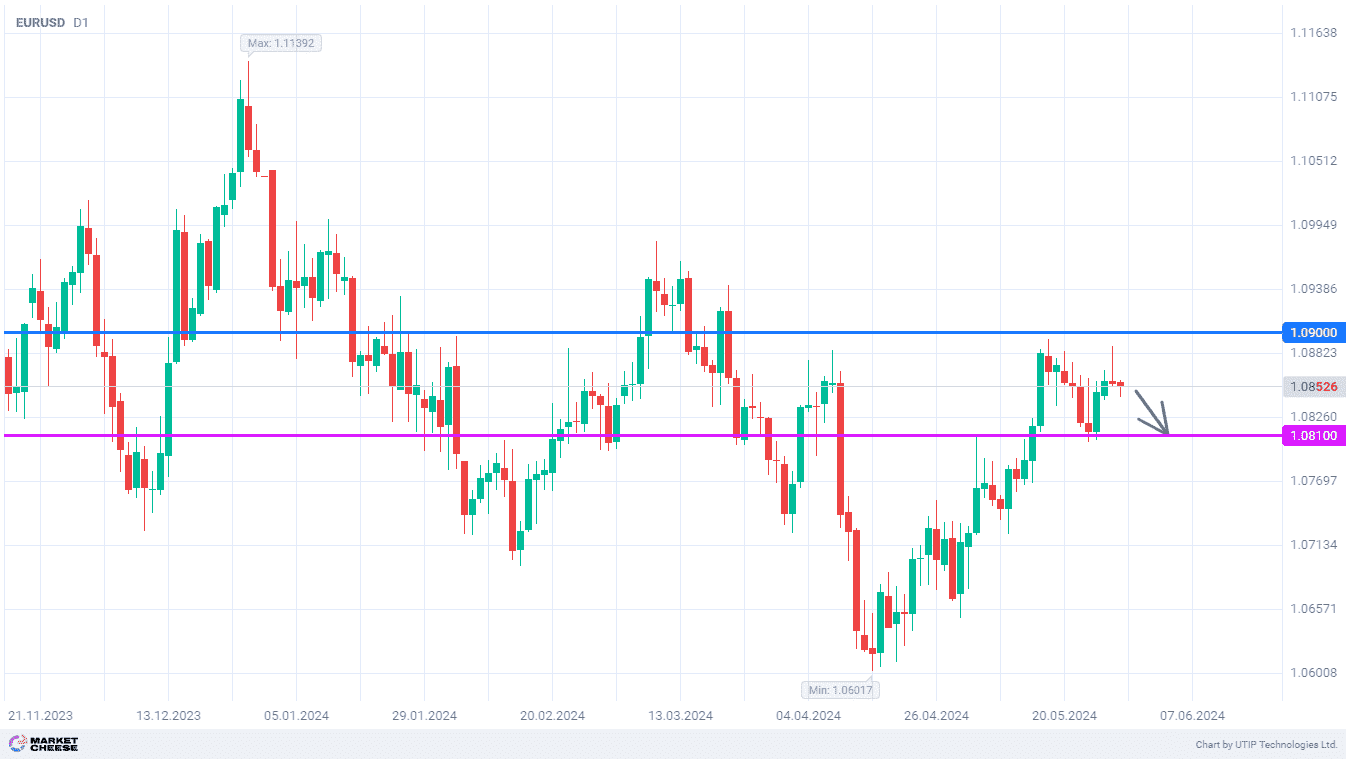

EURUSD pulls back from resistance at 1.09 to support at 1.081

The EURUSD currency pair at the beginning of the current week tried to return to the local highs of mid-May, located just below the level of 1.09. However, that triggered massive euro sales and dollar purchases. Market participants have improved their expectations for the European currency rate in recent weeks, but overcoming the 1.09 level is still unjustified. In such a situation, the price could return to the level of 1.081, where EURUSD formed the low of last week.

A new ECB’s report on inflation expectations contributed to some decline in optimism towards the euro. According to the results of the latest survey, EU residents improved their forecast for the rate of price growth for the next 12 months to 2.9% from 3%, and for the next 3 years — to 2.4% from 2.5%. Both indicators reached their lowest values since September 2021. Expected inflation has a direct impact on actual inflation, making the 2% target more attainable.

Speaking on Tuesday, ECB Governing Council member Klaas Knot was optimistic about the CPI data. According to him, the European regulator finally has an opportunity to cut interest rates. In addition to the expected easing of monetary policy at the June 6 meeting, Knot predicts similar steps in September and December. The refusal to cut rates in July doesn’t significantly affect the future prospects of ECB policy.

At the same time, traders are increasingly pessimistic about the scope of the Fed's key rate cut. By the current moment consensus of the first rate cut was shifted from September to November. Analysts of Bank of America believe the Fed won’t be ready for active actions until December. The consumer confidence data published yesterday also support expectations of a strong dollar.

The long upper shadow of yesterday's candlestick on the daily chart of EURUSD signals the high activity of bears near the level of 1.09. The pullback could continue by reaching 1.081 before the end of the current week.

The following trading strategy can be suggested:

Sell EURUSD at the current price. Take profit — 1.081. Stop loss — 1.09.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account