EURUSD forms new downtrend amid pessimistic ECB forecasts and U.S. data

On Wednesday, the EURUSD currency pair fluctuated near a two-week low ahead of the release of the eurozone Purchasing Managers' Index (PMI). The euro weakened due to the European Central Bank's (ECB) pessimistic outlook for the eurozone economy and expectations of a further fall in inflation. This opens the door for a rate cut in September.

Also, of interest to traders are U.S. gross domestic product (GDP) data for the second quarter, released on Thursday, and the personal consumption expenditure (PCE) price index for June, released on Friday. These indicators could affect the timetable for the Federal Reserve's (Fed) interest rate cut.

According to most economists interviewed by Reuters, the Fed will ease monetary policy twice this year, in September and December. This is due to robust consumer demand in the U.S., which requires a cautious approach, despite falling inflation.

Meanwhile, U.S. Vice President Kamala Harris received the support of enough delegates to secure the Democratic Party's nomination. This led to changes in the financial markets. Market strategies and investments based on the policies and rhetoric of former President Donald Trump have lost their influence on traders. Promises by the Republican candidate to weaken the U.S. currency if he wins the election no longer have a significant impact on the dollar due to the rhetoric of the opposite party.

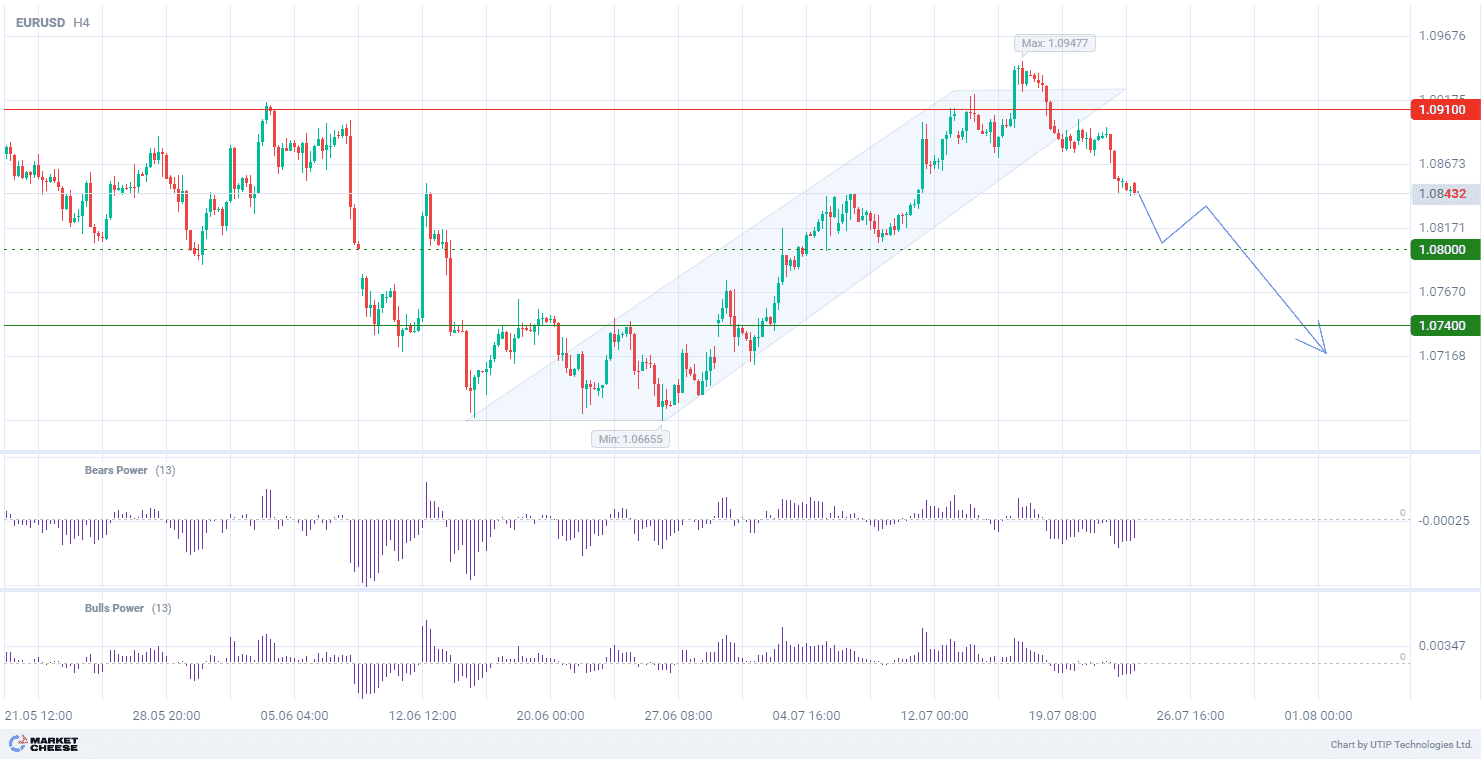

At the technical level, EURUSD quotes on the H4 chart have gone beyond the growing trend. Bulls Power and Bears Power indicators (standard values) are in the negative zone, confirming the strength of bearish sentiment and the formation of a sell-side movement.

Signal:

The short-term outlook for EURUSD is to buy.

The target is at the level of 1.0740.

Part of the profit should be fixed near the level of 1.0800.

A stop-loss could be placed at the level of 1.0910.

The bearish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account