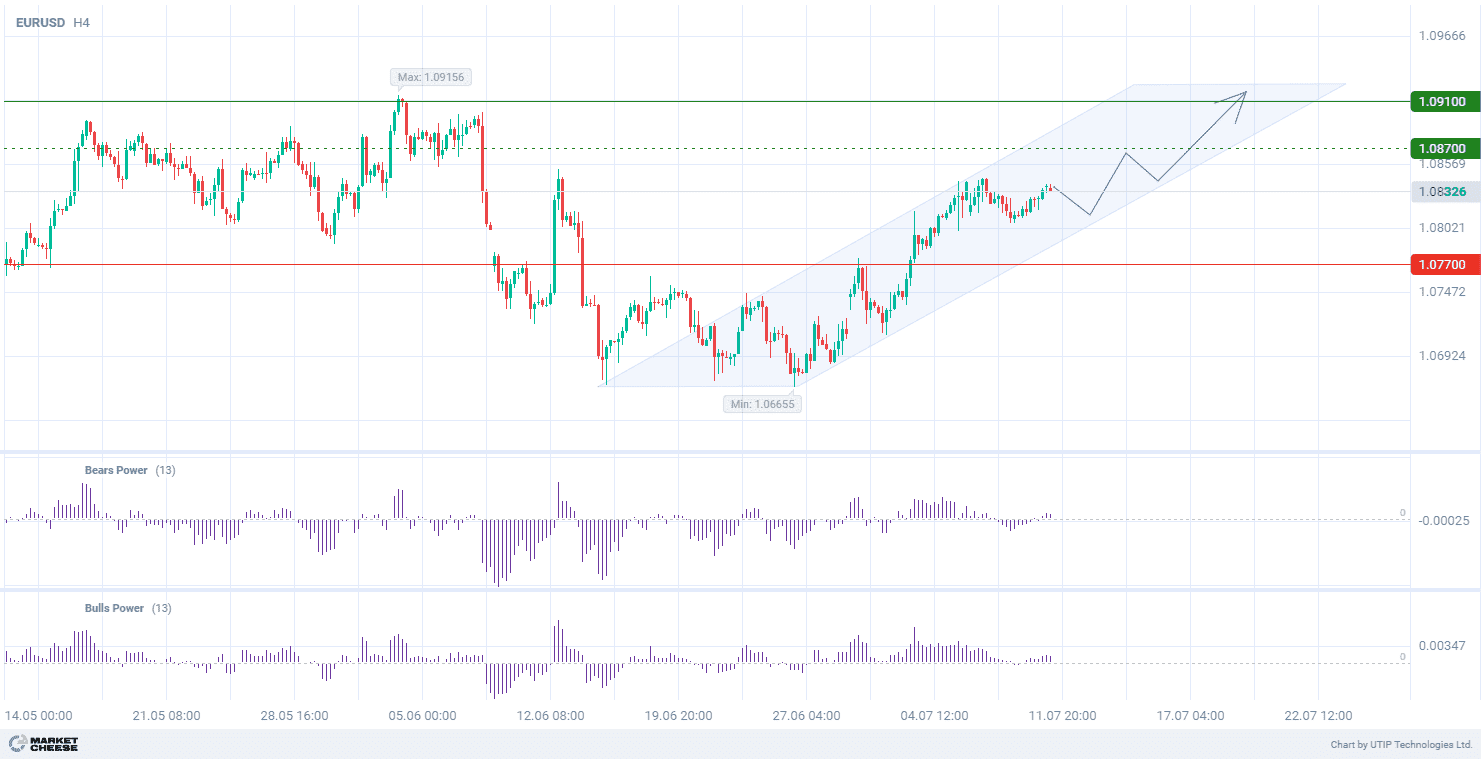

EURUSD has a buy signal at 1.0910 within the uptrend

EURUSD strengthened for the second consecutive session on Thursday as investors awaited the release of U.S. inflation data. These indicators can provide more information on future interest rate decisions by the Federal Reserve (Fed).

Recent comments from Fed Chairman Jerome Powell confirmed market expectations for an easing of monetary policy in the U.S. in September and then again in December. This has weakened the position of dollar bulls.

According to the CME Group's FedWatch tool, traders are pricing in a 46% probability of two Fed rate cuts by the end of the December meeting and a 73% probability of the first cut in September.

Investor attention is focused on the June Consumer Price Index (CPI) report. As Fed member Lisa Cook said on Wednesday, U.S. inflation should continue to decline without a significant increase in the unemployment rate.

According to the Bureau of Labor Statistics, core inflation in the U.S. rose 0.2% month-over-month in June. The annualized rate, however, was likely to be 3.4%.

Meanwhile, officials at the European Central Bank (ECB) said they intend to take a wait-and-see approach. According to them, the regulator's next steps will depend on the incoming economic data. The Governing Council of the ECB intends to keep the deposit rate at the same level of 3.75% at its July meeting. Expectations of keeping rates on hold are having a positive impact on the value of the euro.

On a technical level, the H4 chart shows that the EURUSD rate is forming a new uptrend. Both the Bulls and Bears Power indicators (default values) are within the positive zone. This confirms the strength of the bullish sentiment and the formation of a buying trend.

Signal:

Short-term prospects for EURUSD suggest buying.

The target is at the level of 1.0910.

Part of the profit should be taken near the level of 1.0870.

A stop-loss could be placed at the level of 1.0770.

The bullish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account