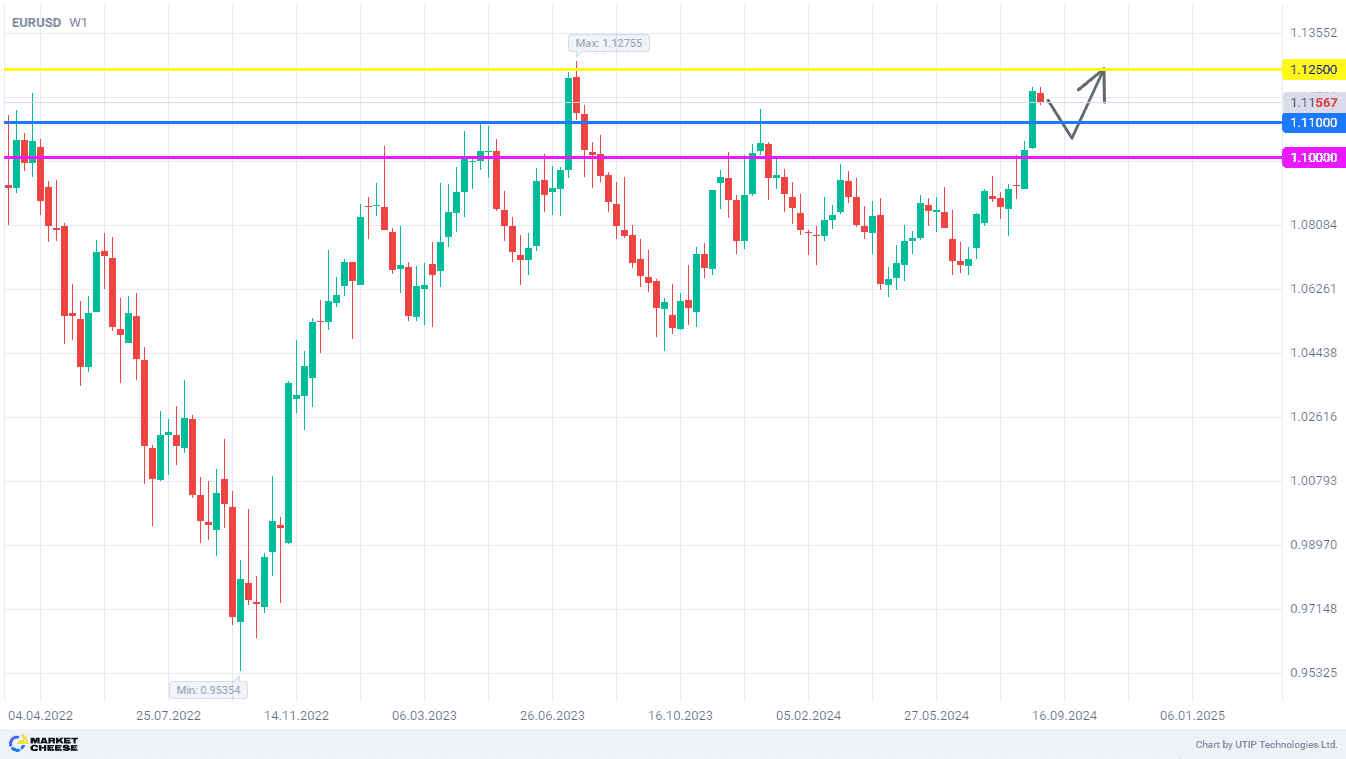

EURUSD on its way to 2023 high and 1.125 level

The EURUSD currency pair continues its upward movement, August may end with a price gain of more than 4%. After the first test of the 1.12 level this year, there is a slight pullback, but it’s unlikely to prevent the development of the upward trend. After consolidation on the achieved levels, the attention of the bulls will shift to the next target. It will be the highs of 2023. The range of 1.125–1.128 is already in reach.

Participants of the currency market expect convergence of monetary policies of the Fed and the ECB. The European regulator has already started a cycle of rate cuts, while the U.S. central bank is set to make a first move on September 18. However, some of its representatives voted in July in favor of such a decision. As the official documents showed, the directors at FRB of New York and Chicago supported more active policy easing, but at that time remained in the minority. Taking into account the latest data from the labor market, the ranks of their supporters have surely grown.

At the same time, the pace of ECB rate cuts is unlikely to accelerate. As the member of the Governing Council Klaas Knot stated, the large deficit of the EU countries' budgets undermines the regulator's efforts to normalize inflation. If the authorities of European countries don’t limit spending, the ECB will have to maintain tight monetary policy. This is unlikely to affect the outcome of the September meeting, but it may be reflected in the long-term forecasts of the central bank.

UBS analysts confirm the forecast of EURUSD quotes growth. In their opinion, the euro/dollar ratio will reach the level of 1.15 by 2025. Experts of the Swiss bank recommend buying out all drawdowns below 1.1 in anticipation of an aggressive cycle of reduction in the cost of borrowing by the Fed. At the same time, the ECB will cut rates by 0.25% once a quarter until at least the middle of next year. The narrowing rate differential signals EURUSD buying.

The local correction of EURUSD may bring the price down to the level of 1.11, giving the opportunity to open long positions on more favorable terms. The level of 1.125 remains the buyers' target.

The following trading strategy can be suggested:

Buy EURUSD in the range of 1.11–1.115. Take profit — 1.125. Stop loss — 1.1.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account