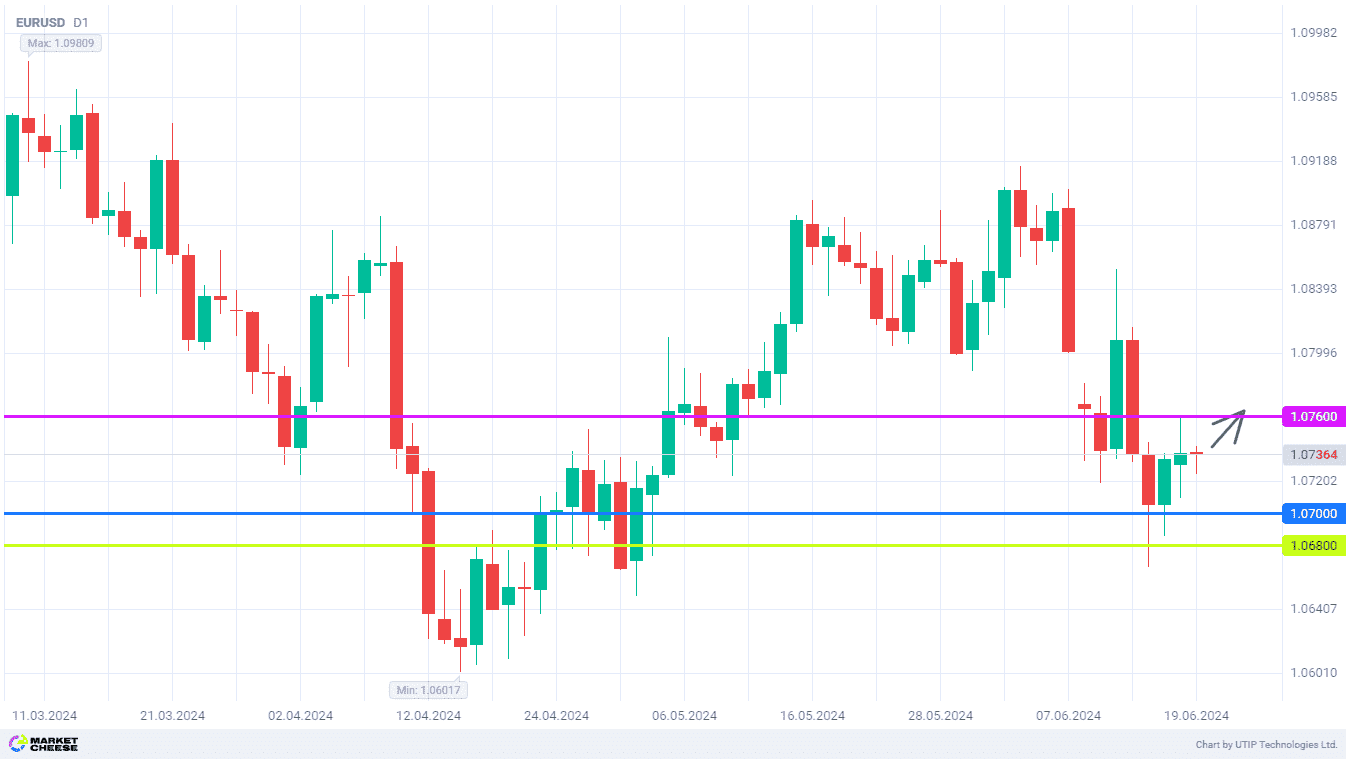

EURUSD will make another attempt to consolidate at level of 1.076

At the beginning of the week, the EURUSD currency pair actively tried to rebound from the month and a half lows. The drop in quotes to the level of 1.07 attracted a large number of buyers, who yesterday raised the price to the level of 1.076. By the end of Tuesday's trading session, almost half of the gains were lost, but this might just be a pause due to today's holiday in the US. Once US traders are back, EURUSD has a good chance of regaining growth momentum.

Before the holidays, US statistical offices published data on retail sales for May. The indicator increased by only 0.1%, while economists' forecasts suggested a more solid growth of 0.3%. Moreover, a number of figures for the previous months of 2024 were revised downward. According to Wells Fargo analysts, this is clear evidence of a slowdown in US consumer spending. As a result, the Fed may start the monetary policy easing cycle sooner than expected.

Meanwhile, a new Reuters survey confirmed that market participants are waiting for 2 more interest rate cuts by the European Central Bank (ECB). 90% of respondents said that the European regulator's position was likely to be more "hawkish" than current forecasts suggest. The final data on inflation for May, released yesterday, confirmed the acceleration of price growth in the EU from 2.4% to 2.6%. Currency market participants expect inflation to reach the 2% target by mid-2025, while the ECB is aiming for the end of next year.

Reuters analysts highlight another reason for the ECB's cautious approach. Having started the cycle of interest rate cuts earlier than the Fed, the European regulator has put significant pressure on the euro exchange rate. This may lead to an additional acceleration of price growth due to the increasing cost of imported goods. This scenario is highly undesirable for the ECB, and therefore officials will surely support the value of the European currency.

The nearest "bullish" target for EURUSD is another testing of the 1.076 level. As long as the price does not consolidate below the level of 1.07, EURUSD will be inclined to an uptrend.

The following trading strategy can be suggested:

Buy EURUSD in the range of 1.071-1.073. Take profit – 1.076. Stop loss – 1.068.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account