Expectations of ECB policy easing may bring EURUSD down

EURUSD is moderately declining on Wednesday as the market awaits the release of the minutes of the U.S. Federal Reserve System (Fed) meeting for May. The publication of the report will determine the further course of the regulator's monetary policy.

Except the FOMC minutes, investors are not expecting the release of almost any significant economic data this week. For this reason, the currency pair is trading in a narrow range.

Recent inflation data in the U.S. showed a slowdown in inflation. However, some Fed policymakers remain cautious and rule out cutting rates too early. They want to make sure that the consumer price indicators will smoothly decline towards the 2% target before deciding to ease monetary policy.

As market participants expect, the first rate cut will not take place until September at the earliest. However, two quarter percentage point cuts are forecast before the end of the year, according to CME's FedWatch tool.

In contrast to the Fed's stance, the European Central Bank (ECB) has all but promised a rate cut on June 6. ECB President Christine Lagarde is confident that inflation in the eurozone is under control as the effects of the energy crisis and commodity supply problems are being overcome. According to her, the central bank's key rate forecasts for the coming years are very close to the 2% target. Expectations of easing monetary policy of the European regulator may have a negative impact on the euro price.

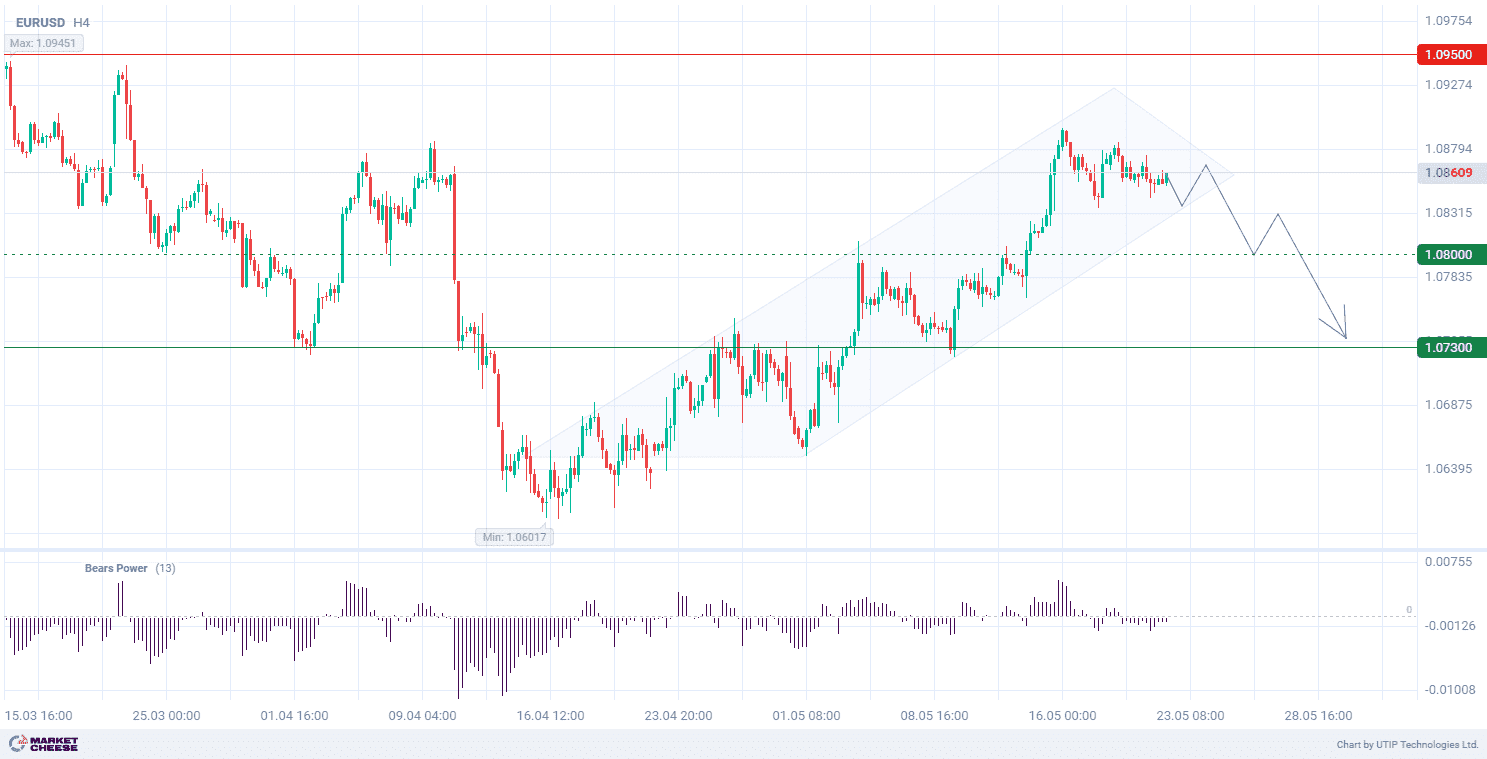

EURUSD quotes are in an upward corrective trend on the H4 time frame. The price has rolled back from the resistance at 1.0885. Negative indicators of the Bears Power indicator (standard values) indicate a downward price trend.

Signal:

The short-term outlook for EURUSD is to sell.

The target is at the level of 1.0730.

Part of the profit should be taken near the level of 1.0800.

A stop-loss could be placed at the level of 1.0905.

The bearish trend is short-term, so trade volume should not exceed 2% of your balance.

Other forecasts

Surging AUDCAD confirms advantage of bulls

08.11.2024Brent oil prices may decline in short-term under global changes

07.11.2024USDJPY maintains uptrend with the nearest target at 156.80

06.11.2024US election results send EURUSD to summer lows

06.11.2024Strong dollar supports USDCAD growth amid soft monetary policy of the Bank of Canada

05.11.2024GBPUSD rebounds towards the level of 1.304

Trade with a reliable broker

Compensation for refills, personal discounts, increased number of bonus points

Open an account