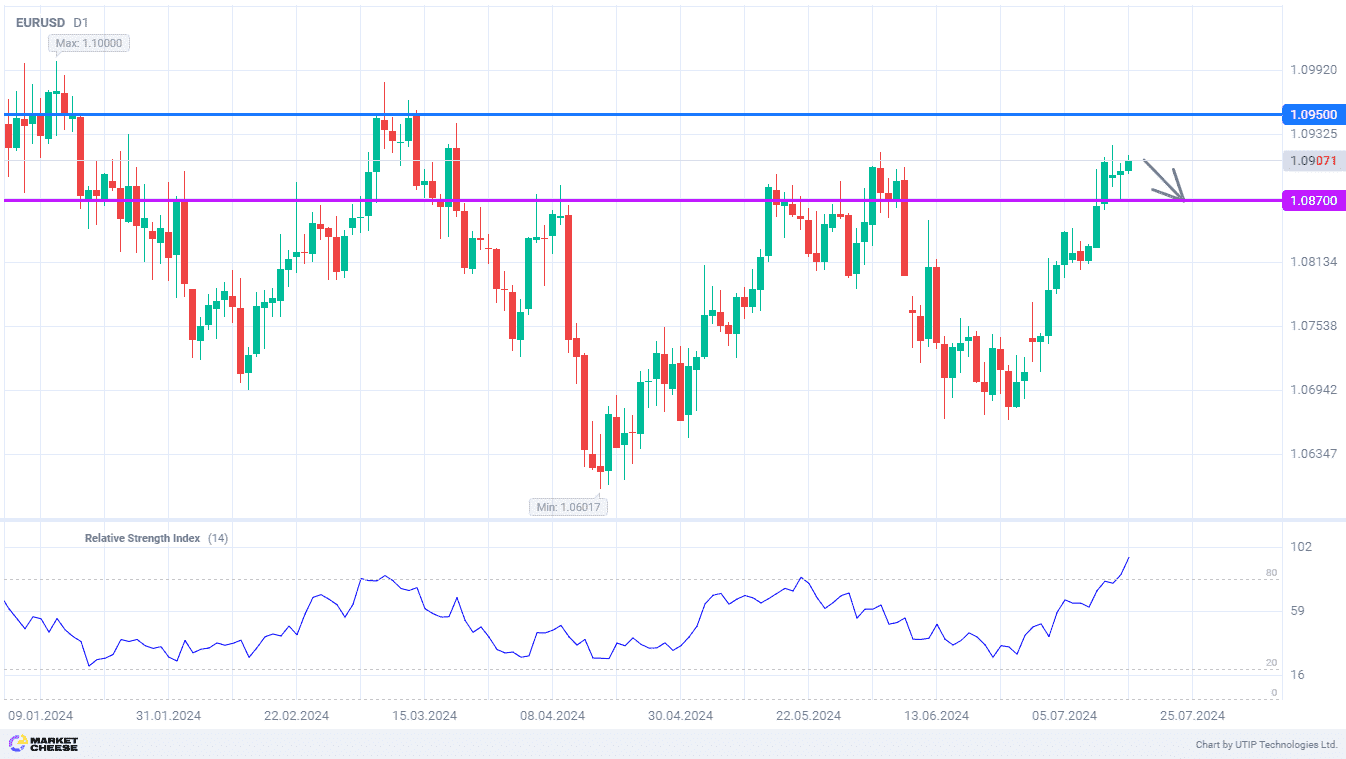

EURUSD set to face another decline to 1.087

The EURUSD pair has been stabilizing around the highs of the last 4 months since the beginning of this week. Near the level of 1.09 the activity of sellers, who doubt the potential for further strengthening of the euro against the dollar, has increased. Yesterday's drawdown was bought back by the end of the trading session, but the bears will surely make new attempts to seize the initiative. The nearest EURUSD correction target at 1.087 remains valid.

Local growth of the dollar on Tuesday was supported by the U.S. retail sales data for June. Contrary to expectations of a 0.3% decline, the actual figure remained unchanged on a monthly basis. Against this background, the Federal Reserve Bank of Atlanta raised its annual growth estimate for the U.S. economy to 2.5% from 2%. The released statistics once again suggests that there’s no need to hurry when it comes to starting rate cuts in the U.S.

Meanwhile, European traders are waiting for tomorrow's ECB meeting. Analysts don’t expect any changes in monetary policy, as European officials will focus on analyzing the consequences of the June rate cut. That said, the probability of another monetary easing in the EU in September is around 80%, confirming a faster cycle of interest rate cuts in Europe compared to the U.S.

ING analysts expect a gradual pullback of EURUSD to the level of 1.08 in the coming weeks. In their opinion, the September easing in the U.S. is already embedded in the quotes, and the dollar now has no room for significant weakening. At the same time, the euro doesn’t have strong support factors, which for the U.S. currency are the stability of the economy and the approaching presidential elections in November.

The RSI indicator on the daily chart of EURUSD has reached the maximum overbought level since March 2020. From a technical point of view, quotes need a correction, which may start after the ECB meeting on Thursday. The first target for sellers will be yesterday's lows near the level of 1.087.

The following trading strategy can be suggested:

Sell EURUSD at the current price. Take profit — 1.087. Stop loss — 1.095.

Traders can also use a Trailing stop instead of a fixed Stop loss at their discretion.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account