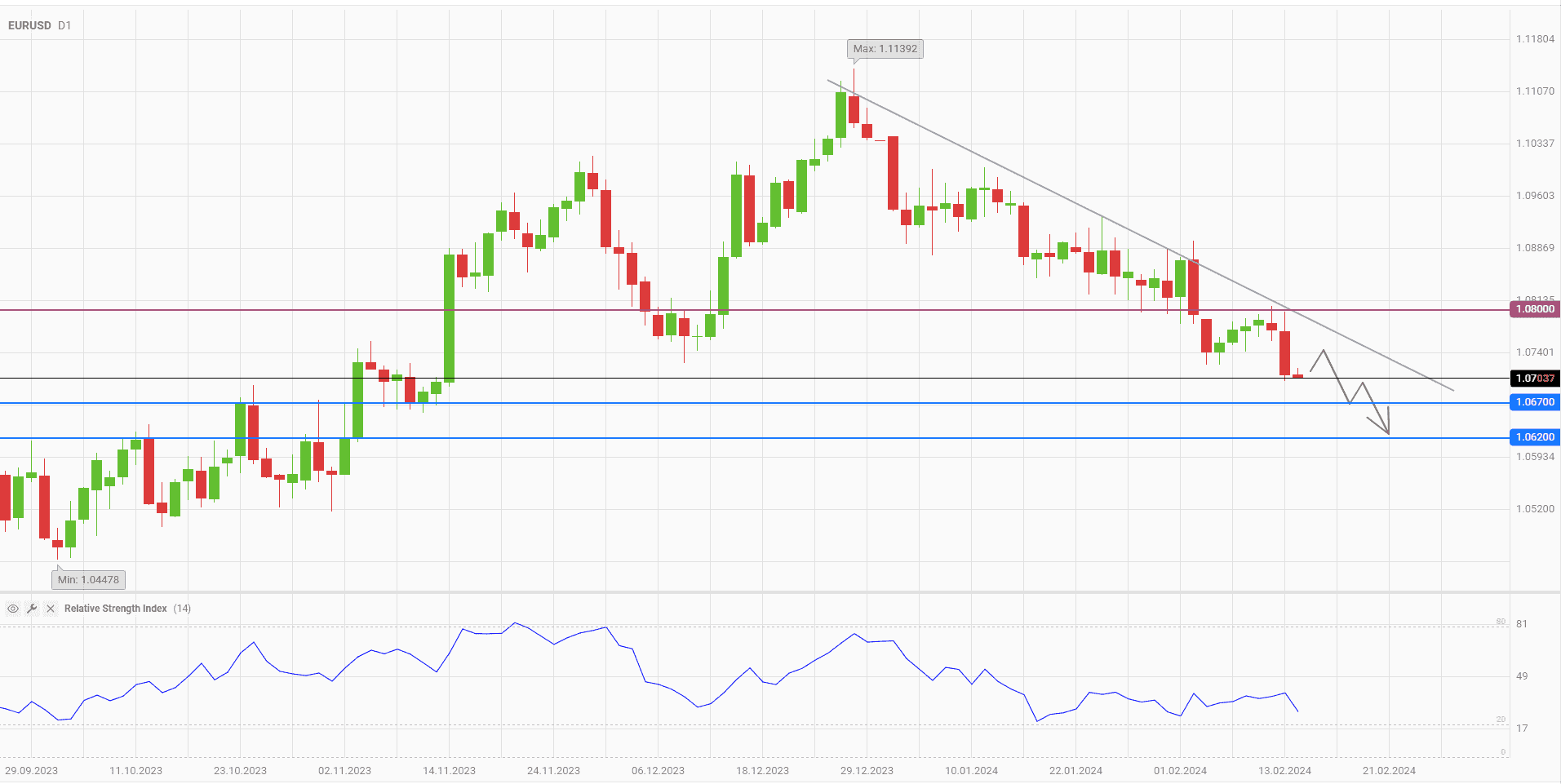

The EURUSD currency pair came under strong pressure from the bears at Tuesday's trading session. Buyers of the dollar and sellers of the euro lowered quotes below the level of 1.07 for the first time since mid-November. Today, traders managed to bring the price back above this level, but there are no signs of a full-fledged rebound. Within the framework of the medium-term downtrend, EURUSD is facing the following targets, located at the levels of 1.067 and 1.062.

A surge in demand for the U.S. currency was provided by the publication of inflation data for January. Price growth in the U.S. slowed down only in the general indicator, while core inflation remained at the December level of 3.9%. In monthly terms, both indicators also failed to meet analysts' forecasts. Market participants immediately began to reevaluate their expectations regarding the Fed's further actions.

Now, the beginning of the monetary policy easing cycle in the U.S. is forecast only in June. Peter Cardillo, chief economist at Spartan Capital Securities, believes that it is quite possible that the first key rate cut might be delayed even further. In his opinion, negative inflation data for February and March may postpone the dovish step of the U.S. regulator until September. This situation speaks in favor of keeping strong positions of the dollar.

At the same time, the situation is not good for the euro. According to Reuters, next week, the German authorities will announce a sharp deterioration of the GDP growth forecast for 2024. The leading EU economy will grow by only 0.2%, while the current forecast is at 1.3%. In such circumstances, an increasing number of ECB representatives speak in favor of cutting rates without waiting for inflation to return to the 2% target. This might deal a serious blow to the appeal of the European currency.

On the daily chart of EURUSD, the RSI indicator is moving downwards, but still has not reached the oversold zone. From a technical point of view, even after the breakdown of the level of 1.07, there are no obstacles for the continuation of the downward movement.

The following trading strategy may be offered:

Sell EURUSD in a range of 1.07-1.075. Take profit 1 – 1.067. Take profit 2 – 1.062. Stop-loss – 1.08.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account