Expectations of an imminent rate cut in Canada support the upward trend of USDCAD

The USDCAD currency pair shows a moderate decline on Wednesday amid growing expectations of an interest rate cut in the U.S. in September. Weakening of the pair came after recent comments from Fed officials.

CEO of the San Francisco Federal Reserve bank Mary Daly expressed confidence that inflation is moving towards 2%. In turn, another representative of the regulator, Adriana Kugler, said it would be appropriate to lower borrowing costs later this year if inflation continues to moderate alongside a cooling yet resilient labor market.

Tuesday's U.S. retail sales were unchanged in June. While such data initially provided support for the dollar, the U.S. currency failed to gain ground due to traders' growing confidence in the Federal Reserve's monetary policy easing this year.

According to the CME FedWatch tool, markets are fully pricing in a rate cut by the Fed by at least 25 basis points at the September meeting.

Meanwhile, Canada's consumer price index fell to 2.3% YoY. Slower-than-expected price growth in the country in June reinforced expectations of another interest rate cut by the Bank of Canada next week.

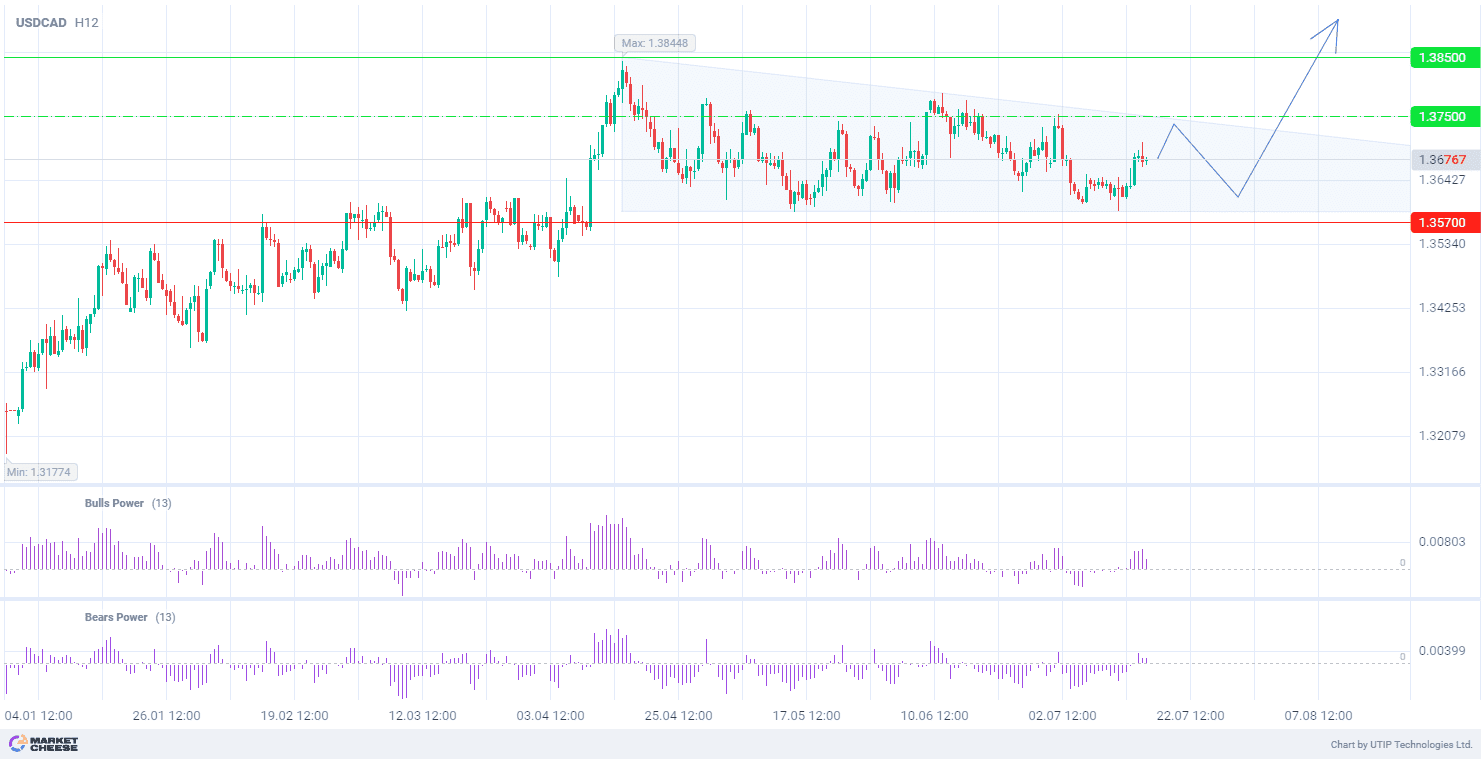

From the technical point of view, USDCAD has formed a triangle uncertainty pattern on the H12 timeframe. The catalyst for the exit from this figure could be the expectation of monetary policy easing in Canada, which can significantly reduce the value of the national currency. Bulls Power and Bears Power (standard values) are in the positive zone, indicating the potential growth of the pair.

Signal:

The short-term outlook for the USDCAD pair is to buy.

The target is near the level of 1.3850.

Part of the profit should be fixed near the level of 1.3750.

The Stop loss could be placed near the level of 1.3570.

The bullish trend is of a short-term nature, so it is suggested to limit the trading volume to no more than 2% of your capital.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account